The Visual Evolution of US Trade Balance

Mapping a Century of Economic Transformation

From manufacturing powerhouse to service economy leader, the United States has experienced dramatic shifts in its trade relationships and balance. This visual journey explores a century of economic transformation through innovative data visualizations, revealing the complex interplay of tariffs, deficits, and global competition that shaped America's economic position.

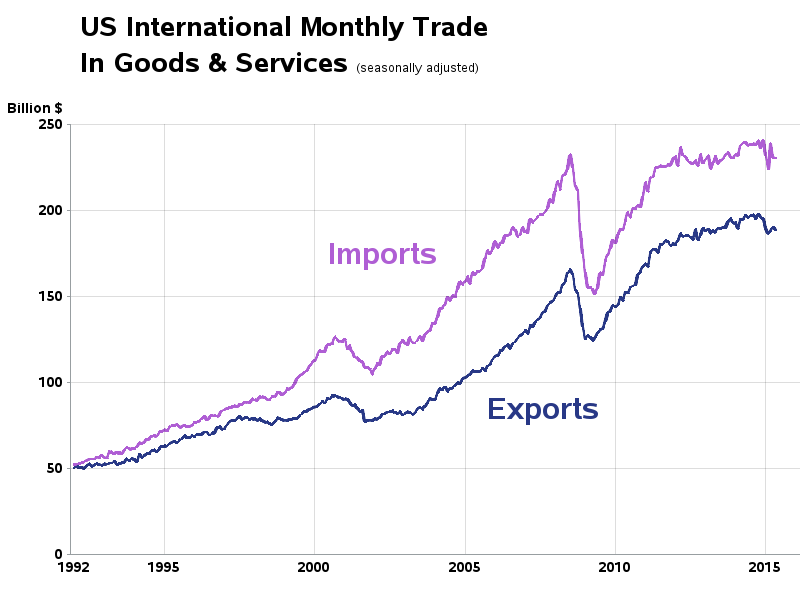

The Shifting Landscape of US Trade (1920s-2020s)

Over the past century, the United States trade balance has undergone dramatic transformations that reflect broader economic, political, and technological changes. Once a manufacturing powerhouse with consistent trade surpluses, the U.S. transitioned to persistent trade deficits beginning in the 1970s, signaling fundamental shifts in global economic dynamics.

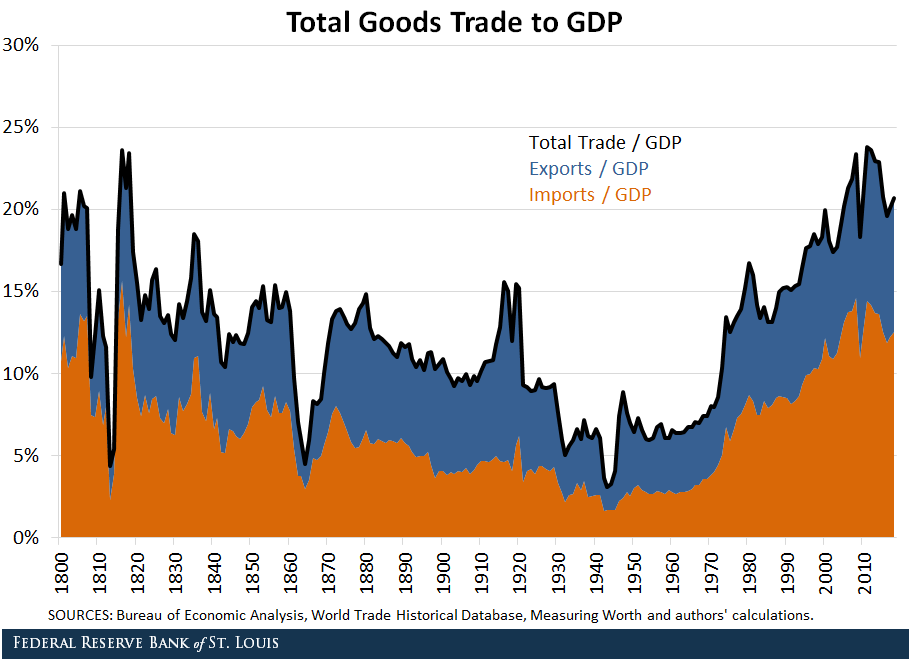

A century of U.S. trade balance evolution showing the dramatic shift from surplus to deficit in the 1970s.

U.S. Trade Balance as Percentage of GDP (1920-2020)

This visualization highlights the dramatic shift from trade surplus to persistent deficit.

Key Turning Points

- Post-World War I manufacturing dominance (1920s)

- Great Depression and Smoot-Hawley tariff impacts (1930s)

- Post-World War II economic boom and Marshall Plan (1940s-50s)

- Rise of global competition and oil price shocks (1970s)

- Plaza Accord and manufacturing outsourcing (1980s-90s)

- China's entry into WTO and accelerated deficits (2000s)

- Digital trade and services expansion (2010s-present)

Evolution of Trade Composition

The changing composition of U.S. trade reflects the nation's economic evolution from manufacturing powerhouse to service economy leader. This shift is particularly visible when exploring free history presentation templates that visually document this transformation.

Trade Composition Evolution

How U.S. exports shifted from goods to services over a century

flowchart TB

1920s["1920s-1950s"] --> |"Industrial Revolution Legacy"| Manufacturing["Manufacturing Dominance

(80% of Exports)"]

Manufacturing --> |"Rising Competition"| 1970s["1970s-1990s"]

1970s --> |"Outsourcing"| Mixed["Mixed Economy

(50% Manufacturing, 50% Services)"]

Mixed --> |"Digital Revolution"| 2000s["2000s-Present"]

2000s --> |"Technology & IP Growth"| Services["Services Dominance

(65% of Value)"]

Services --> |"4th Industrial Revolution"| Future["Future Trends

Digital Trade & Data"]

classDef orange fill:#FFF2E6,stroke:#FF8000,stroke-width:2px

classDef blue fill:#E6F7FF,stroke:#0099FF,stroke-width:2px

class Manufacturing,Mixed,Services orange

class 1920s,1970s,2000s,Future blue

The visualization methods used to track and report trade have also evolved significantly. Modern data analytics allow for more nuanced understanding of trade flows, enabling more sophisticated strategic planning for both businesses and policymakers navigating the global economy 2025 landscape.

Tariff Policies Through Visual Analysis

Tariff policies have significantly shaped U.S. trade patterns throughout the past century. From the protectionist measures of the early 20th century to the liberalization efforts of the post-war era and recent revival of tariff strategies, these policies provide critical context for understanding trade balance evolution.

Comparative visualization of major U.S. tariff regimes and their economic impacts, 1920-2020.

Average U.S. Tariff Rates by Era

This chart illustrates how tariff rates have fluctuated throughout different policy periods.

The Smoot-Hawley Tariff Effect

The Smoot-Hawley Tariff of 1930 remains one of the most studied tariff policies in economic history. Introduced during the Great Depression, it raised duties on over 20,000 imported goods to record levels, averaging 45-50%. The visualization below captures its catastrophic effects:

Smoot-Hawley Tariff Effects

The cascading economic consequences of protectionist policy

flowchart TD

SH[Smoot-Hawley

Tariff Act 1930] --> TR[Tariff Rates

Increased 45-50%]

TR --> |"Global Response"| RET[Retaliatory Tariffs

from Trading Partners]

TR --> |"Domestic Effect"| IP[Import Prices

Increased]

RET --> |"Export Impact"| EXD[U.S. Exports

Declined 61%]

IP --> |"Consumption Effect"| CD[Consumer Demand

Decreased]

CD --> |"Production Impact"| PD[Production

Decreased]

EXD --> EMP[Unemployment

Increased]

PD --> EMP

EMP --> |"Economic Impact"| GD[Depression

Deepened]

GD --> |"Policy Response"| RTAA[Reciprocal Trade

Agreements Act 1934]

RTAA --> |"Long-term Effect"| GATT[Foundation for

GATT/WTO System]

classDef orange fill:#FFF2E6,stroke:#FF8000,stroke-width:2px

classDef red fill:#FFEEEE,stroke:#FF6666,stroke-width:2px

classDef green fill:#F0F8F0,stroke:#66BB6A,stroke-width:2px

class SH,TR,IP,RET orange

class EXD,CD,PD,EMP,GD red

class RTAA,GATT green

GATT/WTO Evolution

The General Agreement on Tariffs and Trade (GATT) and its successor, the World Trade Organization (WTO), fundamentally transformed the global trading system. This transformation can be effectively communicated using 4 Ps of marketing frameworks that emphasize the evolution of global trade policy positioning.

Modern Tariff Conflicts

Recent years have seen a resurgence in tariff usage as a trade policy tool, particularly in the U.S.-China trade relationship. These modern tariff strategies have significantly impacted global supply chains and trade flows.

Before-and-after visualization of U.S.-China trade flows following 2018-2020 tariff implementation.

The Deficit Phenomenon: Beyond the Numbers

The U.S. trade deficit has been a persistent economic feature since the 1970s, yet its causes, effects, and implications remain widely misunderstood. Effective visualizations can help unpack the complex factors contributing to trade imbalances and their relationship to broader economic indicators.

Multi-layered visualization of U.S. trade deficit components and contributing factors in the modern economy.

Comparative Trade Position Analysis

This radar chart compares key trade metrics across major economies, highlighting the distinctive characteristics of the U.S. trade position.

Deficit-Domestic Economy Relationship

The relationship between trade deficits and domestic economic indicators like GDP growth, employment, and inflation is complex and often counterintuitive. Modern analysis using advanced generative AI market report tools can help identify these non-obvious correlations.

Deficit-Domestic Economy Relationship

How trade deficits interact with key domestic economic indicators

flowchart TB

TD[Trade Deficit

Increases]

subgraph Conventional View

TD -->|"Traditional View"| NE[Negative Effect

on Economy]

NE --> J1[Job Losses in

Import-Competing Sectors]

NE --> MO1[Money Flowing

Out of Country]

end

subgraph Modern Economic Analysis

TD -->|"Modern Analysis"| CONS[Higher Consumption

Possibilities]

TD -->|"Capital Account Effect"| INV[Capital Inflows

for Investment]

TD -->|"Currency Effect"| DOL[Dollar Strength/

Reserve Currency Status]

CONS --> WEL[Consumer Welfare

Increases]

INV --> GRO[Economic Growth

Potential]

DOL --> BOW[Global Borrowing

Advantage]

DOL --> INFL[Lower Inflation

Pressure]

end

subgraph Balanced Perspective

WEL & GRO & BOW & INFL ----> BAL[Complex Trade-offs

Sector-Specific Impacts]

J1 & MO1 ----> BAL

end

classDef orange fill:#FFF2E6,stroke:#FF8000,stroke-width:2px

classDef red fill:#FFEEEE,stroke:#FF6666,stroke-width:2px

classDef blue fill:#EFF8FF,stroke:#3B82F6,stroke-width:2px

classDef green fill:#F0F8F0,stroke:#66BB6A,stroke-width:2px

classDef purple fill:#F5F3FF,stroke:#8B5CF6,stroke-width:2px

class TD orange

class NE,J1,MO1 red

class CONS,WEL blue

class INV,GRO green

class DOL,BOW,INFL,BAL purple

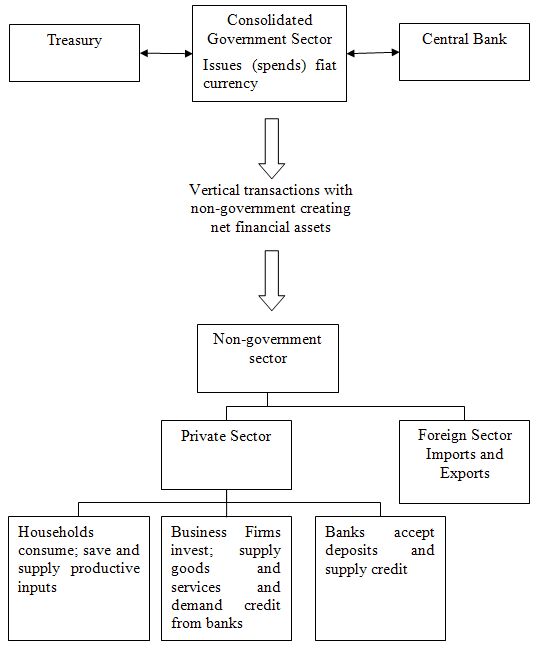

Deficit Financing Mechanisms

Understanding how the U.S. finances its persistent trade deficits is crucial to grasping their long-term implications. The unique role of the dollar as the world's primary reserve currency creates monetary dynamics not seen in other economies.

Visual breakdown of how the U.S. trade deficit is financed through global capital flows and the dollar's reserve currency status.

Potential Deficit Reduction Strategies

Various approaches to address the U.S. trade deficit have been proposed, each with different implications for domestic and global economies. Scenario modeling can help visualize potential outcomes.

Impact of Deficit Reduction Strategies

Comparing projected outcomes of different trade deficit reduction approaches.

Global Competition: Visualizing Changing Partners

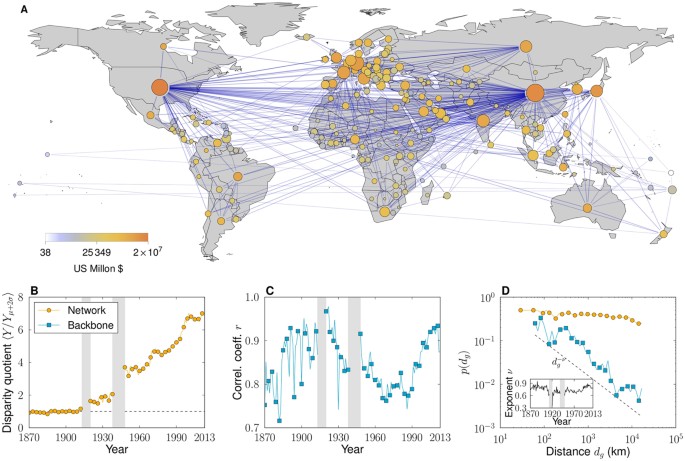

The landscape of U.S. trading partners has transformed dramatically over the past century, with significant geopolitical and economic implications. Visualization tools can effectively capture these evolving relationships, highlighting the rise and fall of key partners and changing competitive dynamics.

Geographic visualization depicting the evolution of U.S. trading partners from 1920 to 2020, with line thickness indicating trade volume.

Top U.S. Trading Partners: 1950 vs. 2020

This comparative chart reveals the dramatic shift in the U.S. trading landscape over 70 years.

Sector-Specific Competition

Global competition varies significantly across different industrial sectors, with the U.S. maintaining strong positions in some areas while facing intense competition in others. These competitive dynamics can be modeled using intelligent agents industry ecosystem approaches to visualize complex multi-dimensional relationships.

Visual mapping of U.S. competitive position across key industrial sectors relative to global competitors.

The Rise of Emerging Economies

Emerging economies have fundamentally transformed the global trading system and U.S. trade relationships over the past decades. These shifts have created both challenges and opportunities for U.S. businesses and policymakers.

Emerging Economies' Impact on U.S. Trade

How developing economies have reshaped global trade flows

flowchart TD

EM[Emerging

Market Growth] --> LABOR[Lower Labor

Costs]

EM --> MCLASS[Growing Middle

Class Consumers]

EM --> TECH[Technology

Adoption & Innovation]

LABOR -->|"Manufacturing

Shift"| USDEF[U.S. Trade Deficit

Expansion]

LABOR -->|"Supply Chain

Reconfiguration"| GVC[Global Value

Chains]

MCLASS -->|"Market

Opportunity"| USEXP[U.S. Exports

Growth Potential]

MCLASS -->|"Consumer Goods

Demand"| COMP[Global Resource

Competition]

TECH -->|"Innovation

Competition"| IP[Intellectual Property

Challenges]

TECH -->|"Digital

Trade"| SERV[Services Trade

Expansion]

USDEF & GVC & USEXP & COMP --- FUT[Future U.S.

Trade Dynamics]

IP & SERV --- FUT

classDef orange fill:#FFF2E6,stroke:#FF8000,stroke-width:2px

classDef blue fill:#EFF8FF,stroke:#3B82F6,stroke-width:2px

classDef green fill:#F0F8F0,stroke:#66BB6A,stroke-width:2px

classDef purple fill:#F5F3FF,stroke:#8B5CF6,stroke-width:2px

class EM orange

class LABOR,MCLASS,TECH blue

class USDEF,USEXP,GVC,COMP,IP,SERV green

class FUT purple

Comparative Strengths and Weaknesses

Understanding the relative competitive position of the U.S. versus key trading partners requires analysis across multiple dimensions including innovation, infrastructure, workforce skills, and policy environments.

Competitive Position Analysis: U.S. vs. Key Trading Partners

This radar chart highlights relative competitive strengths and weaknesses across critical economic dimensions.

Technological Impact on Trade Visualization

Technology has fundamentally transformed both the composition of trade and how trade data is visualized and understood. Digital trade components, including services, intellectual property, and data flows, now constitute a growing share of overall trade value and present unique visualization challenges.

Visual representation of the growing share of digital components in overall U.S. trade, 1990-2020.

U.S. Trade Composition: Digital vs. Physical

This chart shows the changing composition of U.S. trade value over time.

Technological Impact on Trade Patterns

Technological advancements have fundamentally reshaped global trade flows and logistics, from containerization to e-commerce and just-in-time manufacturing. These changes have accelerated in recent decades with digital platforms further transforming trade dynamics.

Technological Transformation of Trade

How innovations have reshaped global trade patterns

flowchart TB

subgraph 1950s-1970s

CONT[Containerization

Revolution]

JET[Jet Air Transport]

end

subgraph 1980s-2000s

EDI[Electronic Data

Interchange]

JIT[Just-In-Time

Manufacturing]

COMM[E-Commerce

Emergence]

end

subgraph 2000s-Present

BLOC[Blockchain & Smart

Contracts]

CLOUD[Cloud Computing

& API Integration]

IOT[Internet of Things

Supply Chain]

AI[AI & Predictive

Analytics]

end

CONT --> INFR[Infrastructure

Standardization]

JET --> SPEED[Speed & Range

Expansion]

INFR --> GLO[Global Supply

Chain Formation]

SPEED --> GLO

EDI --> INFO[Information

Digitization]

JIT --> EFF[Efficiency &

Cost Reduction]

COMM --> DIR[Direct Consumer

Market Access]

INFO & EFF & DIR --> TRANS[Trade Volume

Expansion]

TRANS --> MOD[Modern Digital

Trade Ecosystem]

BLOC & CLOUD & IOT & AI --> FUT[Future Trade

Transformation]

MOD --> FUT

classDef orange fill:#FFF2E6,stroke:#FF8000,stroke-width:2px

classDef blue fill:#EFF8FF,stroke:#3B82F6,stroke-width:2px

classDef green fill:#F0F8F0,stroke:#66BB6A,stroke-width:2px

classDef purple fill:#F5F3FF,stroke:#8B5CF6,stroke-width:2px

classDef yellow fill:#FFFBEB,stroke:#F59E0B,stroke-width:2px

class CONT,JET orange

class EDI,JIT,COMM blue

class BLOC,CLOUD,IOT,AI green

class INFR,SPEED,INFO,EFF,DIR yellow

class GLO,TRANS,MOD,FUT purple

Supply Chain Transformations

Global supply chains have undergone significant restructuring due to technological advancements, geopolitical pressures, and efficiency needs. Visualization tools help illuminate these complex adaptations and their impact on trade flows.

Visual representation of how supply chains evolved from linear models to dynamic networked systems, highlighting key technological enablers.

Future Projection Visualizations

Emerging technologies including AI, blockchain, 3D printing, and the Internet of Things (IoT) are poised to further transform global trade patterns and monitoring capabilities. Scenario-based visualizations can help anticipate these changes.

Emerging Technologies' Projected Impact on Trade

This radar chart shows how different technologies are expected to transform various aspects of global trade.

Creating Effective Trade Balance Narratives

Transforming complex trade data into compelling visual stories requires both technical skill and communication strategy. The most effective visualizations distill complex economic relationships into intuitive formats that engage different audience types while maintaining accuracy and context.

Techniques for transforming complex trade data into compelling visual narratives for different audiences.

Case Study Examples

Several groundbreaking visualizations have significantly influenced public understanding of trade balance dynamics by making complex data accessible to broad audiences. These case studies demonstrate effective approaches for different contexts.

Visualization Impact on Audience Understanding

How different visualization approaches affect comprehension and engagement across audience types.

Avoiding Misrepresentations

Trade balance visualizations can easily distort understanding if not carefully designed. Common pitfalls include misleading scales, missing context, inappropriate chart types, and selective data presentation that can create false impressions.

Common Visualization Pitfalls

Guidelines for avoiding misrepresentations in trade data visualization

flowchart TB

VIZ[Trade Balance

Visualization]

subgraph Common Pitfalls

SCALE[Misleading Scale

Selection]

AXIS[Truncated Axis]

TYPE[Inappropriate

Chart Type]

CONT[Missing Context]

SELECT[Cherry-Picked

Time Periods]

end

subgraph Best Practices

FULL[Show Full Context

& Time Series]

ZERO[Include Zero

in Scales]

COMP[Add Comparative

Metrics]

ANN[Use Annotations

for Context]

MULTI[Show Multiple

Perspectives]

end

VIZ --- Common Pitfalls

VIZ --- Best Practices

SCALE --- |Leads to| PERC[Perception

Distortion]

AXIS --- |Leads to| PERC

TYPE --- |Leads to| MIS[Misunderstanding

of Trends]

CONT --- |Leads to| MIS

SELECT --- |Leads to| BIAS[Biased

Narrative]

FULL --- |Creates| BAL[Balanced

Perspective]

ZERO --- |Creates| BAL

COMP --- |Creates| CLAR[Clarity &

Accuracy]

ANN --- |Creates| CLAR

MULTI --- |Creates| TRUST[Trustworthy

Representation]

classDef orange fill:#FFF2E6,stroke:#FF8000,stroke-width:2px

classDef red fill:#FFEEEE,stroke:#FF6666,stroke-width:2px

classDef green fill:#F0F8F0,stroke:#66BB6A,stroke-width:2px

classDef blue fill:#EFF8FF,stroke:#3B82F6,stroke-width:2px

class VIZ orange

class SCALE,AXIS,TYPE,CONT,SELECT,PERC,MIS,BIAS red

class FULL,ZERO,COMP,ANN,MULTI,BAL,CLAR,TRUST green

class Common Pitfalls,Best Practices blue

Building Interactive Elements

Interactive visualizations allow users to explore multifaceted trade relationships from different angles, making complex data more accessible and personalized. Modern visualization tools enable rich interaction that deepens understanding.

Interactive dashboard design enabling exploration of multifaceted trade relationships through filtering, comparison, and drill-down functionality.

Communication Strategies for Different Audiences

Effective trade balance visualizations must adapt to the specific needs, expertise level, and interests of different audience types. Communication strategies should vary accordingly while maintaining accuracy.

| Audience | Key Interests | Visualization Approach | Format Recommendations |

|---|---|---|---|

| Policymakers | Policy impacts, international context, long-term trends | Comparative metrics, scenario modeling, regional breakdowns | Interactive dashboards with drill-down capability, briefing-friendly visuals |

| Business Leaders | Sector-specific impact, competitive positioning, opportunity areas | Industry benchmarking, market opportunity mapping, risk visualization | Decision-support visualizations, strategic mapping tools |

| General Public | Personal impact, relatable examples, clear conclusions | Narrative-driven visualization, relatable analogies, simplified metrics | Interactive explainers, animated transitions, guided exploration |

| Academic/Experts | Methodological transparency, underlying data access, nuanced analysis | Multiple variables, statistical rigor, downloadable datasets | Complex interactive tools, underlying methodology documentation |

Transform Complex Trade Data into Compelling Visualizations

PageOn.ai makes it simple to create sophisticated trade balance visualizations that tell powerful data stories. Whether you're analyzing historical trends, mapping global relationships, or presenting complex economic data, our intuitive tools help you communicate with clarity and impact.

Start Creating Powerful Trade Visualizations TodayNavigating the Future of Trade Visualization

As the U.S. trade balance continues to evolve in response to global economic shifts, technological advancement, and policy changes, effective visualization tools become increasingly vital for understanding these complex dynamics. The century-long journey from manufacturing powerhouse to service economy leader illustrates the importance of contextual, accurate, and engaging visual representations.

For economists, policymakers, business leaders, and everyday citizens, visualizing trade data effectively creates shared understanding and facilitates more informed decision-making. By leveraging modern visualization techniques and tools like PageOn.ai, complex trade relationships become accessible, enabling deeper insights into how tariffs, deficits, and global competition have shaped—and continue to shape—America's economic position in the world.

As we look toward the future, the continued integration of advanced data visualization, interactive exploration tools, and narrative-driven approaches will be essential for navigating the increasingly complex landscape of global trade relationships and their impact on domestic economies.

You Might Also Like

How to Design Science Lesson Plans That Captivate Students

Create science lesson plans that captivate students with hands-on activities, clear objectives, and real-world applications to foster curiosity and critical thinking.

How to Write a Scientific Review Article Step by Step

Learn how to write a review article in science step by step. Define research questions, synthesize findings, and structure your article for clarity and impact.

How to Write a Self-Performance Review with Practical Examples

Learn how to write a self-performance review with examples and tips. Use an employee performance review work self evaluation sample essay to guide your process.

How to Write a Spec Sheet Like a Pro? [+Templates]

Learn how to create a professional spec sheet with key components, step-by-step guidance, and free templates to ensure clarity and accuracy.