Visualizing Robinhood's Global Crypto Expansion: The $200M Bitstamp Acquisition

A comprehensive analysis of strategic implications and market positioning

In a bold move that signals its ambitions beyond the U.S. retail trading market, Robinhood has completed its $200 million acquisition of Bitstamp. This strategic purchase instantly transforms Robinhood's global footprint, regulatory standing, and product capabilities. This visualization explores how this acquisition reshapes Robinhood's position in the global crypto landscape and what it means for competitors, investors, and the broader financial ecosystem.

The Strategic Acquisition Landscape

Robinhood's $200 million all-cash acquisition of Bitstamp represents a pivotal moment in the company's evolution from a U.S.-focused retail trading app to a global financial platform. This strategic move instantly provides Robinhood with an established international presence, regulatory clearances, and institutional capabilities that would have taken years to build organically.

The timing of this acquisition coincides with significant shifts in global crypto market dynamics, including increased regulatory clarity in many jurisdictions and growing institutional adoption of digital assets. By acquiring Bitstamp, Robinhood gains access to more than 50 active crypto licenses across Europe, the UK, and Asia, as well as an established institutional client base — something the retail trading app has historically lacked.

Robinhood's Transformation Through Bitstamp Acquisition

flowchart TB

subgraph Before["Before Acquisition"]

RH[Robinhood]

BS[Bitstamp]

RH -->|US-Focused| RT[Retail Trading]

RH -->|Limited| CL[15 Crypto Listings]

RH -->|US Only| RM[Regulatory Markets]

BS -->|Europe, UK, Asia| BM[Established Markets]

BS -->|Extensive| BCL[85+ Crypto Listings]

BS -->|50+ Licenses| BR[Regulatory Approvals]

BS -->|Established| IC[Institutional Clients]

end

subgraph After["After Acquisition"]

RHE[Robinhood Enhanced]

RHE -->|Global Reach| GM[Global Markets]

RHE -->|Expanded| ECL[85+ Crypto Listings]

RHE -->|Multi-Region| ER[50+ Regulatory Approvals]

RHE -->|New Capability| NIC[Institutional Clients]

RHE -->|New Services| NS[Lending, Staking, CaaS]

end

RH & BS ==> RHE

style RH fill:#FF8000,color:white

style BS fill:#4285F4,color:white

style RHE fill:#FF8000,color:white,stroke-width:3px

style After fill:#f5f5f5,stroke:#FF8000,stroke-width:2px

This acquisition fundamentally changes Robinhood's business model and competitive positioning. The company now has the infrastructure to offer lending, staking, and "crypto as a service" capabilities, expanding well beyond its original commission-free trading roots. For companies looking to analyze similar strategic expansions, market research reports can provide valuable context on industry trends and competitive dynamics.

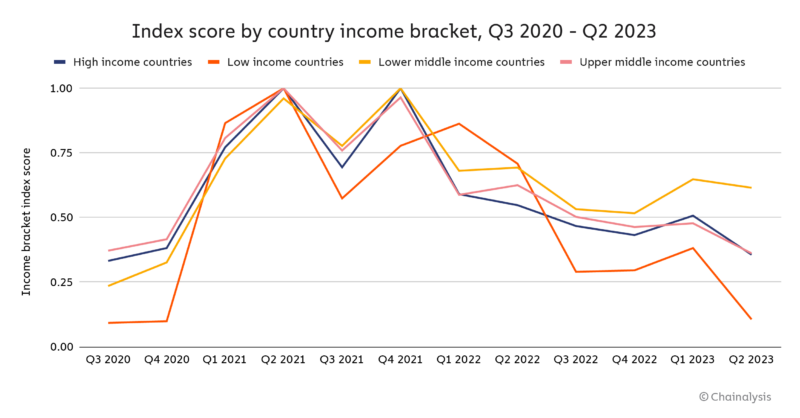

Regulatory Passport: The 50+ License Advantage

Perhaps the most significant aspect of the Bitstamp acquisition is the instant regulatory clearance it provides Robinhood across multiple global markets. The company now possesses more than 50 crypto licenses spanning Europe, the UK, Asia, and the US – regulatory approvals that would have required years of complex application processes and significant resources to obtain organically.

Regulatory Coverage by Region

Distribution of the 50+ crypto licenses acquired through Bitstamp

This regulatory passport provides Robinhood with significant competitive advantages:

- Time-to-market acceleration: Immediate ability to operate in multiple jurisdictions without lengthy approval processes

- Reduced regulatory risk: Leveraging Bitstamp's established compliance frameworks and relationships with regulators

- Flexibility in product offerings: Different regulatory regimes allow for varied service offerings tailored to local markets

- Competitive positioning: Instant parity or advantage against regional competitors who may lack multi-market approvals

The regulatory landscape for cryptocurrency continues to evolve rapidly, with significant differences between regions. While some Asian markets like Singapore have established clear frameworks, others maintain more restrictive approaches. Similarly, the EU's Markets in Crypto-Assets (MiCA) regulation creates a standardized approach across member states, while the UK has its own distinct Financial Conduct Authority (FCA) requirements. Understanding these nuances is critical when analyzing the global economy 2025 outlook, particularly as it relates to digital asset regulation.

Product Portfolio Expansion

The acquisition dramatically expands Robinhood's crypto product capabilities, increasing its tradable assets from just 15 coins to over 85 tokens. This expanded offering positions Robinhood more competitively against dedicated crypto exchanges and diversifies its revenue potential across a much broader asset base.

Tradable Asset Expansion

Comparing pre-acquisition and post-acquisition crypto offerings

Beyond simply expanding the number of tradable assets, the acquisition brings several new capabilities to Robinhood's platform:

New Product Capabilities

flowchart TD

Acquisition[Bitstamp Acquisition]

Acquisition --> TC[Trading Capabilities]

Acquisition --> IC[Institutional Capabilities]

Acquisition --> IS[Infrastructure Services]

TC --> EA[Expanded Assets]

TC --> AM[Advanced Markets]

IC --> ICD[Institutional Client Base]

IC --> OTC[OTC Trading Desk]

IC --> API[Institutional APIs]

IS --> Staking[Staking Services]

IS --> Lending[Crypto Lending]

IS --> CaaS[Crypto as a Service]

EA --> |"85+ tokens"| Altcoins[Altcoin Diversity]

AM --> |"Spot & derivatives"| Markets[Market Types]

style Acquisition fill:#FF8000,color:white

style TC fill:#4285F4,color:white

style IC fill:#34A853,color:white

style IS fill:#EA4335,color:white

The addition of an institutional client base is particularly significant for Robinhood, which has historically focused exclusively on retail investors. This new customer segment opens up entirely different revenue streams and business opportunities, including:

- OTC (Over-the-Counter) trading services for high-volume institutional transactions

- Custody solutions for institutional clients with specific security and compliance requirements

- API-based trading infrastructure for programmatic access to markets

- Staking and yield-generating services for institutional portfolios

For financial institutions looking to present these types of strategic expansions to stakeholders, effective visualization is crucial. Investment banking pitch decks often rely on clear visual representations to communicate complex strategic value propositions to potential investors or partners.

Market Position and Competitive Analysis

The Bitstamp acquisition significantly reshapes Robinhood's competitive positioning in the global crypto exchange landscape. With Bitstamp's approximately $230 million in daily spot trading volume and Robinhood's Q1 2025 crypto revenue of $252 million (representing a 100% year-over-year increase), the combined entity emerges as a more formidable player in the global market.

Competitive Positioning Analysis

Comparing key metrics across major crypto exchange platforms

The acquisition transforms Robinhood's market position in several key dimensions:

| Competitive Dimension | Pre-Acquisition | Post-Acquisition | Strategic Impact |

|---|---|---|---|

| Geographic Reach | US-focused | Global (EU, UK, Asia, US) | Immediate multi-market presence |

| Client Segments | Retail only | Retail + Institutional | New revenue streams, higher volumes |

| Asset Coverage | 15 tokens | 85+ tokens | Broader appeal, diversified trading |

| Service Offerings | Basic trading | Trading, staking, lending, CaaS | Comprehensive crypto platform |

| Regulatory Standing | Limited (US) | Extensive (50+ licenses) | Reduced regulatory risk, faster expansion |

This strategic repositioning places Robinhood in more direct competition with global crypto exchanges like Binance, Coinbase, and Kraken, while differentiating it from traditional fintech players that offer limited crypto functionality. For investors and analysts tracking these market developments, AI stock charting tools can provide valuable insights into how these strategic moves impact company valuations and market dynamics.

Regional Expansion Strategy

The Bitstamp acquisition provides Robinhood with immediate entry into multiple regional markets, each with its own unique characteristics, regulatory frameworks, and competitive dynamics. Let's examine the specific strategic implications for key regions.

European Market Entry

Europe represents a significant opportunity for Robinhood, with its developed financial markets, high digital adoption rates, and evolving regulatory framework under MiCA (Markets in Crypto-Assets). Bitstamp's established presence across multiple EU member states provides Robinhood with immediate market access.

Key European markets where Bitstamp has established operations include:

- Germany: Europe's largest economy with a growing crypto user base and clear regulatory framework

- France: Significant financial hub with progressive crypto regulations

- Netherlands: Strong fintech ecosystem and high digital currency adoption

- Spain: Growing crypto market with regulatory clarity improving

- Italy: Emerging crypto market with recent regulatory developments

The unified EU regulatory approach under MiCA provides Robinhood with the potential for passport-like expansion across the entire European Economic Area once fully implemented, though individual member states still maintain some regulatory differences that require market-specific approaches.

UK Market Positioning

The United Kingdom represents a distinct market opportunity with its own regulatory framework under the Financial Conduct Authority (FCA). Post-Brexit, the UK has been developing its own approach to crypto regulation, separate from the EU's MiCA framework.

UK Crypto Market Competitive Landscape

Market share comparison of major exchanges in the UK market

Bitstamp's established FCA registration provides Robinhood with immediate regulatory clearance in the UK market, bypassing a process that has proven challenging for many crypto businesses. This regulatory standing, combined with Robinhood's user experience expertise, positions the company to potentially disrupt the UK's retail crypto market while serving institutional clients through Bitstamp's existing relationships.

Asian Market Penetration

Asia represents both a massive opportunity and a complex regulatory challenge for crypto businesses. Different countries in the region have widely varying approaches to cryptocurrency regulation, from Singapore's progressive framework to China's restrictive policies.

Bitstamp's Asian licenses likely include:

- Singapore: A key financial hub with a well-developed regulatory framework for digital assets

- Japan: Highly regulated market requiring specific licenses for crypto exchanges

- Hong Kong: Developing clearer regulatory frameworks for virtual asset service providers

- South Korea: Significant crypto trading volume with specific compliance requirements

The competitive landscape in Asia is particularly intense, with strong local players in each market as well as global exchanges with established regional operations. Robinhood will need to leverage Bitstamp's existing relationships and licenses while bringing its distinctive user experience and potentially lower fee structure to compete effectively.

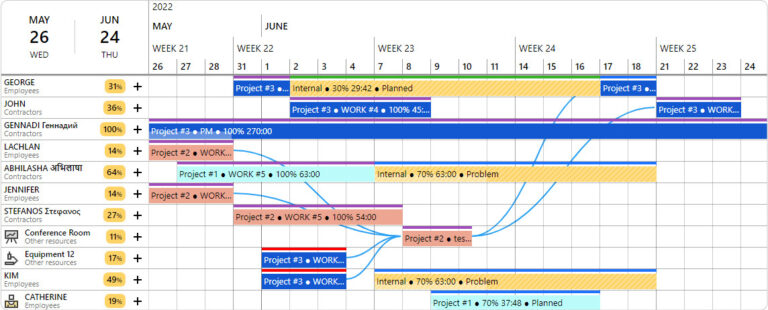

Operational Integration Challenges and Opportunities

While the strategic benefits of the Bitstamp acquisition are clear, the operational integration of the two platforms presents both challenges and opportunities. Robinhood has indicated that it plans to maintain Bitstamp's existing operations intact for the near term, using the exchange for smart order routing and as a foundation for expanding its presence across Europe, the UK, and Asia.

Integration Architecture

flowchart TD

subgraph RH["Robinhood Platform"]

RHU[User Interface]

RHT[Trading Engine]

RHW[Wallet Services]

RHC[Compliance Systems]

end

subgraph BS["Bitstamp Platform"]

BST[Trading Engine]

BSL[Liquidity Pools]

BSI[Institutional Services]

BSC[Compliance Systems]

BSR[Regulatory Licenses]

end

subgraph INT["Integration Layer"]

API[API Gateway]

OR[Order Routing]

IM[Identity Management]

DW[Data Warehouse]

end

RHU --> API

API --> RHT

API --> BST

RHT --> OR

OR --> BSL

RHW <--> IM

BSI <--> IM

RHC --> DW

BSC --> DW

BSR --> DW

style RH fill:#FF8000,color:white

style BS fill:#4285F4,color:white

style INT fill:#34A853,color:white

Key integration considerations include:

- Technology Stack Harmonization: Aligning disparate technology platforms while maintaining operational stability

- User Experience Consistency: Ensuring a coherent user experience across both platforms during the transition period

- Compliance Framework Integration: Merging compliance systems while maintaining regulatory standing in all jurisdictions

- Cultural Integration: Blending Robinhood's retail-focused culture with Bitstamp's institutional expertise

- Brand Strategy: Determining whether to maintain Bitstamp as a separate brand or gradually migrate to the Robinhood brand

The integration process will likely follow a phased approach, beginning with back-end systems integration for order routing and liquidity sharing, followed by gradual harmonization of user interfaces and experiences. Throughout this process, maintaining regulatory compliance across all jurisdictions will remain a critical priority to preserve the value of Bitstamp's extensive licensing portfolio.

Future Growth Trajectory and Strategic Implications

The Bitstamp acquisition represents just the beginning of Robinhood's global expansion strategy. With this foundation in place, the company is positioned for continued growth across multiple dimensions.

Projected Growth Trajectory

Estimated revenue growth across different business segments

Several strategic pathways for future growth emerge from this acquisition:

Geographic Expansion

Further penetration into existing markets and expansion into new regions leveraging the regulatory foundation established through Bitstamp.

Institutional Growth

Expanding institutional services beyond Bitstamp's current offerings to capture larger share of institutional crypto trading and custody market.

Product Innovation

Developing new crypto products and services, particularly in yield-generating offerings like staking and lending, as well as expanding "Crypto as a Service" capabilities.

Additional Acquisitions

Strategic acquisitions in complementary areas such as crypto custody, analytics, or specialized regional players to further strengthen market position.

The longer-term strategic vision appears to be transforming Robinhood from a US-focused retail trading app into a comprehensive global financial platform with diversified revenue streams across retail and institutional segments. This evolution positions the company to compete more directly with both traditional financial institutions and crypto-native exchanges.

As Robinhood continues this transformation, it will face both challenges and opportunities. Regulatory landscapes continue to evolve globally, competitive pressures remain intense, and technology integration will require significant resources. However, the foundation established through the Bitstamp acquisition provides a strong platform for future growth. For analysts and investors tracking these developments, comprehensive generative AI market report tools can provide valuable insights into how these strategic moves may impact market dynamics and company valuations.

Transform Your Financial Data Visualization with PageOn.ai

Create stunning visual representations of market expansions, competitive landscapes, and strategic acquisitions. PageOn.ai's powerful visualization tools help you communicate complex financial data clearly and effectively.

Start Creating with PageOn.ai TodayConclusion: A Transformative Strategic Move

Robinhood's acquisition of Bitstamp for $200 million represents a transformative strategic move that instantly repositions the company in the global crypto landscape. By securing more than 50 regulatory licenses across Europe, the UK, and Asia, expanding its tradable assets from 15 to 85+ tokens, and adding institutional capabilities, Robinhood has laid the foundation for significant future growth.

The integration challenges ahead are substantial but manageable, particularly given the company's approach of maintaining Bitstamp's operations intact in the near term. As Robinhood continues to execute on this global expansion strategy, it has the potential to evolve from a US-focused retail trading app into a comprehensive global financial platform with diversified revenue streams.

For stakeholders seeking to understand complex strategic moves like this one, visual representation is key. PageOn.ai's visualization tools provide the perfect solution for transforming complex financial data and strategic analysis into clear, compelling visual narratives that communicate the full strategic implications of major market developments.

You Might Also Like

How to Design Science Lesson Plans That Captivate Students

Create science lesson plans that captivate students with hands-on activities, clear objectives, and real-world applications to foster curiosity and critical thinking.

How to Write a Scientific Review Article Step by Step

Learn how to write a review article in science step by step. Define research questions, synthesize findings, and structure your article for clarity and impact.

How to Write a Self-Performance Review with Practical Examples

Learn how to write a self-performance review with examples and tips. Use an employee performance review work self evaluation sample essay to guide your process.

How to Write a Spec Sheet Like a Pro? [+Templates]

Learn how to create a professional spec sheet with key components, step-by-step guidance, and free templates to ensure clarity and accuracy.