Bitcoin Price Target Predictions Through Machine Learning

Leveraging advanced algorithms to navigate cryptocurrency market volatility

Introduction to Bitcoin Price Prediction Landscape

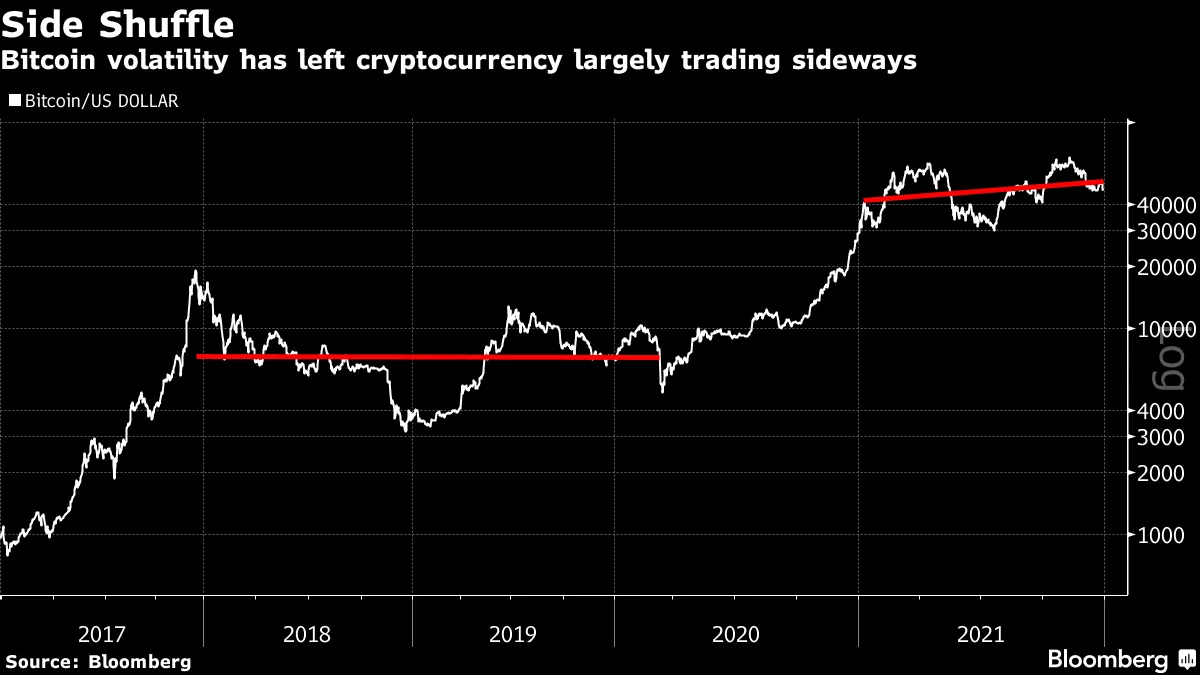

Bitcoin price prediction remains one of the most challenging yet potentially rewarding applications of machine learning. As the cryptocurrency market continues to mature, investors and traders increasingly rely on data-driven approaches to navigate its notorious volatility.

The cryptocurrency market's inherent volatility presents both unique challenges and opportunities for machine learning applications. Unlike traditional financial markets, Bitcoin operates 24/7, experiences rapid price swings, and is influenced by a complex web of factors ranging from technological developments to regulatory announcements and market sentiment.

As machine learning techniques have evolved, they've become increasingly sophisticated at identifying patterns within this chaotic environment. From simple regression models to complex deep learning architectures, the field of Bitcoin price prediction has grown significantly, offering valuable insights for investors navigating this dynamic market.

Understanding the Machine Learning Approach to Bitcoin Forecasting

Key Algorithmic Models in Cryptocurrency Prediction

flowchart TD

A[Machine Learning Models] --> B[Neural Networks]

A --> C[Ensemble Methods]

A --> D[Traditional ML]

B --> E[RNN]

B --> F[LSTM]

B --> G[GRU]

C --> H[Random Forest]

C --> I[XGBoost]

C --> J[Gradient Boosting]

D --> K[SVM]

D --> L[Linear Regression]

Recurrent Neural Networks (RNNs)

Specialized for sequential data analysis, capturing temporal dependencies in price movements. RNNs maintain a memory of previous inputs, making them well-suited for time series data like Bitcoin prices.

Long Short-Term Memory (LSTM) Networks

Addressing the vanishing gradient problem in RNNs, enabling more effective long-term pattern recognition. LSTMs excel at capturing both short and long-term dependencies in Bitcoin price data.

Gated Recurrent Units (GRUs)

Offering computational efficiency while maintaining strong predictive performance. GRUs are simpler than LSTMs but often achieve comparable results with faster training times.

Random Forest and XGBoost

Ensemble methods that excel at capturing non-linear relationships between features. These algorithms combine multiple decision trees to create robust models that are less prone to overfitting.

Data Features That Drive Prediction Accuracy

Effective Bitcoin price prediction relies on a diverse set of features that capture different aspects of market behavior. These features can be broadly categorized into:

Historical Price Data

- Open, high, low, close prices

- Trading volume

- Price momentum

- Volatility measures

Technical Indicators

- Relative Strength Index (RSI)

- Moving Average Convergence Divergence (MACD)

- Bollinger Bands

- Momentum oscillators

Market Sentiment Analysis

- Social media sentiment

- News sentiment analysis

- Google Trends data

- Forum activity metrics

On-chain Metrics

- Transaction volume

- Active addresses

- Mining difficulty

- Network hash rate

By leveraging these diverse data features, machine learning models can capture complex patterns and relationships that might be missed by traditional analysis methods. The integration of alternative data sources like social media sentiment and on-chain metrics has been particularly valuable in improving prediction accuracy.

Evaluating Model Performance and Limitations

Performance Metrics for Bitcoin Price Prediction Models

Mean Absolute Error (MAE)

Measures the average magnitude of errors without considering direction. MAE is intuitive and treats all errors equally, making it useful for understanding the typical prediction error.

Root Mean Squared Error (RMSE)

Emphasizes larger errors through square root of average squared differences. RMSE is more sensitive to outliers, which is valuable in the volatile Bitcoin market where large price swings are significant.

Mean Absolute Percentage Error (MAPE)

Provides error magnitude relative to actual values. MAPE is scale-independent, making it useful for comparing performance across different price ranges or time periods.

Directional Accuracy

Assesses correct prediction of price movement direction. For many trading strategies, correctly forecasting whether the price will go up or down is more important than the exact price level.

The Challenge of Market Volatility and Non-Stationarity

Bitcoin price prediction faces several unique challenges that can limit model effectiveness:

Regime Changes

The Bitcoin market undergoes structural shifts in behavior patterns, requiring models to adapt to fundamentally different market dynamics. These regime changes can occur rapidly and without warning, making consistent prediction difficult.

Black Swan Events

Unpredictable market shocks and regulatory changes can cause significant price movements that no model could reasonably forecast. Examples include exchange hacks, sudden regulatory crackdowns, or macroeconomic crises.

Data Leakage Risks

Ensuring training data doesn't inadvertently include future information is crucial for realistic performance evaluation. Models that seem to perform well in backtesting may fail in live trading if proper time-series cross-validation techniques aren't employed.

To address these challenges, successful Bitcoin price prediction models often incorporate adaptive learning techniques, robust validation methodologies, and ensemble approaches that can better handle the market's inherent unpredictability.

Advanced Techniques for Improved Prediction Accuracy

Feature Engineering Strategies

flowchart TD

A[Raw Data] --> B[Feature Engineering]

B --> C[Time-based Features]

B --> D[Technical Indicator Transformations]

B --> E[Cross-asset Correlations]

C --> F[Cyclical Patterns]

C --> G[Seasonality]

C --> H[Day-of-week Effects]

D --> I[Composite Indicators]

D --> J[Signal Thresholds]

E --> K[Traditional Market Correlations]

E --> L[Inter-cryptocurrency Relationships]

F & G & H & I & J & K & L --> M[Enhanced Feature Set]

M --> N[ML Model]

N --> O[Improved Predictions]

Feature engineering is critical to extracting meaningful signals from raw cryptocurrency data. Advanced techniques include:

Time-based Features

Creating features that capture cyclical patterns, seasonality, and day-of-week effects can help models identify recurring price patterns tied to temporal factors.

Technical Indicator Transformations

Developing composite indicators that combine multiple technical signals can provide more robust market condition assessments than individual indicators alone.

Cross-asset Correlations

Leveraging relationships with traditional markets and other cryptocurrencies can provide valuable context for Bitcoin price movements and improve prediction accuracy.

Ensemble and Hybrid Approaches

Ensemble and hybrid approaches combine multiple models to achieve better performance than any single model alone:

Model Stacking

Combining predictions from multiple algorithms to reduce variance. This approach uses the outputs of several base models as inputs to a meta-model, which makes the final prediction.

Bagging and Boosting

Improving model robustness through ensemble techniques. Bagging trains models on random subsets of the data, while boosting iteratively focuses on examples that previous models struggled with.

Deep Learning Fusion

Integrating CNN-LSTM architectures for multi-dimensional pattern recognition. Convolutional layers can extract spatial features from price charts, while LSTM layers capture temporal dependencies.

By leveraging these advanced techniques, researchers and practitioners can develop more robust and accurate Bitcoin price prediction models that better capture the complex dynamics of the cryptocurrency market.

Practical Applications and Implementation

Trading Strategy Development

Translating Bitcoin price predictions into effective trading strategies requires careful consideration of several factors:

Entry and Exit Signal Generation

Converting predictions into actionable trading decisions requires clear rules for when to enter and exit positions. This might involve setting price thresholds, confidence levels, or combining predictions with technical indicators.

Risk Management Integration

Incorporating prediction uncertainty into position sizing helps manage risk. Models that provide confidence intervals or probability distributions allow for more sophisticated risk management than point forecasts alone.

Backtesting Frameworks

Evaluating strategy performance across different market conditions is essential. Proper backtesting should account for transaction costs, slippage, and market impact to provide realistic performance estimates.

Adaptive Strategy Parameters

Markets evolve over time, requiring strategies to adapt. Dynamic parameter adjustment based on recent performance or market regime detection can improve long-term strategy robustness.

Portfolio Optimization and Risk Assessment

Beyond direct trading applications, machine learning models for Bitcoin price prediction can enhance portfolio management in several ways:

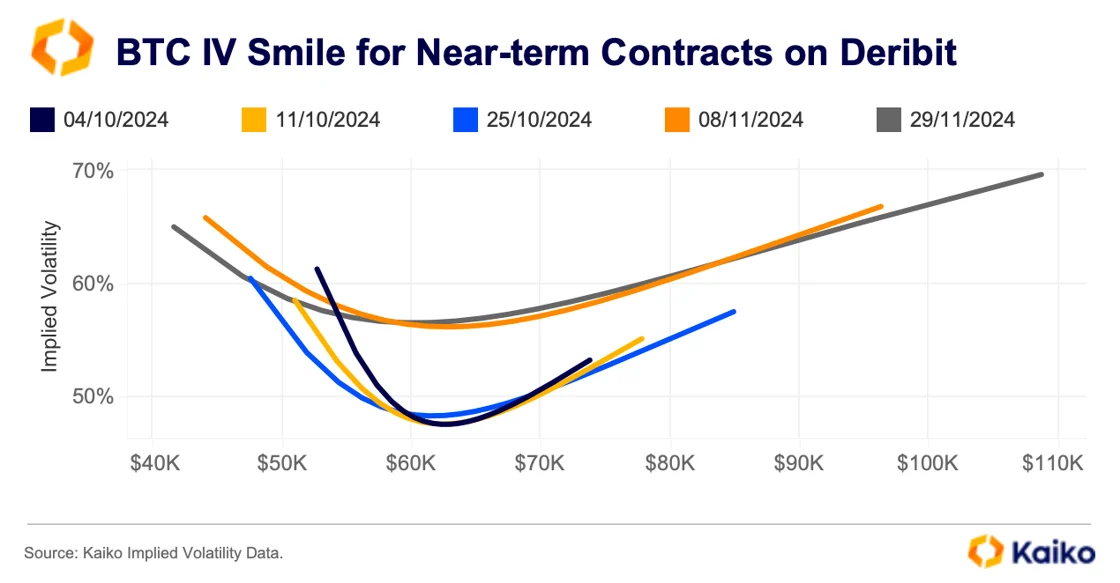

Volatility Forecasting

Predicting price fluctuation magnitude for risk assessment. Volatility forecasts help determine appropriate position sizes and set stop-loss levels that balance risk protection with avoiding premature exits.

Correlation Dynamics

Understanding changing relationships with other assets. Bitcoin's correlations with traditional assets like stocks, gold, and currencies vary over time, affecting its role in portfolio diversification.

Drawdown Protection

Developing mechanisms to limit losses during adverse market conditions. Machine learning models can help identify early warning signs of major market corrections, allowing for preemptive risk reduction.

By integrating these portfolio management techniques with price prediction models, investors can develop a more holistic approach to cryptocurrency investing that balances return optimization with prudent risk management.

Future Directions in Bitcoin Price Prediction

Explainable AI for Investment Decisions

flowchart TD

A[Black-box ML Model] --> B[Explainable AI Techniques]

B --> C[Model Interpretability]

B --> D[Feature Importance]

B --> E[Confidence Intervals]

C --> F[LIME]

C --> G[SHAP Values]

D --> H[Permutation Importance]

D --> I[Partial Dependence Plots]

E --> J[Prediction Intervals]

E --> K[Uncertainty Quantification]

F & G & H & I & J & K --> L[Transparent Investment Decisions]

As machine learning models become more complex, there's a growing need for explainability to build trust and improve decision-making:

Model Interpretability Techniques

Methods like LIME (Local Interpretable Model-agnostic Explanations) and SHAP (SHapley Additive exPlanations) help make black-box models more transparent by explaining individual predictions.

Feature Importance Analysis

Identifying which factors drive predictions helps investors understand market dynamics and validate model behavior against their domain knowledge.

Confidence Intervals

Quantifying uncertainty in price forecasts allows for more nuanced decision-making, with higher conviction trades when uncertainty is low and more cautious approaches when it's high.

Emerging Technologies and Methodologies

Several cutting-edge technologies and methodologies are poised to transform Bitcoin price prediction in the coming years:

Quantum Computing Applications

Exploring potential for handling complex market patterns. Quantum algorithms could potentially solve optimization problems and identify patterns in financial data that are computationally infeasible for classical computers.

Federated Learning

Collaborative model training while preserving data privacy. This approach allows multiple organizations to contribute to model training without sharing sensitive data, potentially enabling more comprehensive market models.

Transfer Learning

Applying knowledge from other financial markets to cryptocurrency prediction. Models pre-trained on traditional markets can be fine-tuned for cryptocurrency prediction, potentially improving performance with limited data.

As these technologies mature, they promise to address current limitations in Bitcoin price prediction and enable more sophisticated models that better capture the cryptocurrency market's complex dynamics.

Conclusion: The Path Forward for ML-Based Bitcoin Price Targets

Machine learning approaches to Bitcoin price prediction continue to evolve rapidly, offering increasingly valuable insights for investors navigating this volatile asset class. While no model can perfectly predict such a complex market, several key trends are shaping the future of this field:

- Integration of diverse data sources – Models are increasingly incorporating alternative data, from social media sentiment to on-chain metrics, providing a more holistic view of market dynamics.

- Advanced model architectures – Deep learning approaches, particularly recurrent neural networks like LSTM and GRU, continue to demonstrate superior performance for time series prediction tasks.

- Explainability and transparency – As models become more complex, techniques for explaining predictions are growing in importance to build trust and enable effective human oversight.

- Adaptive learning approaches – Given the non-stationary nature of cryptocurrency markets, models that can continuously adapt to changing conditions show the most promise for long-term success.

As computational capabilities and data availability improve, we can expect further refinements in prediction accuracy and practical applications. However, it's important to recognize that forecasting Bitcoin prices will likely always involve uncertainty due to the market's inherent complexity and the influence of unpredictable external factors.

For investors and traders, machine learning models are best viewed as one component of a broader decision-making framework that includes risk management, portfolio diversification, and an understanding of fundamental market drivers. By combining quantitative insights from ML models with qualitative analysis and prudent risk management, market participants can navigate the cryptocurrency landscape more effectively.

Transform Your Visual Expressions with PageOn.ai

Ready to create stunning visualizations for your cryptocurrency analysis and financial data? PageOn.ai provides powerful tools to transform complex data into clear, compelling visual stories that communicate insights effectively.

Start Creating with PageOn.ai TodayYou Might Also Like

Revolutionizing Presentations: How AI-Generated Visuals Transform Slide Design

Discover how AI-generated visuals are transforming presentation design, saving hours of effort while creating stunning slides that engage audiences and communicate ideas effectively.

Building New Slides from Prompts in Seconds | AI-Powered Presentation Creation

Discover how to create professional presentations instantly using AI prompts. Learn techniques for crafting perfect prompts that generate stunning slides without design skills.

Mastering MCP Architecture: The Ultimate Blueprint for Seamless AI-Data Integration

Explore the Model Context Protocol architecture that solves the N×M integration problem. Learn how MCP creates standardized connections between AI systems and data sources.

Smart Icon Libraries: Transform Your Document Design with Visual Intelligence

Discover how smart icon libraries can enhance your document design. Learn strategic icon selection, AI-powered systems, and visual communication techniques for better engagement and retention.