Visualizing the Impact: How Exchange Consolidation Shapes Crypto Market Sentiment

The Evolving Landscape of Crypto Exchange Mergers

The consolidation of cryptocurrency exchanges is reshaping market dynamics, influencing investor sentiment, and creating new opportunities in the digital asset space. This analysis explores how major exchange mergers drive bullish market sentiment through data-driven visualizations and expert insights.

The Evolving Landscape of Crypto Exchange Mergers

The cryptocurrency exchange ecosystem has undergone significant transformation since 2020, with consolidation becoming a dominant trend in the industry. Major players have strategically acquired smaller exchanges to expand their market reach, enhance technological capabilities, and navigate increasingly complex regulatory environments.

Timeline of Major Crypto Exchange Mergers (2020-Present)

timeline

title Major Crypto Exchange Mergers & Acquisitions

2020 : Binance acquires CoinMarketCap

2020 : FTX acquires Blockfolio

2021 : Coinbase acquires Bison Trails

2021 : Galaxy Digital acquires BitGo

2022 : FTX attempts to acquire Voyager Digital

2022 : Binance attempts to acquire FTX (failed)

2023 : Coinbase acquires One River Digital

2023 : Crypto.com acquires TripleA

2024 : Kraken acquires Staked

Timeline visualization of significant merger events in the crypto exchange space

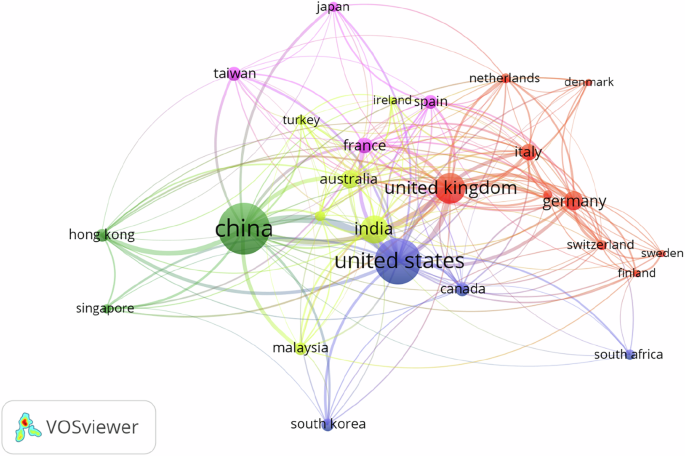

The geographic distribution of exchange consolidation activity reveals interesting patterns about regulatory arbitrage and market dominance strategies. While North American and European entities focus on compliance-driven acquisitions, Asian exchanges often prioritize technology and user base expansion.

Geographic Distribution of Exchange Consolidation

Regulatory developments have been significant catalysts for merger activities. New compliance requirements across jurisdictions have made it increasingly difficult for smaller exchanges to operate independently, creating opportunities for larger players with established compliance frameworks to expand through strategic acquisitions. This consolidation trend is a natural response to the technology industry insights showing increased regulatory scrutiny across digital asset markets.

Market Psychology Behind Exchange Consolidation

Exchange mergers and acquisitions trigger significant shifts in investor psychology. When major exchanges consolidate, it often signals industry maturation and improved infrastructure, which can boost market confidence and drive positive sentiment.

Sentiment Analysis: Social Media Reactions to Exchange Mergers

One fascinating psychological phenomenon in the crypto market is the "consolidation premium." This refers to the price appreciation of assets listed on exchanges involved in merger activities. This premium reflects increased investor confidence in the exchange's future stability and liquidity.

The "Consolidation Premium" Effect on Asset Prices

Average price movement of top 10 assets on exchanges following merger announcements

Trust signals emanating from exchange consolidation are particularly powerful in the crypto market, where security and reliability concerns remain prominent. When established exchanges merge or acquire others, it often creates a perception of enhanced security measures, better custody solutions, and improved trading infrastructure. These trust signals can be effectively visualized using PageOn.ai's sentiment analysis tools, which track and display changes in market confidence metrics following major exchange announcements.

Quantifiable Market Impacts of Exchange Mergers

Beyond sentiment shifts, exchange consolidation produces measurable impacts on key market metrics. Trading volumes typically experience significant changes following merger announcements, with most successful mergers leading to increased activity as traders respond to improved liquidity and trading conditions.

Trading Volume Changes Post-Merger Announcements

Price volatility patterns during consolidation events reveal another interesting trend. While initial announcements often trigger short-term volatility spikes, successful mergers typically lead to reduced volatility in the medium term as market confidence increases and trading conditions improve.

Market Relationship Visualization

flowchart TD

A[Exchange Merger Announcement] --> B[Initial Volatility Spike]

A --> C[Trading Volume Increase]

B --> D[Market Sentiment Shift]

C --> D

D --> E[Price Discovery Phase]

E --> F[New Market Equilibrium]

F --> G[Reduced Long-term Volatility]

F --> H[Improved Liquidity Metrics]

F --> I[Institutional Capital Inflows]

style A fill:#FF8000,stroke:#FF8000,color:white

style D fill:#FF8000,stroke:#FF8000,color:white

style F fill:#FF8000,stroke:#FF8000,color:white

Flow diagram showing market impact relationships following exchange consolidation

Liquidity improvements represent one of the most significant quantifiable benefits of exchange mergers. When exchanges consolidate, their combined order books often result in tighter bid-ask spreads, reduced slippage, and greater depth at each price level. These improvements are particularly valuable for institutional traders who require deep liquidity for large-volume transactions. Using PageOn.ai's AI Blocks feature, these complex market data relationships can be visualized effectively to identify correlation patterns between exchange consolidation news and subsequent market research reports showing improved trading conditions.

Liquidity Metrics Comparison

Case Studies: Transformative Exchange Mergers

Examining specific exchange merger cases provides valuable insights into market reaction patterns and long-term impacts. The following case studies highlight some of the most influential consolidation events in recent crypto history.

Case Study: Binance Acquisition Attempts

Binance's acquisition strategy has been particularly aggressive, with both successful acquisitions (CoinMarketCap) and failed attempts (FTX). The market reactions to these events demonstrate how sentiment can be influenced by both completed mergers and high-profile acquisition attempts, even when unsuccessful.

Market impact visualization of Binance's major acquisition attempts

Case Study: Coinbase Strategic Acquisitions

Coinbase's acquisition strategy has focused on enhancing its institutional offerings and compliance capabilities. The acquisitions of Bison Trails (blockchain infrastructure) and One River Digital (institutional asset management) demonstrate a clear strategy to position for institutional adoption.

Coinbase Stock Performance Following Acquisitions

Case Study: Asian Exchange Consolidation

The consolidation trend among Asian exchanges has been particularly notable, with regional players seeking to establish dominant positions in specific markets. These mergers often reflect the unique regulatory environments across different Asian jurisdictions and the strategic importance of establishing compliant operations in multiple markets.

Geographic visualization of major Asian exchange consolidation activities

Creating compelling visual narratives of these case studies becomes straightforward with PageOn.ai's visualization tools. Complex merger events can be transformed into clear, engaging visual stories that highlight key market impacts and strategic implications. This approach is particularly valuable when analyzing the broader implications of exchange consolidation for the global economy 2025 outlook and beyond.

Institutional Confidence Factors

Exchange consolidation serves as a powerful signal of market maturation to institutional investors. As the exchange landscape evolves from fragmented competition to consolidated, well-capitalized platforms, institutional confidence in the crypto market infrastructure tends to grow.

Key Factors Driving Institutional Confidence

mindmap

root((Institutional Confidence))

Custody Solutions

Enhanced security infrastructure

Multi-signature protocols

Insurance coverage expansion

Compliance Enhancements

AML/KYC improvements

Regulatory reporting capabilities

Legal expertise consolidation

Capital Markets Infrastructure

Prime brokerage services

OTC desk consolidation

Cross-margining capabilities

Risk Management

Advanced market surveillance

Counterparty risk reduction

Liquidity risk mitigation

Market Access

API standardization

Trading algorithm support

Institutional-grade interfaces

Custody solution improvements represent one of the most significant benefits of exchange consolidation for institutional investors. When exchanges merge, they often combine their security expertise and infrastructure, resulting in more robust custody offerings that meet institutional standards for asset protection.

Institutional Capital Inflows Following Major Mergers

Compliance enhancements following major mergers further strengthen institutional confidence. Consolidated exchanges can leverage combined resources to implement more sophisticated compliance frameworks, addressing a critical concern for institutional participants subject to strict regulatory requirements. The pattern of capital inflow following consolidation events suggests that institutions view these mergers as positive developments for market infrastructure quality and reliability. These trends can be effectively visualized using PageOn.ai's Deep Search capabilities, which help identify patterns in institutional adoption metrics that might otherwise remain hidden in complex datasets.

Future Outlook: Predicting Merger Impact Patterns

As the crypto exchange landscape continues to evolve, identifying potential future merger candidates and their market implications becomes increasingly valuable for investors and market participants.

Potential Consolidation Candidates Matrix

Bubble size represents relative market capitalization/valuation

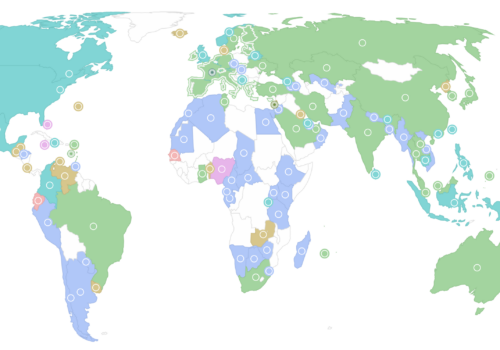

The regulatory landscape continues to shape merger and acquisition activities in the crypto exchange sector. Forward-looking exchanges are increasingly focused on identifying merger-friendly jurisdictions that offer regulatory clarity while maintaining access to key markets.

Regulatory Horizon for Exchange Consolidation

Global regulatory clarity index for crypto exchange operations

Technological consolidation benefits represent another key driver of future merger activity. As exchanges combine their technological resources, users can expect significant improvements in trading infrastructure, including faster execution speeds, more sophisticated order types, and enhanced API capabilities. These improvements are particularly valuable for algorithmic traders and institutions that rely on high-performance trading infrastructure.

PageOn.ai's visualization tools enable the creation of predictive visual models that can help investors anticipate market outcomes from potential future consolidation events. By analyzing historical patterns and current market conditions, these models can provide valuable insights for strategic decision-making in a rapidly evolving exchange landscape. The integration with generative AI market report data allows for sophisticated pattern recognition that identifies emerging consolidation trends before they become widely recognized.

Strategic Insights for Crypto Investors

Exchange merger news presents specific trading opportunities for informed investors. Understanding how to interpret these announcements and their potential market impacts can provide a significant edge in crypto markets.

| Merger Event Type | Initial Market Reaction | Medium-Term Impact | Strategic Opportunity |

|---|---|---|---|

| Major Exchange Acquiring Smaller Platform | Short-term volatility spike, often positive for assets listed on smaller platform | Integration period with potential listing expansions | Consider accumulating unique assets from acquired exchange before wider listing |

| Merger of Equal-Sized Exchanges | Mixed initial reaction, often based on perceived synergies | Improved liquidity across combined asset listings | Look for previously illiquid assets that will benefit from combined order books |

| Traditional Finance Acquiring Crypto Exchange | Strong positive sentiment, institutional validation signal | Increased institutional participation, compliance focus | Position in assets likely to benefit from institutional adoption wave |

| Failed Merger Announcement | Sharp negative reaction, uncertainty increase | Potential regulatory scrutiny, confidence erosion | Volatility trading opportunities, consider reduced exposure |

A robust risk assessment framework is essential when navigating exchange consolidation events. While these events often create opportunities, they also introduce specific risks that must be carefully managed.

Risk Assessment Framework for Exchange Consolidation

graph TD

A[Exchange Merger Announcement] --> B{Risk Assessment}

B --> C[Integration Risk]

B --> D[Regulatory Risk]

B --> E[User Experience Risk]

B --> F[Asset Delisting Risk]

C --> G[Technical Integration Challenges]

C --> H[Cultural Integration Issues]

D --> I[Regulatory Approval Uncertainty]

D --> J[Compliance Framework Changes]

E --> K[Platform Changes]

E --> L[Fee Structure Revisions]

F --> M[Portfolio Exposure Analysis]

F --> N[Liquidity Migration Planning]

G & H & I & J & K & L & M & N --> O[Comprehensive Risk Mitigation Strategy]

style A fill:#FF8000,stroke:#FF8000,color:white

style B fill:#FF8000,stroke:#FF8000,color:white

style O fill:#FF8000,stroke:#FF8000,color:white

Portfolio diversification strategies become increasingly important during periods of market consolidation. As exchanges merge and the competitive landscape evolves, investors should consider diversifying both their exchange relationships and asset holdings to mitigate platform-specific risks.

Portfolio Diversification Strategy

Long-term investment thesis building around exchange ecosystem evolution requires a deep understanding of industry trends and competitive dynamics. As the exchange landscape continues to consolidate, investors should consider how these changes will affect the broader crypto ecosystem and position their portfolios accordingly. By analyzing churn in marketing data from various exchanges, investors can identify platforms with strong user retention that may become attractive acquisition targets.

PageOn.ai's visualization tools make it possible to transform complex market strategy considerations into clear visual guidance. By creating intuitive visualizations of market trends, risk factors, and strategic opportunities, investors can develop more informed approaches to navigating the evolving exchange landscape.

Transform Your Market Analysis with PageOn.ai

Unlock powerful visual expressions that clarify complex crypto market trends, exchange mergers, and investment opportunities. Create professional-grade visualizations without design expertise.

Start Creating with PageOn.ai TodayConclusion: The Future of Exchange Consolidation

Exchange consolidation represents a natural evolution in the maturing cryptocurrency market. As the industry continues to develop, mergers and acquisitions will likely accelerate, driving improvements in market infrastructure, regulatory compliance, and user experience.

For investors, understanding the market psychology and quantifiable impacts of exchange mergers provides valuable insights for portfolio management and trading strategy development. By recognizing the patterns that typically follow consolidation announcements, traders can position themselves to capitalize on these predictable market movements.

The ability to clearly visualize these complex market dynamics is essential for effective decision-making. PageOn.ai's suite of visualization tools enables investors, analysts, and market participants to transform complex data into clear, actionable insights. Whether tracking sentiment shifts following merger announcements or analyzing liquidity improvements across multiple exchanges, PageOn.ai provides the visual clarity needed to navigate the evolving crypto landscape with confidence.

You Might Also Like

How to Design Science Lesson Plans That Captivate Students

Create science lesson plans that captivate students with hands-on activities, clear objectives, and real-world applications to foster curiosity and critical thinking.

How to Write a Scientific Review Article Step by Step

Learn how to write a review article in science step by step. Define research questions, synthesize findings, and structure your article for clarity and impact.

How to Write a Self-Performance Review with Practical Examples

Learn how to write a self-performance review with examples and tips. Use an employee performance review work self evaluation sample essay to guide your process.

How to Write a Spec Sheet Like a Pro? [+Templates]

Learn how to create a professional spec sheet with key components, step-by-step guidance, and free templates to ensure clarity and accuracy.