Visual Pattern Recognition: Decoding Wall Street's Financial Crises Through History

Understanding the anatomy and cyclical nature of market meltdowns

Throughout history, Wall Street has experienced recurring financial crises that follow surprisingly similar patterns. By visually analyzing these patterns, we can better understand warning signs, regulatory responses, and human behaviors that contribute to market catastrophes—ultimately helping to prevent future economic disasters.

The Anatomy of Financial Meltdowns

Financial crises on Wall Street follow surprisingly similar patterns throughout history. From the Great Depression of 1929 to the Global Financial Crisis of 2008, certain key characteristics remain constant despite the decades between them.

Market Volatility Preceding Major Crashes

Historical data reveals distinctive volatility patterns in the months before a major market crash. These patterns, when visualized, show remarkable similarities across different eras.

Common Warning Signs

Several key indicators consistently emerge before major financial breakdowns. Recognizing these patterns can provide early warnings of impending market instability.

Key Warning Signs Before Financial Crises

flowchart TD

A[Market Warning Signs] --> B[Unsustainable Debt Levels]

A --> C[Excessive Market Euphoria]

A --> D[Regulatory Blind Spots]

A --> E[Asset Price Bubbles]

B --> F[High Leverage Ratios]

B --> G[Risky Lending Practices]

C --> H[Media Hype]

C --> I["'This Time Is Different' Narratives"]

D --> J[Unregulated Financial Products]

D --> K[Regulatory Arbitrage]

E --> L[Disconnection From Fundamentals]

E --> M[Rapid Price Acceleration]

style A fill:#FF8000,stroke:#FF8000,color:white

style B fill:#FFB74D,stroke:#FFB74D

style C fill:#FFB74D,stroke:#FFB74D

style D fill:#FFB74D,stroke:#FFB74D

style E fill:#FFB74D,stroke:#FFB74D

Financial professionals can leverage AI financial assistant tools to monitor these warning signs and transform complex market data into clear visualizations that reveal emerging patterns before they become full-blown crises.

Using PageOn.ai's visual timeline tools, analysts can map these indicators across different historical periods, making it easier to identify when current market conditions begin to mirror past pre-crisis patterns. This transformation of complex financial data into readily understandable visuals enables better decision-making for both institutional investors and regulators.

The Cyclical Nature of Financial Catastrophes

Financial markets tend to follow cyclical patterns, with periods of stability and growth often followed by crashes or corrections. Understanding these cycles is crucial for anticipating future market movements.

The 7-10 Year Crisis Cycle Theory

Historical analysis reveals that major financial disruptions often occur within 7-10 year intervals, suggesting a cyclical pattern that may be tied to human memory, regulatory evolution, and market innovation.

Bubble Formation Comparison

Different market bubbles across history show remarkably similar formation patterns, despite occurring in entirely different asset classes and time periods.

The striking similarities between historical bubbles suggest that regardless of the asset class or era, market psychology follows predictable patterns. PageOn.ai's AI Blocks enable analysts to create compelling market cycle visualizations that reveal these underlying patterns, making complex financial concepts more accessible to investors and policymakers.

Recovery Patterns Following Major Crashes

Market recovery patterns also exhibit notable similarities across different historical crises, with certain sectors typically leading the rebound while others lag behind.

Financial analysts can leverage AI stock charting tools to identify these cyclical patterns and prepare more effectively for potential market downturns. By transforming historical market data into intuitive visuals, PageOn.ai helps investors recognize when current market conditions are beginning to mirror historical pre-crisis indicators.

Regulatory Responses and Their Effectiveness

Following each major financial crisis, regulatory reforms have been implemented to prevent similar failures in the future. However, the effectiveness of these responses varies significantly.

Major Financial Regulations Timeline

A visual mapping of key financial regulations introduced after each crisis reveals how regulatory frameworks evolve in response to market failures.

Evolution of Financial Regulation Following Major Crises

timeline

title Major Financial Regulations Following Crises

section 1929 Crash

1933 : Glass-Steagall Act

1934 : Securities Exchange Act

1935 : Banking Act of 1935

section 1987 Crash

1988 : Basel I Accord

1990 : Market Reform Act

1991 : Circuit Breakers Introduced

section Dot-com Bubble

2002 : Sarbanes-Oxley Act

section 2008 Financial Crisis

2010 : Dodd-Frank Act

2010 : Basel III Framework

2012 : Volcker Rule Finalized

2018 : Partial Rollback of Dodd-Frank

section 2020 COVID Crisis

2020 : CARES Act Stimulus

2021 : Increased Focus on Climate Risks

Regulatory Effectiveness Metrics

Comparing market stability before and after major regulatory interventions provides insights into which approaches have been most effective.

Regulatory Blind Spots

Despite good intentions, regulatory responses often contain blind spots that contribute to subsequent crises. Identifying these gaps is crucial for improving future regulatory frameworks.

Regulatory Blind Spots Leading to Crises

flowchart LR

A[Pre-Crisis Regulation] --> B[Regulatory Reform]

B --> C[New Financial Innovation]

C --> D[Regulatory Blind Spot]

D --> E[Market Exploitation]

E --> F[New Crisis]

F --> G[New Regulatory Reform]

style A fill:#FFB74D,stroke:#FFB74D

style B fill:#66BB6A,stroke:#66BB6A

style C fill:#42A5F5,stroke:#42A5F5

style D fill:#EF5350,stroke:#EF5350

style E fill:#EF5350,stroke:#EF5350

style F fill:#E63946,stroke:#E63946,color:white

style G fill:#66BB6A,stroke:#66BB6A

PageOn.ai's Deep Search capabilities enable regulators and analysts to integrate regulatory timeline data with market performance metrics, creating comprehensive visualizations of regulatory effectiveness. By identifying patterns in which regulations have succeeded or failed, policymakers can design more robust frameworks for the future.

For financial institutions preparing investment banking pitch decks, these regulatory visualizations provide valuable context for explaining market conditions and regulatory risks to clients. PageOn.ai helps transform complex regulatory information into clear, impactful visuals that enhance client understanding.

The Human Element: Behavioral Economics in Financial Crises

Behind every financial crisis lies a complex web of human psychology and behavioral biases. These psychological patterns repeat across different market crashes, regardless of the specific financial instruments involved.

Mapping Market Sentiment and Irrational Exuberance

Tracking investor sentiment reveals how markets can become disconnected from fundamental values during periods of irrational exuberance.

Psychological Patterns in Market Crashes

Common cognitive biases repeatedly influence market behavior during bubble formation and subsequent crashes.

Psychological Biases in Market Cycles

flowchart TD

A[Psychological Biases in Market Cycles] --> B[Early Bull Market]

B --> C[Mature Bull Market]

C --> D[Euphoria/Peak]

D --> E[Early Decline]

E --> F[Panic/Capitulation]

F --> G[Depression/Bottom]

G --> B

B -.-> B1[Anchoring Bias]

B -.-> B2[Confirmation Bias]

C -.-> C1[FOMO - Fear of Missing Out]

C -.-> C2[Herding Behavior]

D -.-> D1["'New Era' Thinking"]

D -.-> D2[Overconfidence Bias]

E -.-> E1[Denial Phase]

E -.-> E2[Normalcy Bias]

F -.-> F1[Panic Selling]

F -.-> F2[Recency Bias]

G -.-> G1[Loss Aversion]

G -.-> G2[Risk Avoidance]

style A fill:#FF8000,stroke:#FF8000,color:white

style D fill:#E63946,stroke:#E63946,color:white

style F fill:#E63946,stroke:#E63946,color:white

Groupthink in Financial Institutions

Institutional decision-making is often affected by groupthink, where the desire for consensus overrides critical evaluation of risks.

PageOn.ai enables the creation of narrative-driven visual explanations that make complex behavioral economics concepts accessible to investors and financial professionals. By visualizing how cognitive biases influence market behavior, investors can become more aware of their own decision-making processes.

Creating comprehensive generative AI market report visualizations with PageOn.ai helps investors understand how behavioral patterns are influencing current market conditions, potentially highlighting areas where psychological biases may be creating market inefficiencies or risk.

Data-Driven Crisis Prediction Models

Modern financial analysis increasingly relies on data-driven models to identify potential crisis indicators before they trigger full-scale market meltdowns.

Leading Economic Indicators

Certain economic indicators have historically provided early warnings of impending financial troubles when properly visualized and analyzed.

Pattern Recognition for Market Vulnerability

Advanced pattern recognition techniques can identify when markets are entering vulnerability phases that have historically preceded major corrections.

Market Vulnerability Assessment Process

flowchart LR

A[Market Data Collection] --> B[Historical Pattern Analysis]

B --> C[Vulnerability Indicators Detection]

C --> D[Risk Assessment Scoring]

D --> E{Risk Level?}

E -->|Low| F[Normal Monitoring]

E -->|Medium| G[Enhanced Surveillance]

E -->|High| H[Crisis Preparation]

F --> A

G --> A

H --> I[Intervention Planning]

style A fill:#42A5F5,stroke:#42A5F5

style E fill:#FF8000,stroke:#FF8000,color:white

style H fill:#E63946,stroke:#E63946,color:white

Machine Learning Correlation Analysis

Modern machine learning techniques can identify unexpected correlations between seemingly unrelated market factors that may contribute to systemic risk.

PageOn.ai enables financial analysts to create interactive scenario planning visuals that model different market conditions and potential crisis triggers. By transforming complex financial data into clear, actionable visualizations, PageOn.ai helps financial professionals prepare for various market scenarios before they unfold.

When preparing ai financial report generators to monitor these indicators, PageOn.ai's visualization capabilities ensure that warning signs are immediately apparent and easily understood by decision-makers across the organization.

Case Studies: Visual Deconstruction of Major Crises

Examining specific historical crises provides valuable insights into how financial meltdowns develop and spread through markets and economies.

2008 Financial Crisis: Cause and Effect

The 2008 Global Financial Crisis represents one of the most significant financial meltdowns in modern history, with complex interconnections between housing markets, financial derivatives, and regulatory failures.

2008 Financial Crisis: Cause and Effect Chain

flowchart TD

A[Housing Bubble Formation] --> B[Subprime Lending Expansion]

B --> C[Mortgage-Backed Securities Creation]

C --> D[Complex Derivatives: CDOs, CDSs]

D --> E[Ratings Agency Failures]

E --> F[Systemic Risk Buildup]

F --> G[Housing Price Decline]

G --> H[Mortgage Default Wave]

H --> I[MBS Value Collapse]

I --> J[Lehman Brothers Collapse]

J --> K[Market Panic]

K --> L[Credit Market Freeze]

L --> M[Global Economic Crisis]

style A fill:#FFB74D,stroke:#FFB74D

style D fill:#EF5350,stroke:#EF5350

style J fill:#E63946,stroke:#E63946,color:white

style M fill:#E63946,stroke:#E63946,color:white

Black Monday 1987: Program Trading's Cascading Effect

The market crash of October 19, 1987, saw the Dow Jones Industrial Average drop by 22.6% in a single day, largely amplified by automated program trading.

Dot-com Bubble: Irrational Valuation Methods

The dot-com bubble of the late 1990s demonstrated how traditional valuation metrics were abandoned in favor of new paradigms that ultimately proved unsustainable.

1929 Great Depression: From Market Crash to Economic Impact

The 1929 stock market crash initiated the most severe economic crisis of the 20th century, with ripple effects that lasted for more than a decade.

PageOn.ai's visual tools enable analysts to create compelling comparative analysis dashboards that highlight similarities and differences across historical crises. These visual case studies make complex financial history more accessible and reveal patterns that may help predict and prevent future market meltdowns.

Future Crisis Prevention Framework

Drawing lessons from historical crises, we can develop comprehensive frameworks for identifying and mitigating financial risks before they threaten market stability.

Visual Risk Assessment Decision Tree

A structured visual approach to risk assessment can help financial institutions and regulators identify emerging threats more systematically.

Financial Risk Assessment Framework

flowchart TD

A[Financial System Risk Assessment] --> B{Yield Curve Inverted?}

B -->|Yes| C{Credit Spreads Widening?}

B -->|No| D[Low Immediate Risk]

C -->|Yes| E{Market Volatility Rising?}

C -->|No| F[Monitor Closely]

E -->|Yes| G{Liquidity Constraints?}

E -->|No| H[Moderate Risk - Prepare]

G -->|Yes| I[High Risk - Activate Crisis Protocols]

G -->|No| J[Elevated Risk - Restrict Exposure]

style A fill:#FF8000,stroke:#FF8000,color:white

style D fill:#66BB6A,stroke:#66BB6A

style F fill:#FFCA28,stroke:#FFCA28

style H fill:#FFCA28,stroke:#FFCA28

style I fill:#E63946,stroke:#E63946,color:white

style J fill:#EF5350,stroke:#EF5350

Early Warning System Dashboard

An effective early warning system integrates multiple risk indicators into a comprehensive dashboard for ongoing monitoring.

Interactive What-If Scenario Modeling

Preparing for potential future market stressors requires modeling various scenarios and their potential impacts.

PageOn.ai excels at transforming complex financial warning signs into actionable visuals that can be quickly understood by decision-makers. The platform enables the creation of interactive dashboards that monitor multiple risk factors simultaneously, providing a comprehensive view of potential market vulnerabilities.

By implementing these visual frameworks through PageOn.ai, financial institutions and regulatory bodies can develop more robust early warning systems that identify emerging threats before they escalate into full-blown crises.

Global Interconnectivity and Contagion Risks

Modern financial markets are more interconnected than ever before, creating complex pathways for crisis contagion across borders and asset classes.

Financial Contagion Patterns

Understanding how financial crises spread between markets and countries is crucial for containing systemic risks.

Global Financial Contagion Network

flowchart TD

A[Crisis Epicenter] --> B[Major Financial Hub Markets]

A --> C[Direct Trade Partners]

B --> D[Secondary Financial Markets]

B --> E[Commodity Markets]

C --> F[Supply Chain Partners]

D --> G[Emerging Markets]

E --> H[Resource-Dependent Economies]

G --> I[Frontier Markets]

style A fill:#E63946,stroke:#E63946,color:white

style B fill:#EF5350,stroke:#EF5350

style D fill:#FFCA28,stroke:#FFCA28

style G fill:#FFB74D,stroke:#FFB74D

International Regulatory Cooperation

Effective crisis prevention requires coordinated regulatory approaches across international boundaries.

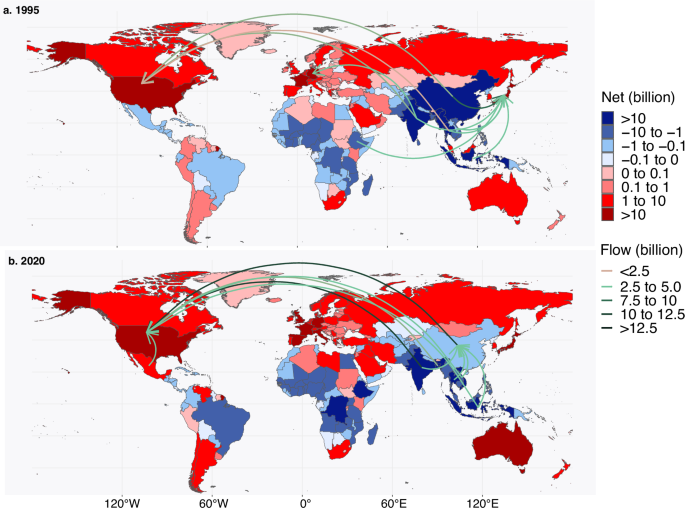

Global Financial Vulnerability Heat Map

Geographic visualization of financial vulnerability helps identify potential crisis origins and transmission paths.

Cross-Border Capital Flow Visualization

Understanding cross-border capital movements during crisis periods reveals how instability spreads internationally.

PageOn.ai's geographic heat mapping capabilities allow financial analysts to create visual representations of global financial vulnerabilities, making it easier to identify potential crisis trigger points and transmission pathways. These visualizations help regulators and market participants understand complex international interconnections that might otherwise remain hidden.

By leveraging these visualization tools, international regulatory bodies can better coordinate their efforts to monitor and mitigate global financial risks, potentially preventing future crises before they can spread across international boundaries.

Transform Your Financial Pattern Recognition with PageOn.ai

Turn complex financial data into clear, actionable visualizations that help identify market patterns, anticipate risks, and prevent potential crises before they occur.

Start Creating with PageOn.ai TodayConclusion: Learning from History to Prevent Future Crises

By visually analyzing the patterns of historical financial crises, we can develop more effective frameworks for identifying and mitigating risks in today's complex global markets. The striking similarities between different market crashes throughout history suggest that human psychology, market dynamics, and regulatory challenges remain consistent despite changing financial instruments and technologies.

Effective visual representation of financial data is crucial for recognizing these patterns early and communicating warnings clearly to decision-makers. PageOn.ai's visualization tools transform complex financial metrics into intuitive visual formats that make pattern recognition more accessible and actionable.

Whether you're a financial regulator monitoring systemic risks, an institutional investor managing exposure, or a financial educator explaining market dynamics, PageOn.ai provides the tools to create compelling, insightful visualizations that reveal hidden patterns and potential warning signs in financial markets. By learning from history and leveraging modern visualization techniques, we can work toward a more stable financial future with fewer devastating market crashes.

You Might Also Like

How to Design Science Lesson Plans That Captivate Students

Create science lesson plans that captivate students with hands-on activities, clear objectives, and real-world applications to foster curiosity and critical thinking.

How to Write a Scientific Review Article Step by Step

Learn how to write a review article in science step by step. Define research questions, synthesize findings, and structure your article for clarity and impact.

How to Write a Self-Performance Review with Practical Examples

Learn how to write a self-performance review with examples and tips. Use an employee performance review work self evaluation sample essay to guide your process.

How to Write a Spec Sheet Like a Pro? [+Templates]

Learn how to create a professional spec sheet with key components, step-by-step guidance, and free templates to ensure clarity and accuracy.