Crafting a Magnetic Founding Team Profile

The Strategic Blueprint for Investor Attraction

I've found that beyond a brilliant business idea, investors are increasingly focused on the people behind the vision. In this guide, I'll share proven strategies for building and presenting a founding team that not only impresses investors but actively draws them to your venture.

Understanding Investor Psychology

When I've spoken with venture capitalists and angel investors, I've consistently found that their investment decisions are driven by much more than just business metrics. The founding team often weighs more heavily in their decision-making than the business idea itself.

I've learned that investors fundamentally invest in people, not just concepts. When evaluating your founding team, they're looking for specific "trust factors" that make them comfortable with the inherent risk of early-stage investments.

Key Investor Trust Factors

In my experience, investors are particularly concerned about team capability and compatibility. They're asking themselves: "Can this specific group of people execute on this vision and navigate the inevitable challenges?"

When creating your startup one pager for investors, it's crucial to highlight not just what your team has accomplished individually, but how your collective expertise creates a uniquely qualified group to solve the problem you're addressing.

Strategic Team Composition for Maximum Investor Appeal

I've found that the most attractive founding teams demonstrate a careful balance of complementary skills. This isn't about assembling random talents, but strategically combining expertise that directly addresses the specific challenges of your venture.

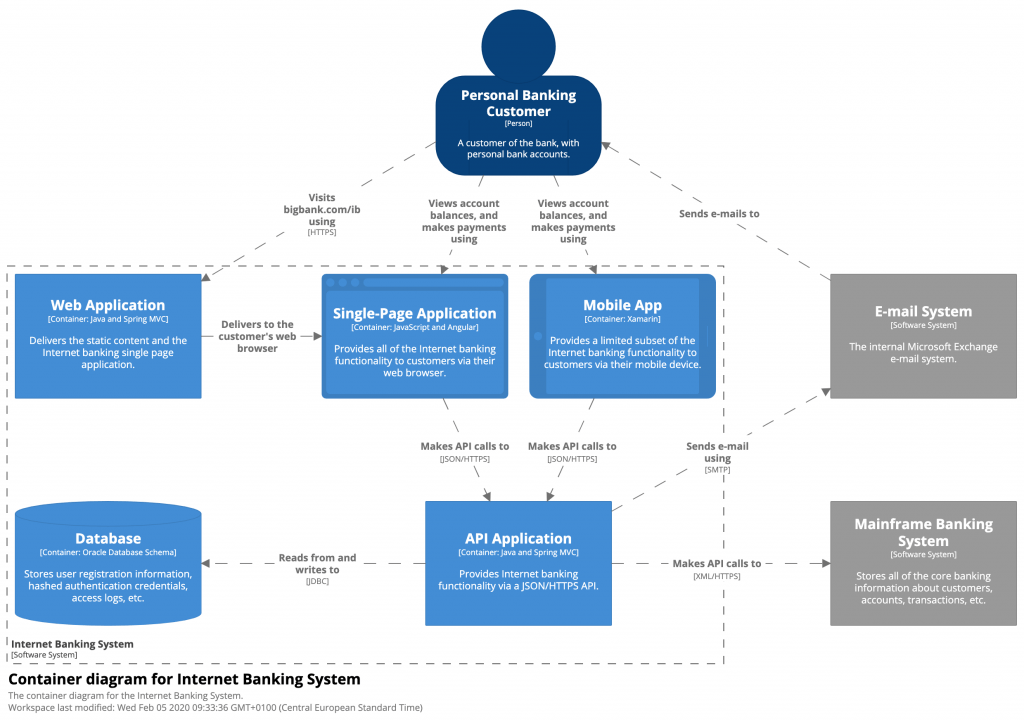

The Credibility Matrix

The "credibility matrix" is a concept I've developed to help founders understand how different expertise combinations signal reduced investment risk. When investors see that your team covers all critical functional areas needed for your business model, their confidence in your venture increases substantially.

flowchart TD

A[Founding Team Composition] --> B[Technical Expertise]

A --> C[Business/Market Expertise]

A --> D[Domain/Industry Expertise]

A --> E[Operational Excellence]

B --> F[Risk Reduction: Product Development]

C --> G[Risk Reduction: Go-to-Market]

D --> H[Risk Reduction: Market Fit]

E --> I[Risk Reduction: Execution]

F --> J[Investor Confidence]

G --> J

H --> J

I --> J

style A fill:#FF8000,stroke:#333,stroke-width:2px

style J fill:#66BB6A,stroke:#333,stroke-width:2px

style F fill:#FFB366,stroke:#333,stroke-width:1px

style G fill:#FFB366,stroke:#333,stroke-width:1px

style H fill:#FFB366,stroke:#333,stroke-width:1px

style I fill:#FFB366,stroke:#333,stroke-width:1px

Optimal Founding Team Size by Funding Stage

I've found that addressing skill gaps proactively is essential for investor appeal. For each missing competency, develop a clear strategy for how you'll fill that gap, whether through future hires, advisors, or strategic partnerships.

When creating your startup pitch deck, it's valuable to visualize your team's complementary skills using tools like PageOn.ai's AI Blocks. This creates compelling team architecture diagrams that clearly communicate how your founding team is strategically constructed to succeed.

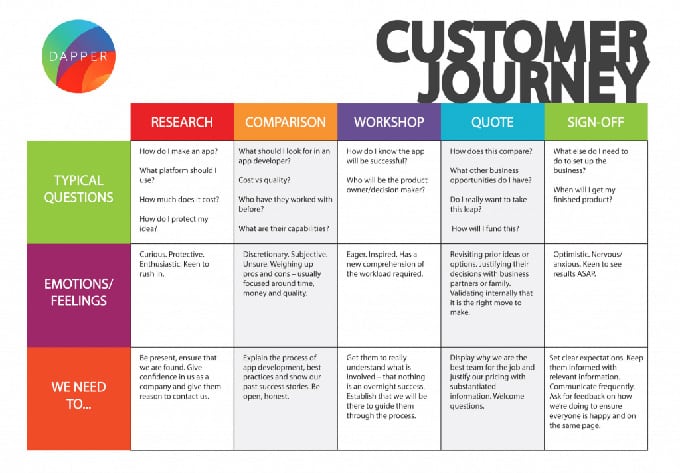

Showcasing Problem-Solution Expertise

I've learned that investors are deeply impressed by founding teams who demonstrate profound understanding of customer pain points. It's not enough to have a clever solution; you must show that you truly comprehend the problem from the customer's perspective.

One common mistake I see founders make is focusing too much on product features rather than customer outcomes. As Keji Mustapha, Global Director of Brand & Community at Partech, points out, "founders often talk about the product features rather than how the product solves the problem the customer has." This is especially critical in B2B markets, where customers buy outcomes, not technology.

"Particularly in the B2B market, you just can't lose sight of the fact that people buy outcomes, not technology."

The Outcome-Focused Approach

flowchart LR

A[Customer Pain Point] --> B[Your Unique Insight]

B --> C[Solution Approach]

C --> D[Customer Outcome]

D --> E[Business Impact]

style A fill:#f9d6c1,stroke:#333,stroke-width:1px

style B fill:#f9b17a,stroke:#333,stroke-width:1px

style C fill:#f78b31,stroke:#333,stroke-width:1px

style D fill:#FF8000,stroke:#333,stroke-width:1px

style E fill:#d96c00,stroke:#333,stroke-width:1px

I've found that creating visual representations of your solution journey using PageOn.ai's Vibe Creation tools can transform complex market analysis into clear visual narratives. This highlights not just your solution, but your team's strategic thinking process.

When developing investment banking pitch decks, I always emphasize how the founding team's expertise directly connects to solving the target market's most pressing challenges. This creates a powerful narrative that investors can easily follow and believe in.

Leveraging Founder Backgrounds Strategically

I've observed that investors conduct thorough due diligence on founder backgrounds. They're not just examining your idea; they're scrutinizing your experience and network to assess your likelihood of success. A founder with relevant industry experience significantly reduces perceived investment risk.

High-Value Founder Experience Types

I've found that creating visual timelines highlighting relevant founder milestones is extremely effective. Using PageOn.ai's Deep Search for contextual examples allows you to build compelling visualizations that show how your past achievements directly predict future success.

Addressing Experience Gaps

I always recommend being proactive about addressing potential experience gaps. For each area where your team might lack direct experience, develop a clear strategy that demonstrates:

- How transferable skills from other domains apply

- Key advisors who complement your team's knowledge

- Specific learning initiatives already underway

- Early evidence of success despite the experience gap

When creating a business overview pitch deck, I make sure to highlight how the founding team's collective experience creates a unique advantage in the market, even if individual members have different background strengths.

Building the Network Effect into Your Team Profile

I've consistently seen that investors place high value on founding teams with strong industry networks. Your connections represent a competitive advantage that can accelerate customer acquisition, talent recruitment, and strategic partnerships.

Strategic Network Mapping

flowchart TD

A[Founding Team Network] --> B[Industry Connections]

A --> C[Investor Relationships]

A --> D[Talent Network]

A --> E[Customer Access]

B --> F[Faster Market Entry]

B --> G[Strategic Partnerships]

C --> H[Future Funding Rounds]

C --> I[Strategic Guidance]

D --> J[Talent Acquisition]

D --> K[Advisory Board]

E --> L[Early Customers]

E --> M[Product Feedback]

style A fill:#FF8000,stroke:#333,stroke-width:2px

style B fill:#FFB366,stroke:#333,stroke-width:1px

style C fill:#FFB366,stroke:#333,stroke-width:1px

style D fill:#FFB366,stroke:#333,stroke-width:1px

style E fill:#FFB366,stroke:#333,stroke-width:1px

I've found that visualizing your team's industry network using PageOn.ai's AI Blocks for relationship mapping creates a powerful visual asset for investor presentations. This helps investors immediately grasp the breadth and value of your connections.

Building on existing networks is particularly valuable for talent acquisition. Access to a network of talented professionals significantly accelerates the hiring process, allowing founders to tap into existing connections to recruit top-tier talent.

When creating impactful project team presentations, I always highlight how our network provides unique advantages in execution speed and market access.

Crafting Your Team's Narrative for Maximum Impact

I've learned that a compelling founding story creates an emotional connection with investors. Beyond skills and experience, investors want to understand why your specific team came together and what drives your collective mission.

Elements of a Powerful Team Narrative

I've found that structuring team presentations to highlight complementary skills and unified vision is crucial. This isn't just about listing qualifications, but showing how your team functions as a cohesive unit with shared purpose.

Using PageOn.ai's Agentic capabilities to transform your team's story into compelling visual assets creates memorable presentations that stand out from typical founder slide decks. Visual storytelling helps investors connect emotionally with your team's journey.

When crafting your narrative, I recommend focusing on authentic connection to the problem you're solving. Investors are particularly drawn to founders who have personally experienced the pain point they're addressing, as this demonstrates genuine insight and commitment.

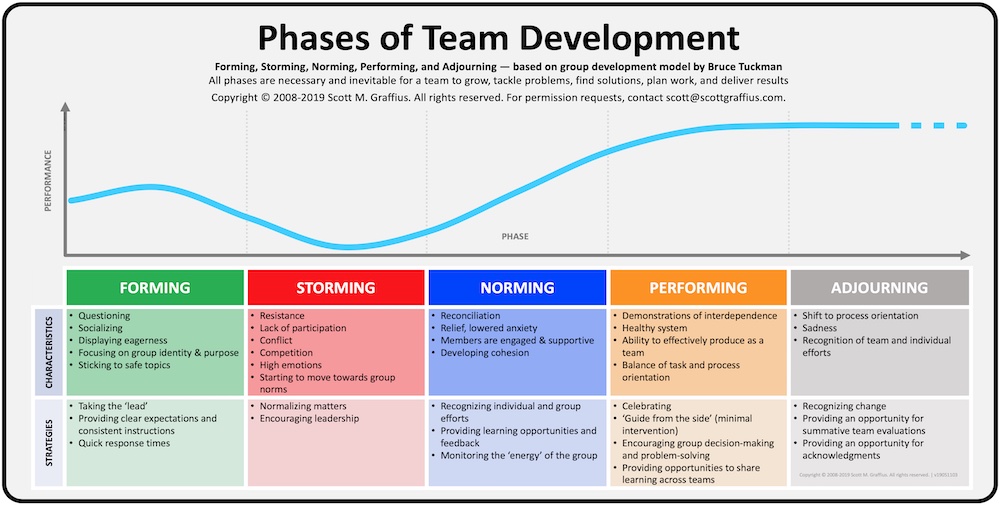

Demonstrating Growth Capacity and Adaptability

I've observed that investors at all stages need to be confident that founders have the skills as leaders to transform an idea into a successful business. At early stages, it's about showing vision and leadership ability to grow a team. At Series B and beyond, you need to demonstrate you can deliver business outcomes with your strategic approach.

Leadership Evolution Framework

flowchart TD

A[Founding Leadership] --> B[Pre-Seed/Seed: Vision & Direction]

A --> C[Series A: Team Building & Culture]

A --> D[Series B: Operational Excellence]

A --> E[Series C+: Strategic Scaling]

B --> F[Key Skills: Inspiration & Resilience]

C --> G[Key Skills: Recruitment & Delegation]

D --> H[Key Skills: Systems & Processes]

E --> I[Key Skills: Strategic Partnerships]

style A fill:#FF8000,stroke:#333,stroke-width:2px

style B fill:#FFB366,stroke:#333,stroke-width:1px

style C fill:#FFB366,stroke:#333,stroke-width:1px

style D fill:#FFB366,stroke:#333,stroke-width:1px

style E fill:#FFB366,stroke:#333,stroke-width:1px

I've found that creating visual representations of your leadership philosophy and team development approach helps investors understand how you'll scale beyond founding stage challenges. This demonstrates foresight and planning that builds investor confidence.

Adaptability Indicators That Impress Investors

- Learning Velocity: Evidence of rapidly acquiring new skills and knowledge

- Pivoting Experience: Examples of successfully changing direction based on market feedback

- Crisis Navigation: Stories of effectively handling unexpected challenges

- Diverse Thinking: Demonstration of approaching problems from multiple perspectives

- Feedback Integration: Systems for incorporating customer and team input

Using PageOn.ai to illustrate your team's evolution plan as the company grows creates visual assets that help investors envision your leadership capacity at scale. This forward-thinking approach signals that you've considered how your team will adapt to changing demands.

Practical Applications: From Team Profile to Investment Success

I've found that successfully presenting your founding team requires a strategic approach across different investor touchpoints. Each interaction with potential investors is an opportunity to reinforce your team's unique strengths and capabilities.

Strategic Roadmap for Team Presentation

flowchart LR

A[Initial Contact] --> B[One-Page Team Profile]

A --> C[LinkedIn Profiles]

B --> D[First Meeting]

C --> D

D --> E[Pitch Deck Presentation]

D --> F[Team Q&A Session]

E --> G[Due Diligence]

F --> G

G --> H[Investment Decision]

style A fill:#FFE5CC,stroke:#333,stroke-width:1px

style B fill:#FFCC99,stroke:#333,stroke-width:1px

style C fill:#FFCC99,stroke:#333,stroke-width:1px

style D fill:#FFB366,stroke:#333,stroke-width:1px

style E fill:#FF9A3C,stroke:#333,stroke-width:1px

style F fill:#FF9A3C,stroke:#333,stroke-width:1px

style G fill:#FF8000,stroke:#333,stroke-width:1px

style H fill:#d96c00,stroke:#333,stroke-width:1px

One-Page Team Profile Elements

I've found that transforming your team's strengths into visual assets for pitch decks and presentations significantly increases investor engagement. Using PageOn.ai to create consistent visual branding across all team-related investment materials ensures a cohesive and professional impression.

When integrating your team profile into broader investment materials, I recommend maintaining consistent visual language and messaging. This creates a seamless experience as investors move from your one-page profile to your full pitch deck and other materials.

Transform Your Founding Team Profile with PageOn.ai

Create stunning visual representations of your founding team that communicate your unique value proposition and build investor confidence. PageOn.ai's intelligent visualization tools help you showcase your team's strengths in ways that traditional presentations simply can't match.

Start Creating Your Team Profile TodayFinal Thoughts

Throughout this guide, I've shared strategies for creating a founding team profile that truly resonates with top-tier investors. Remember that your founding team is your startup's most valuable asset—it's the engine that drives your vision, the foundation that supports your growth, and the key to attracting investment.

Building a strong, balanced team isn't just important; it's essential for success. By strategically presenting your team's unique combination of skills, experience, and vision, you create a compelling case for investment that goes beyond your business model or product features.

I encourage you to use the visualization techniques we've explored to transform how you present your founding team. With tools like PageOn.ai, you can create visual assets that clearly communicate your team's strengths and unique advantages in ways that traditional text-heavy presentations simply can't match.

You Might Also Like

Strategic AI Marketing Investment Roadmap: Maximizing ROI from the $360 Billion Surge | 2025 Marketing Tech Budget Guide

Navigate the $360 billion AI investment surge with strategic marketing technology budget allocation. Discover proven frameworks for maximizing ROI from AI marketing tools in 2025.

Visualizing the AI Revolution: From AlphaGo to AGI Through Key Visual Milestones

Explore the visual journey of AI evolution from AlphaGo to AGI through compelling timelines, infographics and interactive visualizations that map key breakthroughs in artificial intelligence.

Building Trust in AI-Generated Marketing Content: Transparency, Security & Credibility Strategies

Discover proven strategies for establishing authentic trust in AI-generated marketing content through transparency, behavioral intelligence, and secure data practices.

How AI Saves Marketing Teams 5+ Hours Weekly While Boosting Productivity 83% | Visual Content Revolution

Discover how AI transforms marketing workflows, saving 5+ hours weekly and boosting productivity by 83%. Learn visual content strategies that eliminate manual tasks and accelerate campaigns.