June 2024 Crypto Calendar: Major Events Transforming the Digital Asset Landscape

Navigate the evolving cryptocurrency ecosystem with insights on landmark events shaping the future of digital finance

The Evolving Crypto Ecosystem in June 2024

June 2024 stands as a pivotal month in the cryptocurrency and blockchain space, marked by transformative events that could redefine the digital asset landscape for years to come. As we navigate through this critical period, understanding the interconnections between major developments becomes essential for investors and enthusiasts alike.

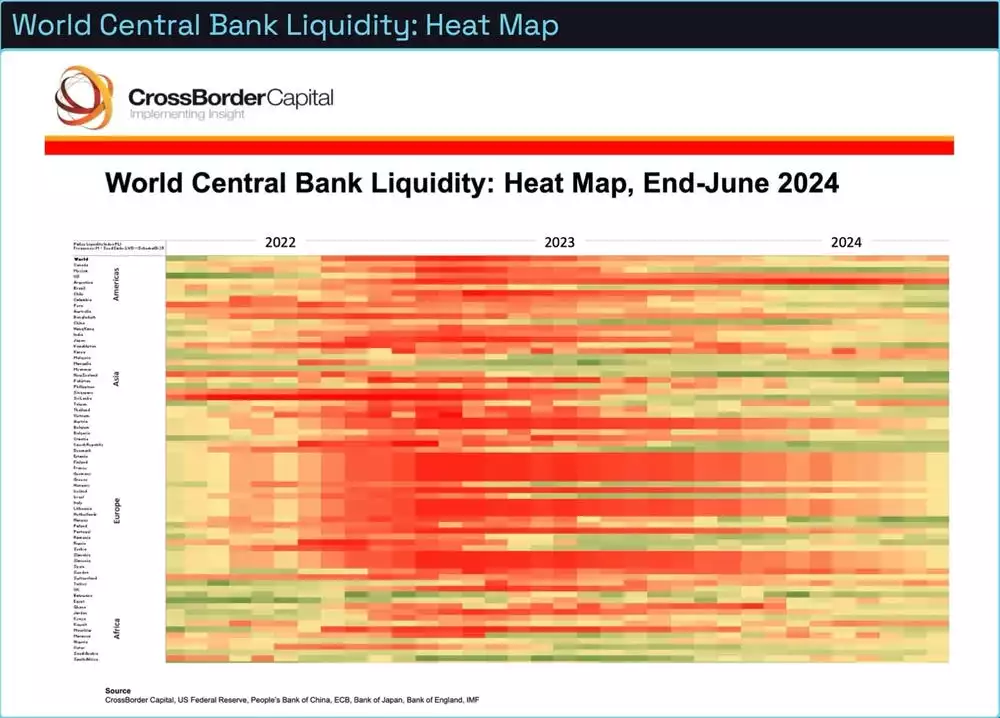

Market sentiment heading into June reveals cautious optimism among investors, with key indicators suggesting increased institutional interest coinciding with the global economy 2025 outlook. The convergence of traditional finance and cryptocurrency ecosystems is accelerating, positioning June's events at a critical juncture in the broader adoption curve.

Crypto Market Sentiment Index (Q1-Q2 2024)

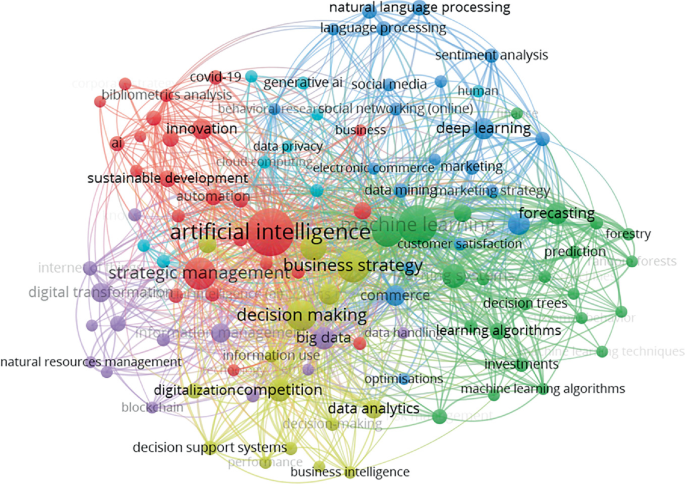

PageOn.ai offers powerful tools for visualizing these complex market relationships, enabling investors to map connections between different crypto projects and identify potential ripple effects from June's major events. By transforming complex data into intuitive visual representations, investors can gain clearer insights into how events like Defidotapp's TGE and Strategy's IPO might influence the broader ecosystem.

Defidotapp Token Generation Event: A Closer Look

Defidotapp has positioned itself as a revolutionary infrastructure provider in the DeFi space, offering composable financial primitives that enable developers to build sophisticated applications with minimal overhead. Their upcoming Token Generation Event (TGE) represents not just a fundraising milestone but a fundamental expansion of their ecosystem governance model.

Defidotapp Token Economic Structure

flowchart TD

TGE[Token Generation Event] --> TokenDistribution[Token Distribution]

TokenDistribution --> PublicSale[Public Sale: 15%]

TokenDistribution --> TeamAllocation[Team: 20%]

TokenDistribution --> Treasury[Treasury: 25%]

TokenDistribution --> Ecosystem[Ecosystem Rewards: 30%]

TokenDistribution --> Advisors[Advisors: 10%]

TGE --> Governance[Governance Mechanism]

Governance --> Proposals[Protocol Proposals]

Governance --> ParameterSettings[Parameter Settings]

Governance --> TreasuryManagement[Treasury Management]

TGE --> Utility[Token Utility]

Utility --> FeeDiscounts[Fee Discounts]

Utility --> Staking[Yield Generation]

Utility --> AccessControl[Premium Features]

TGE Timeline

- June 5: Whitelist registration closes

- June 10: Private sale allocation distribution

- June 12: Public sale begins (24-hour window)

- June 14: Token distribution to participants

- June 15: Exchange listings commence

- June 18: Liquidity mining program launches

Participation Mechanisms

- Whitelisted allocation guaranteed for community members

- Fair launch auction mechanism to determine final token price

- Multi-chain accessibility (Ethereum, Solana, Arbitrum)

- Minimum participation of $100 equivalent in stablecoins

- Maximum allocation caps based on tier system

PageOn.ai's AI Blocks feature provides an intuitive way to visualize Defidotapp's complex ecosystem integration. By breaking down the interconnections between different components of the protocol, investors can better understand how the token fits into the broader DeFi landscape and identify potential value creation mechanisms that might be missed in traditional analysis. This visual approach is particularly valuable for understanding new technology industry insights and innovations in the DeFi space.

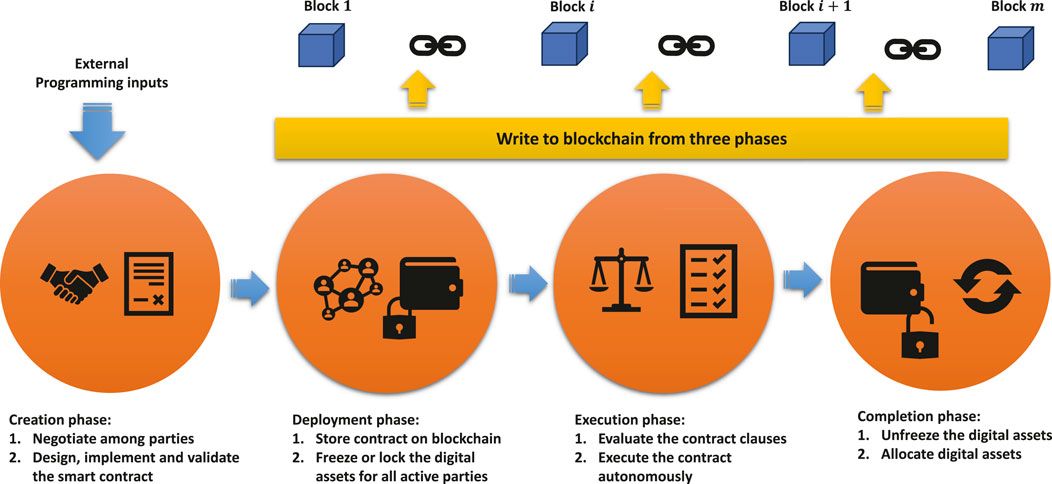

Strategy's IPO: Breaking New Ground in Crypto-Traditional Finance Convergence

Strategy's initial public offering represents a watershed moment in the convergence of traditional financial markets and cryptocurrency ecosystems. As one of the first crypto-native financial services firms to pursue a traditional IPO, Strategy is creating a new blueprint for institutional adoption and regulatory integration.

The historical significance of this IPO cannot be overstated. While previous crypto companies have gone public, Strategy's approach differs fundamentally in its hybrid business model that bridges institutional investment practices with digital asset infrastructure. This creates new possibilities for capital formation and investment vehicles that could accelerate mainstream adoption.

Comparative Analysis: Crypto Company Public Offerings

The strategic implications for institutional adoption are profound. Strategy's IPO establishes a precedent for regulatory compliance that could pave the way for more traditional financial institutions to engage directly with digital assets. It also creates a blueprint for investment banking pitch decks focused on crypto-related offerings.

Key Strategy IPO Details

- Offering Date: June 20, 2024

- Exchange: NASDAQ

- Ticker Symbol: STGY

- Shares Offered: 25 million

- Price Range: $38-42 per share

- Lead Underwriters: Goldman Sachs, JP Morgan, Morgan Stanley

- Use of Proceeds: Expansion of institutional services, regulatory compliance infrastructure, and strategic acquisitions

PageOn.ai's Deep Search capabilities enable investors to create compelling presentations by aggregating relevant market data from multiple sources. This is particularly valuable when analyzing Strategy's IPO in the context of broader market trends and institutional adoption patterns. By visualizing these relationships, investors can better understand the potential long-term implications of this landmark event on both traditional finance and the crypto ecosystem.

Additional Key Crypto Events in June 2024

Beyond the headline events of Defidotapp's TGE and Strategy's IPO, June 2024 features several other significant developments that could substantially impact the crypto ecosystem. From regulatory announcements to major protocol upgrades, these events create a complex web of potential market catalysts.

June 2024 Crypto Event Timeline

gantt

title June 2024 Crypto Events Calendar

dateFormat YYYY-MM-DD

axisFormat %d

section Regulatory

EU MiCA Phase 2 Implementation :2024-06-03, 5d

US SEC Spot ETF Decision :2024-06-15, 1d

G20 Crypto Framework Discussion :2024-06-28, 2d

section Protocol Updates

Ethereum Pectra Upgrade :2024-06-08, 2d

Solana Performance Enhancement :2024-06-12, 2d

Polkadot Parachain Auction :2024-06-18, 7d

section Market Events

Defidotapp TGE :2024-06-12, 3d

Strategy IPO :2024-06-20, 1d

DeFi Summit Singapore :2024-06-24, 3d

Regulatory Developments

- EU Markets in Crypto-Assets (MiCA) Phase 2 implementation begins

- US SEC decision on additional spot cryptocurrency ETFs

- G20 discussion on global crypto regulatory framework

- Japan's FSA new guidelines for stablecoin issuers

Protocol Upgrades

- Ethereum Pectra upgrade enhancing layer 2 integration

- Solana performance enhancement implementation

- Polkadot's 8th parachain auction begins

- Cardano's Hydra scaling solution final testnet

- Avalanche subnet optimization release

Conference Highlights

- DeFi Summit Singapore (June 24-26)

- European Blockchain Convention Barcelona

- NFT.NYC 2024 with major platform announcements

- Institutional Digital Asset Summit London

- Asia Crypto Week featuring key partnership reveals

PageOn.ai's visual relationship mapping tools are particularly valuable for tracking the interconnected impacts of these diverse events. By creating interactive visualizations that show how regulatory decisions might affect protocol development, or how conference announcements could influence market sentiment, investors can develop a more holistic understanding of the complex crypto ecosystem. This approach to online marketing ppt creation enables clearer communication of complex relationships.

Investment Opportunities and Risk Assessment

June 2024's major crypto events are likely to trigger significant market movements across different sectors of the digital asset ecosystem. Understanding the potential impact patterns and preparing appropriate strategies can help investors navigate this volatile period effectively.

Sector Impact Analysis: June 2024 Events

| Investor Profile | Risk Level | Recommended Strategy | Focus Areas |

|---|---|---|---|

| Conservative | Low | Defensive positioning with limited exposure to volatility | Established L1s, Regulated stablecoins, Compliant infrastructure |

| Balanced | Medium | Diversified approach with strategic allocation to growth sectors | Blue-chip DeFi, L2 scaling, Institutional-grade services |

| Aggressive | High | High-conviction positions in emerging protocols with significant upside | New DeFi primitives, Emerging L1/L2, Early-stage infrastructure |

| Institutional | Tailored | Structured products with defined risk parameters and regulatory compliance | Compliant yield strategies, Regulated derivatives, Custody solutions |

PageOn.ai's data visualization capabilities enable investors to build comprehensive scenario analysis dashboards that model different potential outcomes from June's events. By visualizing how various market segments might respond to different scenarios, investors can develop more nuanced risk management strategies and identify opportunities that might be missed through traditional analysis methods. This approach is particularly valuable when analyzing complex generative AI market report data alongside crypto market developments.

Preparing Your Crypto Strategy for June 2024

With multiple high-impact events scheduled for June 2024, developing a clear strategic approach is essential for navigating potential market volatility and capitalizing on emerging opportunities. This requires both careful preparation and agile response capabilities.

Essential Resources

- Real-time data feeds: Set up customized alerts for price movements, trading volume spikes, and on-chain metrics

- Regulatory updates: Subscribe to specialized legal services focused on digital asset regulation

- Community insights: Monitor governance forums and developer communities for early signals

- Market sentiment tools: Track social media sentiment and institutional positioning

- Expert analysis: Follow respected analysts with track records of accurate market interpretation

Portfolio Adjustments

- Liquidity management: Ensure sufficient liquidity for potential opportunities or necessary defensive moves

- Position sizing: Adjust exposure based on conviction level and potential volatility

- Hedging strategies: Consider options, perpetual futures, or stablecoin positions as hedges

- Correlation analysis: Identify assets likely to move together and diversify accordingly

- Entry/exit planning: Establish clear parameters for position management during high volatility

Real-Time Monitoring System Architecture

flowchart TD

DataSources[Data Sources] --> DataCollection[Data Collection Layer]

DataCollection --> DataProcessing[Data Processing Layer]

DataProcessing --> Analytics[Analytics Engine]

Analytics --> Visualization[Visualization Layer]

Analytics --> Alerts[Alert System]

subgraph DataSources

Market[Market Data]

Social[Social Sentiment]

OnChain[On-Chain Metrics]

News[News & Events]

Regulatory[Regulatory Updates]

end

subgraph DataProcessing

Filtering[Data Filtering]

Normalization[Data Normalization]

Enrichment[Data Enrichment]

end

subgraph Analytics

Correlation[Correlation Analysis]

Anomaly[Anomaly Detection]

Prediction[Predictive Models]

Impact[Impact Assessment]

end

subgraph Alerts

PriceAlerts[Price Alerts]

VolatilityAlerts[Volatility Triggers]

EventAlerts[Event Notifications]

CustomAlerts[Custom Thresholds]

end

PageOn.ai excels at transforming complex crypto strategies into clear visual roadmaps that can guide decision-making during volatile market periods. By creating intuitive visualizations of contingency plans, trigger points, and strategic options, investors can respond more effectively to rapidly changing market conditions. This visual approach to strategy development helps ensure that all stakeholders share a common understanding of the plan and can execute it efficiently when opportunities or risks emerge.

Beyond June: The Ripple Effects on Global Digital Finance

The events of June 2024 will likely have lasting implications that extend far beyond the immediate market reactions. Understanding these potential ripple effects is crucial for developing longer-term strategic positioning and identifying emerging narratives that could shape the crypto landscape through the remainder of 2024 and beyond.

Long-Term Impact Projection: Q3-Q4 2024

The convergence of traditional finance and cryptocurrency ecosystems, exemplified by Strategy's IPO, is likely to accelerate throughout 2024. This could lead to new hybrid financial products, increased regulatory clarity, and greater institutional participation in digital asset markets. These developments will unfold against the backdrop of broader global economy 2025 trends.

Emerging Q3-Q4 Narratives

- Institutional DeFi adoption accelerates following Defidotapp's infrastructure expansion

- Cross-chain interoperability becomes central focus for major protocols

- Regulatory frameworks mature with clearer guidelines for compliant innovation

- Real-world asset tokenization scales with improved infrastructure

- AI integration with blockchain creates new computational markets

Traditional Finance Connections

- Major banks launch dedicated digital asset divisions following Strategy's success

- Traditional asset managers introduce crypto allocation in balanced portfolios

- Payment processors expand cryptocurrency settlement options

- Securities exchanges explore tokenized asset listings

- Insurance products for digital asset custody gain traction

Global Economic Impacts

- Emerging markets accelerate crypto adoption for financial inclusion

- Cross-border payment transformation reduces friction in global trade

- Central Bank Digital Currencies respond to private sector innovation

- Digital asset markets increasingly correlate with macroeconomic factors

- New economic models emerge around tokenized governance systems

PageOn.ai's agentic capabilities empower users to create forward-looking presentation decks that effectively communicate these complex relationships and future scenarios. By leveraging AI to identify connections between disparate data points and visualize emerging trends, investors can develop more robust long-term strategies that account for the transformative potential of June's landmark events. This approach is particularly valuable for communicating complex ideas to stakeholders who may not have deep technical expertise in cryptocurrency markets.

Transform Your Crypto Insights with PageOn.ai

Don't let critical market developments get lost in complexity. PageOn.ai helps you visualize crypto market relationships, create compelling investment presentations, and develop clear strategic roadmaps for navigating the evolving digital asset landscape.

Start Creating with PageOn.ai TodayYou Might Also Like

How to Design Science Lesson Plans That Captivate Students

Create science lesson plans that captivate students with hands-on activities, clear objectives, and real-world applications to foster curiosity and critical thinking.

How to Write a Scientific Review Article Step by Step

Learn how to write a review article in science step by step. Define research questions, synthesize findings, and structure your article for clarity and impact.

How to Write a Self-Performance Review with Practical Examples

Learn how to write a self-performance review with examples and tips. Use an employee performance review work self evaluation sample essay to guide your process.

How to Write a Spec Sheet Like a Pro? [+Templates]

Learn how to create a professional spec sheet with key components, step-by-step guidance, and free templates to ensure clarity and accuracy.