Visualizing the Market Shift: How Robinhood's $200M Bitstamp Acquisition Transforms the Crypto Exchange Landscape

A detailed analysis of the strategic acquisition and its global implications

The Strategic Acquisition Breakdown

On June 3, 2025, Robinhood Markets Inc. completed its $200 million all-cash acquisition of Bitstamp Ltd., instantly transforming the popular trading app from a U.S.-focused retail platform into a global player with institutional capabilities. This strategic move represents one of the most significant consolidations in the cryptocurrency exchange market in recent years.

Bitstamp, founded in 2011, holds the distinction of being one of the world's oldest cryptocurrency exchanges. Its longevity has earned it a reputation for reliability and trust in an industry often plagued by volatility and security concerns. The exchange serves both retail and institutional clients, with a particularly strong presence in European markets.

Acquisition Timeline

timeline

title Robinhood's Bitstamp Acquisition Journey

section Negotiation Phase

Q1 2025 : Initial discussions

March 2025 : Due diligence begins

section Deal Structure

April 2025 : $200M all-cash offer

May 2025 : Agreement reached

section Completion

June 3, 2025 : Acquisition finalized

Q3 2025 : Integration begins

The acquisition process moved relatively quickly, reflecting Robinhood's aggressive expansion strategy in the technology industry. The all-cash nature of the deal also demonstrates Robinhood's strong financial position and commitment to growing its cryptocurrency offerings.

To effectively visualize complex acquisition data like this, PageOn.ai's AI Blocks feature transforms intricate financial and timeline information into clear, structured visual formats that highlight key milestones and strategic implications, making it easier for stakeholders to understand the full context of the deal.

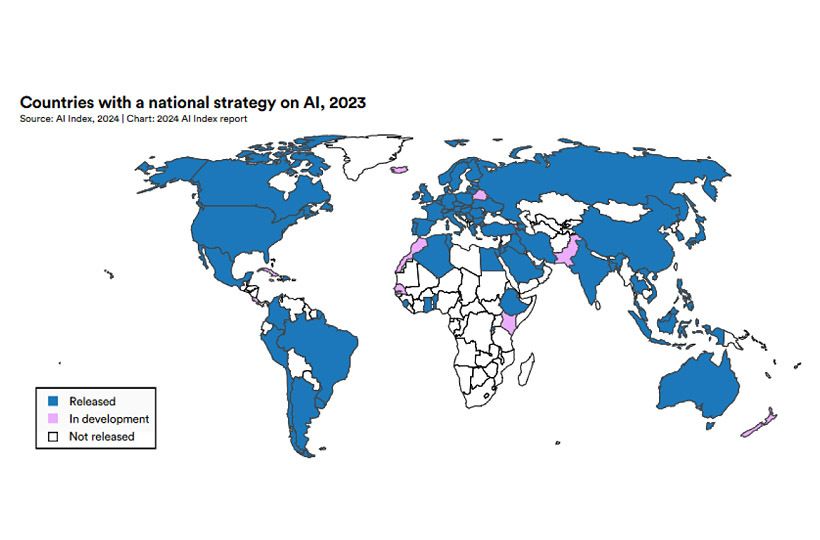

Global Expansion Strategy Unveiled

The Bitstamp acquisition represents a pivotal moment in Robinhood's evolution from a U.S.-centric retail trading platform to a global cryptocurrency powerhouse. This move follows a clear pattern of strategic expansion, notably including Robinhood's agreement to acquire Canadian crypto platform WonderFi for approximately $179 million in May 2025.

With these strategic acquisitions, Robinhood has rapidly expanded its geographical footprint, particularly strengthening its position in key markets:

Robinhood's Global Market Presence

The acquisition of Bitstamp significantly enhances Robinhood's presence in the European market, where Bitstamp has established regulatory compliance and a loyal customer base. This move is particularly strategic as Europe continues to develop its Markets in Crypto-Assets (MiCA) regulatory framework, potentially giving Robinhood an advantage in navigating these new rules.

Furthermore, Bitstamp's existing relationships with institutional clients open new revenue streams for Robinhood, which has historically focused primarily on retail investors. This diversification is especially important in the context of the global economy 2025 outlook, which suggests increased institutional adoption of digital assets.

flowchart LR

R[Robinhood]

W[WonderFi\n$179M]

B[Bitstamp\n$200M]

NA[North American\nMarket]

EU[European\nMarket]

INST[Institutional\nClients]

RETAIL[Retail\nClients]

R -->|Acquires| W

R -->|Acquires| B

W -->|Strengthens| NA

B -->|Dominates| EU

B -->|Provides Access to| INST

R -->|Existing Strength with| RETAIL

classDef orange fill:#FF8000,stroke:#FF6000,color:white

classDef red fill:#E74C3C,stroke:#C0392B,color:white

classDef green fill:#2ECC71,stroke:#27AE60,color:white

classDef blue fill:#3498DB,stroke:#2980B9,color:white

class R orange

class W,B red

class NA,EU green

class INST,RETAIL blue

PageOn.ai's visual mapping capabilities are particularly useful for illustrating these complex market relationships, transforming abstract business strategies into clear geographical and relational visualizations that help stakeholders understand the full scope of Robinhood's expansion.

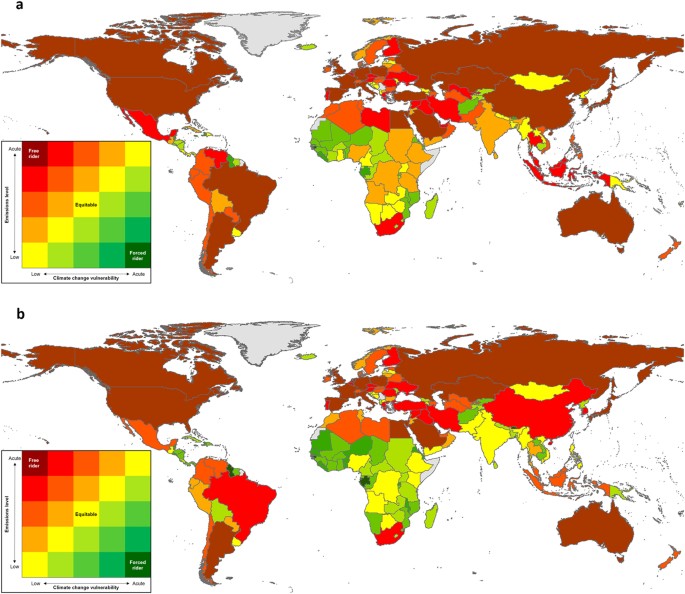

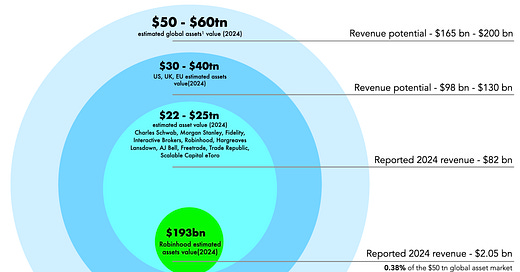

Market Positioning & Competitive Landscape

The acquisition dramatically reshapes the competitive landscape of global cryptocurrency exchanges. Prior to the acquisition, Robinhood was primarily known as a commission-free stock trading platform with cryptocurrency capabilities limited to the U.S. market. Now, it stands as a formidable competitor to established crypto-native exchanges.

Let's examine how Robinhood now compares to major competitors in key operational dimensions:

| Exchange | Global Reach | Institutional Focus | Retail Integration | Regulatory Standing |

|---|---|---|---|---|

| Robinhood + Bitstamp | Strong (NA, EU) | Medium-High | Very High | Strong in key markets |

| Binance | Very High (Global) | High | High | Challenged in some regions |

| Coinbase | Medium (NA, parts of EU) | High | High | Strong in NA |

| Kraken | Medium-High | Medium-High | Medium | Strong in NA, EU |

| OKX | High (Asia focus) | Medium | Medium-High | Strong in Asia |

A key advantage that Robinhood gains through the Bitstamp acquisition is enhanced institutional trading capabilities. Bitstamp has long served institutional clients with high-volume trading needs, premium API access, and dedicated support teams—capabilities that Robinhood previously lacked.

Market Share Shift (Trading Volume)

For businesses looking to create compelling startup one pager for investors, PageOn.ai's Deep Search capabilities can integrate real-time market share data and competitor profiles to produce visually striking comparisons that highlight competitive advantages and market opportunities.

Business Model Transformation

The acquisition fundamentally transforms Robinhood's business model and revenue structure. Prior to acquiring Bitstamp, Robinhood's crypto revenue came primarily from retail trading spreads and payment for order flow. Now, the company can tap into institutional trading fees, custody services, and advanced trading features.

flowchart TD

R[Robinhood Revenue Streams]

R --> PRE[Pre-Acquisition]

R --> POST[Post-Acquisition]

PRE --> P1[Retail Trading Spreads]

PRE --> P2[Payment for Order Flow]

PRE --> P3[Robinhood Gold Subscriptions]

PRE --> P4[Interest on Cash Balances]

POST --> N1[Institutional Trading Fees]

POST --> N2[Custody Services]

POST --> N3[Advanced API Access]

POST --> N4[International Retail Markets]

POST --> P1

POST --> P2

POST --> P3

POST --> P4

classDef orange fill:#FF8000,stroke:#FF6000,color:white

classDef blue fill:#3498DB,stroke:#2980B9,color:white

classDef green fill:#2ECC71,stroke:#27AE60,color:white

class R orange

class PRE,POST blue

class N1,N2,N3,N4 green

The integration of Bitstamp's institutional capabilities with Robinhood's user-friendly retail platform creates several potential synergies:

- Enhanced liquidity: The combined order books can provide better pricing and reduced slippage for all users

- Cross-selling opportunities: Introducing Robinhood's stock trading to Bitstamp's European customers

- Technology integration: Leveraging Bitstamp's robust exchange infrastructure with Robinhood's intuitive interface

- Operational efficiencies: Shared compliance, security, and customer service resources

Projected Revenue Growth by Segment

PageOn.ai's data visualization tools are invaluable for creating these projection models, transforming complex financial forecasts into clear, compelling visuals that effectively communicate business growth trajectories to stakeholders and potential investors.

For financial analysts preparing investment banking pitch decks, these visualizations can effectively communicate the strategic value and financial potential of such acquisitions.

Regulatory Implications & Challenges

The acquisition places Robinhood in a complex regulatory landscape spanning multiple jurisdictions. While this presents challenges, it also offers strategic advantages if navigated successfully.

Key regulatory considerations include:

mindmap

root((Regulatory

Landscape))

United States

SEC oversight

CFTC commodity regulations

State-by-state licensing

BSA/AML compliance

European Union

MiCA framework

AMLD5 implementation

Country-specific requirements

Luxembourg

Germany

France

Asia Pacific

Singapore PSA

Japan FSA

South Korea regulations

Canada

CSA oversight

Provincial securities laws

Bitstamp brings valuable regulatory assets to Robinhood, including established compliance frameworks in European markets. The exchange holds licenses in Luxembourg and other EU jurisdictions, providing Robinhood with a regulatory foothold that would have taken years to build independently.

However, the acquisition also creates new compliance challenges, particularly around integrating different KYC/AML systems and adapting to evolving global crypto regulations. Robinhood will need to navigate these complexities while maintaining operational efficiency.

Regulatory Complexity by Region

PageOn.ai's AI Blocks are particularly effective for simplifying and clarifying these regulatory complexities. By transforming dense regulatory information into intuitive visual structures, PageOn.ai helps stakeholders quickly understand compliance requirements across different jurisdictions and identify potential regulatory challenges or opportunities.

This regulatory complexity is reflective of broader trends in the intelligent agents industry ecosystem, where global regulatory frameworks are still evolving to address new technological capabilities.

Investment & Market Response Analysis

The market's reaction to Robinhood's acquisition of Bitstamp has been predominantly positive, with several key indicators reflecting investor confidence in the strategic move.

Following the announcement, Robinhood's stock experienced significant movement:

Robinhood Stock Performance Around Acquisition

Analyst sentiment has also been largely favorable, with several key investment firms upgrading their outlook for Robinhood following the acquisition announcement:

Bullish Factors

- Expanded global market access

- New institutional revenue streams

- Established regulatory compliance in EU

- Competitive positioning against Coinbase

- Potential for cross-selling financial products

Risk Factors

- Integration challenges

- Regulatory uncertainty in multiple jurisdictions

- Crypto market volatility

- Competition from established global exchanges

- Potential cultural differences between companies

Analyst Sentiment Distribution

Based on current projections, the acquisition is expected to reach ROI breakeven within 3-4 years, with significant upside potential if crypto market conditions remain favorable and global expansion proceeds as planned.

PageOn.ai's Agentic capabilities are particularly valuable for generating customized investor presentation visuals that highlight these market responses and ROI projections, helping companies effectively communicate the value of strategic acquisitions to shareholders and potential investors.

Future Outlook & Industry Impact

Robinhood's acquisition of Bitstamp signals a potential acceleration in cryptocurrency exchange consolidation, as companies seek scale and geographic diversification to compete in an increasingly global market.

Several industry trends are likely to emerge or accelerate following this acquisition:

graph TD

A[Robinhood-Bitstamp Acquisition]

A --> B[Industry Consolidation]

A --> C[Traditional Finance Entry]

A --> D[Regulatory Evolution]

A --> E[Product Innovation]

B --> B1[Smaller exchanges acquired]

B --> B2[Regional players merge]

B --> B3[Market share concentration]

C --> C1[Banks launch crypto divisions]

C --> C2[Investment firms enter space]

C --> C3[Payment providers expand offerings]

D --> D1[Harmonized global standards]

D --> D2[Clearer compliance frameworks]

D --> D3[Institutional-grade safeguards]

E --> E1[Integrated trading experiences]

E --> E2[New derivative products]

E --> E3[DeFi/CeFi hybrid solutions]

classDef orange fill:#FF8000,stroke:#FF6000,color:white

classDef blue fill:#3498DB,stroke:#2980B9,color:white

classDef green fill:#2ECC71,stroke:#27AE60,color:white

classDef purple fill:#9B59B6,stroke:#8E44AD,color:white

class A orange

class B,B1,B2,B3 blue

class C,C1,C2,C3 green

class D,D1,D2,D3 purple

class E,E1,E2,E3 orange

The combined Robinhood-Bitstamp entity is well-positioned to introduce several innovative products and services that could reshape the crypto trading landscape:

- Integrated stock-crypto trading platform with seamless asset transfers across traditional and digital markets

- Enhanced institutional services including custody, OTC trading, and API access with Robinhood's user-friendly interface

- Global retail access to diverse crypto assets with localized compliance and fiat on/off ramps

- Cross-border payment solutions leveraging crypto rails with traditional financial integration

Projected Exchange Market Evolution

PageOn.ai's Vibe Creation capabilities are particularly valuable for developing these forward-looking visualizations, transforming abstract industry trends and future scenarios into compelling visual narratives that help stakeholders understand potential market evolutions and strategic opportunities.

Transform Your Market Analysis with PageOn.ai

Create stunning visual expressions that bring complex market dynamics to life. From acquisition analysis to competitive landscapes, PageOn.ai helps you communicate intricate financial stories with clarity and impact.

Start Visualizing with PageOn.ai TodayThe Future of Digital Asset Trading

Robinhood's acquisition of Bitstamp represents more than just another fintech merger—it signals a fundamental shift in how digital asset markets are structured and accessed globally. As traditional finance and cryptocurrency markets continue to converge, we can expect further consolidation and innovation in this space.

For investors, traders, and industry observers, understanding these market dynamics is crucial for navigating the evolving landscape. The combined entity creates new opportunities for both retail and institutional participants, while potentially setting new standards for user experience, regulatory compliance, and global market access.

As we've seen throughout this analysis, visualizing complex market relationships and business transformations is essential for clear understanding. PageOn.ai's suite of visualization tools empowers analysts, investors, and business leaders to transform intricate market data into compelling visual narratives that reveal insights and drive strategic decision-making.

You Might Also Like

How to Design Science Lesson Plans That Captivate Students

Create science lesson plans that captivate students with hands-on activities, clear objectives, and real-world applications to foster curiosity and critical thinking.

How to Write a Scientific Review Article Step by Step

Learn how to write a review article in science step by step. Define research questions, synthesize findings, and structure your article for clarity and impact.

How to Write a Self-Performance Review with Practical Examples

Learn how to write a self-performance review with examples and tips. Use an employee performance review work self evaluation sample essay to guide your process.

How to Write a Spec Sheet Like a Pro? [+Templates]

Learn how to create a professional spec sheet with key components, step-by-step guidance, and free templates to ensure clarity and accuracy.