Crafting a Winning Startup Pitch Deck: Essential Elements That Captivate Investors

Master the art of creating pitch decks that secure funding and showcase your startup's true potential

I've reviewed hundreds of pitch decks throughout my career, and I've discovered that the most successful ones share specific critical elements. In this comprehensive guide, I'll walk you through the essential components every winning pitch deck needs, and show you how to create them efficiently using modern visualization tools.

The Foundation: Opening Your Pitch with Impact

I've learned that you have less than 30 seconds to grab an investor's attention. Your opening slides must instantly communicate who you are and why they should care. This critical first impression sets the tone for your entire presentation.

The 30-Second Hook

Your mission statement should be concise, compelling, and instantly communicate your startup's purpose. I recommend limiting it to 1-2 sentences that capture the essence of what you do and the value you provide.

"We're building the operating system for last-mile delivery, helping e-commerce businesses reduce delivery times by 30% while cutting costs by 25%."

Visual Brand Identity

Your startup pitch deck should maintain consistent visual elements throughout. This includes your logo, color scheme, typography, and imagery style. This consistency makes your presentation memorable and reinforces your brand identity.

Consistent visual identity across slides creates a professional and memorable impression

Origin Story Elements

Investors connect with founders who have authentic passion and purpose. I always advise including a brief but compelling narrative about why your startup exists and the personal connection you have to the problem you're solving.

flowchart LR

A[Personal Experience] -->|Led to| B[Problem Identification]

B --> C[Initial Solution]

C --> D[Market Validation]

D --> E[Current Venture]

style A fill:#FF8000,stroke:#333,stroke-width:1px

style E fill:#FF8000,stroke:#333,stroke-width:1px

When I'm working with founders, I recommend using PageOn.ai's Vibe Creation tools to transform founding stories into visually engaging narratives. This helps investors connect emotionally with your journey without requiring advanced design skills or expensive agencies.

Problem-Solution Framework: The Core of Your Pitch

In my experience reviewing successful pitch decks, I've found that the problem-solution framework forms the core of any compelling presentation. Investors need to clearly understand the market pain point and how your solution addresses it in a unique and valuable way.

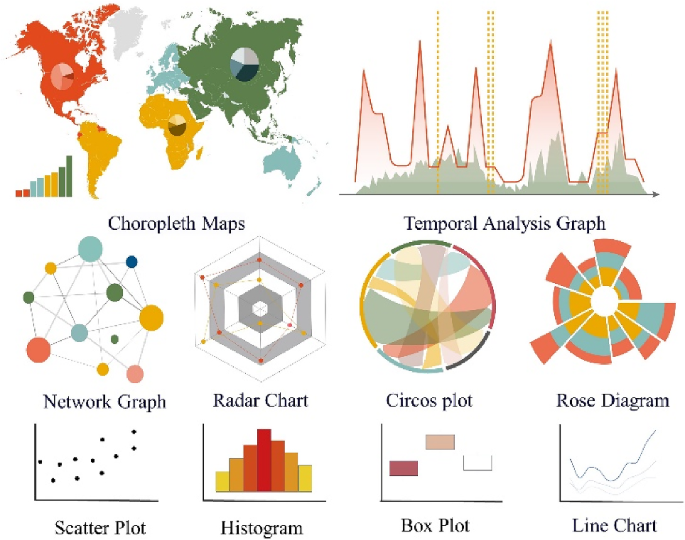

Problem Statement Visualization

When I help startups craft their pitch decks, I emphasize the importance of visually illustrating the problem. This could be through data points, customer quotes, or scenario illustrations that make the pain point tangible and relatable.

Effective problem visualization makes the pain point immediately clear to investors

Solution Architecture

Your solution should be presented with clarity and precision. I always recommend using visual breakdowns that show how your product or service solves the identified problem in a logical, step-by-step manner.

flowchart TD

A[Problem Identified] --> B[Your Solution]

B --> C[Key Feature 1]

B --> D[Key Feature 2]

B --> E[Key Feature 3]

C --> F[Benefit 1]

D --> G[Benefit 2]

E --> H[Benefit 3]

F --> I[Problem Solved]

G --> I

H --> I

style B fill:#FF8000,stroke:#333,stroke-width:1px

style I fill:#66BB6A,stroke:#333,stroke-width:1px

Before & After Scenarios

One of the most effective techniques I've seen in business overview pitch decks is contrasting visuals that show life with and without your solution. This creates an immediate understanding of your value proposition.

I frequently recommend using PageOn.ai's AI Blocks to create comparison charts and process flows that demonstrate solution impact. These tools help transform complex concepts into clear visual narratives that investors can quickly understand and appreciate.

Market Opportunity & Competitive Landscape

In my years of experience, I've noticed that investors are particularly focused on understanding the market size and competitive positioning. This section needs to communicate not just that there's a large opportunity, but that you have a realistic plan to capture a significant portion of it.

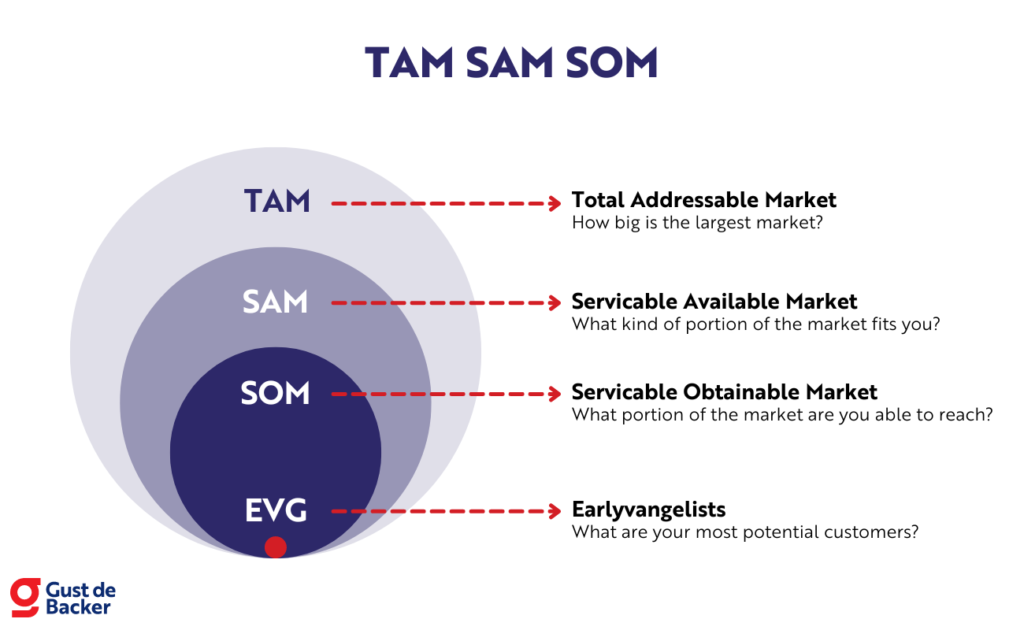

Total Addressable Market (TAM)

When I review pitch decks, I look for clear market size visualizations that break down the total addressable market, serviceable addressable market (SAM), and serviceable obtainable market (SOM). This demonstrates that founders understand their market scope.

TAM-SAM-SOM breakdown showing realistic market capture potential

Competitive Matrix

A well-designed competitive matrix is essential for digital marketing pitch decks and other startup presentations. I advise clients to visually position themselves against competitors across key differentiating factors.

Market Trends

In my work with startups, I emphasize the importance of showing favorable industry movements that support your growth hypothesis. This could be changing consumer behaviors, technological shifts, or regulatory changes that create opportunity.

When I help startups create these market visualizations, I recommend utilizing PageOn.ai's Deep Search to automatically integrate relevant market data and competitor information. This saves significant research time while ensuring your deck contains accurate and compelling market insights.

Product Showcase & Demonstration

In my experience reviewing successful pitch decks, I've found that investors need to clearly understand what you've built and how it works. This section should bring your product to life through visual storytelling.

Product Architecture

When I help startups create their investment banking pitch decks, I emphasize the importance of visually breaking down product or service components. This demonstrates technical depth and implementation clarity.

flowchart TD

subgraph "User Interface Layer"

UI1[Mobile App]

UI2[Web Dashboard]

UI3[API Access]

end

subgraph "Core Platform"

C1[Authentication]

C2[Data Processing]

C3[Analytics Engine]

C4[Payment System]

end

subgraph "Infrastructure"

I1[Cloud Hosting]

I2[Database]

I3[Security]

end

UI1 --> C1

UI2 --> C1

UI3 --> C1

C1 --> C2

C2 --> C3

C2 --> C4

C3 --> I2

C4 --> I2

C1 --> I3

C2 --> I1

C3 --> I1

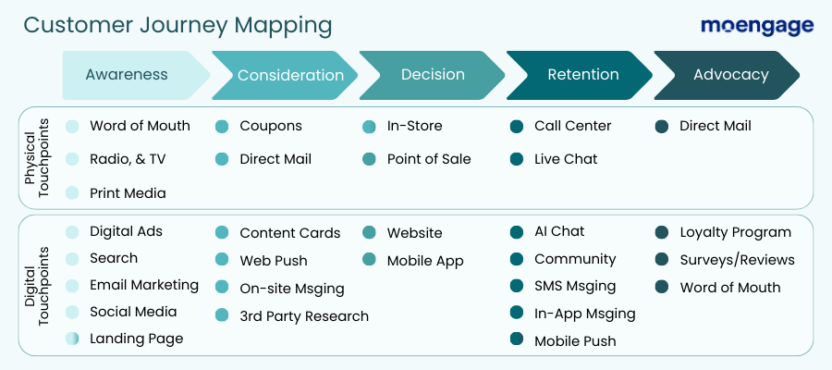

User Experience Journey

I always advise founders to include a step-by-step visualization of how users interact with their product. This helps investors understand the user experience and the value delivered at each touchpoint.

User journey map highlighting key interaction points and value delivery

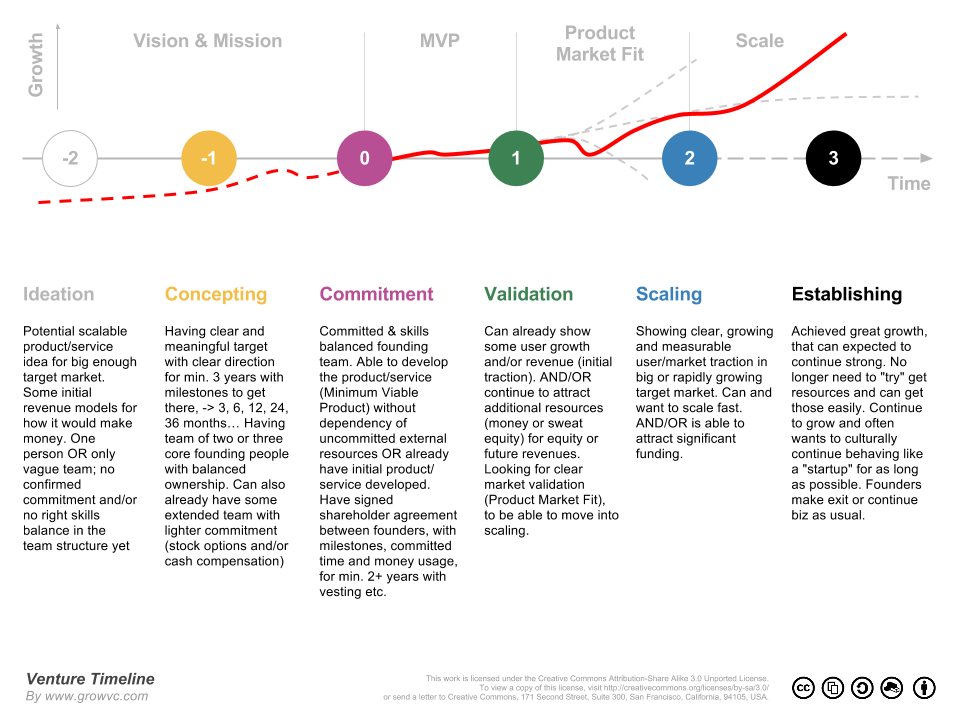

Product Roadmap

When reviewing YouTube Innovation Pitch Deck examples and other successful presentations, I notice they always include a clear product roadmap. This timeline visualization shows past developments and future enhancements, demonstrating strategic thinking.

gantt

title Product Development Roadmap

dateFormat YYYY-MM

section Completed

MVP Release :done, mvp, 2023-01, 2023-03

Beta Testing :done, beta, 2023-03, 2023-06

Initial Launch :done, launch, 2023-06, 2023-08

section Current

Feature Expansion :active, expand, 2023-08, 2023-12

section Planned

Enterprise Features :planned, enterprise, 2024-01, 2024-04

Mobile App 2.0 :planned, mobile, 2024-03, 2024-07

International Expansion :planned, intl, 2024-06, 2024-12

In my consulting work, I've found that PageOn.ai's AI-driven visualization tools are invaluable for transforming complex product concepts into clear visual explanations. These tools help founders communicate technical details in ways that non-technical investors can easily understand and appreciate.

Traction & Validation Metrics

From my experience evaluating hundreds of pitch decks, I can confidently say that traction is what separates the funded from the unfunded. Investors need concrete evidence that your solution is gaining momentum in the market.

Key Performance Indicators

I always advise founders to include data visualizations of their most impressive metrics. This could be user growth, engagement rates, revenue increases, or other relevant KPIs that demonstrate business momentum.

Customer Testimonials

In my work with successful startups, I've seen how powerful customer testimonials can be. I recommend visually presenting user feedback and success stories with photos, quotes, and measurable results achieved.

Sarah Johnson

CMO, TechGrowth Inc.

"This solution reduced our customer acquisition costs by 40% while increasing conversion rates by 25%. The ROI has been exceptional."

Michael Chen

Founder, DataDrive

"Implementation was seamless, and we saw results within the first month. Our team productivity increased by 35%, directly impacting our bottom line."

Partnerships & Milestones

When I review pitch decks, I look for a clear timeline of significant achievements and relationships. This demonstrates execution capability and business development progress.

timeline

title Key Milestones & Partnerships

section 2022

Concept Validation : Initial market research

Seed Funding : $500K raised

section 2023

MVP Launch : March

First Enterprise Client : May

Strategic Partnership : July : With IndustryLeader Inc.

Series A : October : $3.5M raised

section 2024

International Expansion : Q1

Major Client Win : Q2 : Fortune 500 company

I frequently recommend using PageOn.ai to create professional data visualizations that transform raw metrics into compelling evidence of success. This helps investors quickly grasp your growth trajectory and market validation without getting lost in spreadsheets or complex data.

The Team Behind the Vision

Throughout my career evaluating startups, I've consistently found that investors fund teams as much as ideas. Your team slide needs to inspire confidence that you have the right people to execute on your vision.

Team Structure

I advise founders to create visual organization charts highlighting expertise and roles. This demonstrates that you've built a balanced team with complementary skills and relevant experience.

flowchart TD

CEO[CEO & Founder\nEx-Google, 2 exits] --> CTO[CTO\nEx-AWS, 10+ yrs]

CEO --> CMO[CMO\nEx-Hubspot, 8+ yrs]

CEO --> COO[COO\nEx-McKinsey, 12+ yrs]

CTO --> E1[Engineering Lead\nFull-stack, 6+ yrs]

CTO --> E2[Data Science Lead\nPhD, ML expert]

CMO --> M1[Growth Lead\n5+ yrs SaaS]

CMO --> M2[Content Strategist\nEx-Salesforce]

COO --> O1[Operations Manager\nSupply chain expert]

COO --> O2[Finance Lead\nEx-Deloitte]

style CEO fill:#FF8000,stroke:#333,stroke-width:1px

style CTO fill:#42A5F5,stroke:#333,stroke-width:1px

style CMO fill:#42A5F5,stroke:#333,stroke-width:1px

style COO fill:#42A5F5,stroke:#333,stroke-width:1px

Key Experience Highlights

When I help founders prepare their pitch decks, I encourage them to create visual timelines of relevant past achievements. This helps investors understand why this specific team is uniquely positioned to succeed.

Founder experience timeline highlighting relevant background and achievements

Advisory Board

In my experience, including a strong advisory board can significantly strengthen your pitch. I recommend visually presenting your mentors and their specific contributions to your startup's development.

Dr. Jennifer Lee

Former CTO, TechGiant

Technical architecture & scaling

Marcus Williams

Partner, VentureX Capital

Fundraising strategy & connections

Sophia Rodriguez

Founder, $200M exit

Growth strategy & market positioning

When working with early-stage startups, I often suggest using PageOn.ai to craft professional team visualizations that highlight expertise without requiring design skills. This allows founders to create impressive team slides that build investor confidence in their execution capabilities.

Business Model & Financial Projections

In my experience reviewing pitch decks for investors, I've found that clear business model visualization is crucial. Investors need to understand not just what you're building, but how you'll make money and achieve profitability.

Revenue Streams

I always advise founders to include a visual breakdown of how their business makes money. This demonstrates multiple potential revenue sources and their relative importance to the overall business model.

Unit Economics

When I review pitch decks, I look for clear infographics showing cost structure and profitability at the unit level. This demonstrates that you understand the fundamental economics of your business.

Unit economics breakdown showing CAC, LTV, and payback period

Growth Projections

Based on my experience with successful pitch decks, I recommend including charts visualizing expected growth over 3-5 years. This shows investors the potential scale and return of their investment.

In my consulting work, I've found that PageOn.ai's visualization capabilities are invaluable for transforming complex financial data into clear, professional charts. This helps non-financial investors quickly understand your business model and growth potential without getting lost in spreadsheets.

The Investment Opportunity

From my experience reviewing hundreds of pitch decks, I know that this section is where you make your specific case for investment. It needs to clearly articulate what you're seeking and how those funds will accelerate growth.

Funding Requirements

I always advise founders to include a visual breakdown of their capital needs. This demonstrates thoughtful planning and responsible stewardship of investor funds.

Use of Funds

In my work with startups, I emphasize creating detailed infographics showing how investment will be utilized. This builds investor confidence in your execution plan and financial discipline.

Detailed breakdown of how investment will be utilized with key milestones

Exit Strategy Options

Based on my experience with successful pitch decks, I recommend including visual pathways to potential acquisition or IPO scenarios. This demonstrates that you're thinking about investor returns from day one.

flowchart TD

Start[Current Valuation: $15M] --> A[Series A: $6.5M raise]

A --> B[Series B: $20M raise]

B --> C[Series C: $50M+ raise]

C --> D{Exit Options}

D --> E[Strategic Acquisition\n$300M-500M]

D --> F[IPO\n$500M+]

style Start fill:#FF8000,stroke:#333,stroke-width:1px

style E fill:#66BB6A,stroke:#333,stroke-width:1px

style F fill:#66BB6A,stroke:#333,stroke-width:1px

When helping founders prepare this critical section, I recommend using PageOn.ai to create professional investment visualizations that communicate complex financial concepts clearly. This helps ensure investors understand the opportunity and potential returns without getting lost in technical financial details.

Call to Action & Next Steps

From my experience reviewing successful pitch decks, I know that ending with a strong call to action is essential. This final section should clearly communicate what you're asking for and create a sense of urgency.

The Ask

I always advise founders to include a clear visual presentation of what they're seeking from investors. This should specify the amount, terms, and timeline for the investment round.

Series A Funding Round

- Amount: $6.5 Million

- Pre-money Valuation: $25 Million

- Equity Offered: 20%

- Minimum Investment: $500,000

- Target Close: Q2 2024

Milestone Timeline

When I help founders finalize their pitch decks, I encourage them to include a visual roadmap of what they'll achieve with funding. This demonstrates strategic planning and creates confidence in execution.

timeline

title 12-Month Milestone Timeline Post-Funding

section Q1 2024

Team Expansion : +5 key hires

Product Enhancement : Launch v2.0

section Q2 2024

Market Expansion : Enter 2 new markets

Strategic Partnership : Sign major partner

section Q3 2024

Revenue Growth : Reach $1M ARR

Customer Milestone : 100 enterprise clients

section Q4 2024

Series B Preparation : Begin fundraising

International Launch : First global office

Q&A Preparation

Based on my experience with investor presentations, I recommend preparing visual supplements for anticipated investor questions. This demonstrates thorough preparation and builds credibility.

Backup slides prepared for common investor questions

When finalizing pitch decks with founders, I often recommend using PageOn.ai's intuitive tools to design a memorable closing visual that reinforces the startup's value proposition. This ensures that investors leave with a clear understanding of the opportunity and next steps.

Transform Your Startup Pitch Deck with PageOn.ai

Create professional, investor-ready visualizations in minutes without design experience. Turn complex data into compelling visual stories that capture investor attention and secure funding.

Start Creating Your Winning Pitch DeckFinal Thoughts: Bringing It All Together

Throughout my career helping startups secure funding, I've found that the most successful pitch decks excel at visual storytelling. They transform complex business concepts into clear, compelling narratives that investors can quickly understand and get excited about.

The nine essential elements we've covered—from opening with impact to delivering a strong call to action—work together to create a comprehensive investment case. Each element builds on the others to tell a cohesive story about your startup's vision, traction, and potential.

Remember that investors see hundreds of pitch decks. The ones that stand out combine strong content with exceptional visual presentation. By using tools like PageOn.ai, you can create professional-quality visualizations that elevate your pitch from good to unforgettable—without requiring advanced design skills or expensive agencies.

As you develop your pitch deck, focus on clarity, visual impact, and telling a compelling story. With these essential elements in place, you'll maximize your chances of capturing investor interest and securing the funding your startup needs to grow.

You Might Also Like

Mapping the Great Depression: Visualizing Economic Devastation and Recovery

Explore how data visualization transforms our understanding of the Great Depression, from unemployment heat maps to New Deal program impacts, bringing America's greatest economic crisis to life.

Bridging Worlds: How Diffusion Models Are Reshaping Language Generation | PageOn.ai

Explore the revolutionary convergence of diffusion models and language generation. Discover how diffusion techniques are creating new paradigms for NLP, bridging visual and linguistic domains.

How AI Amplifies Marketing Team Capabilities While Preserving Human Jobs | Strategic Marketing Enhancement

Discover how AI transforms marketing teams into powerhouses without reducing workforce size. Learn proven strategies for capability multiplication and strategic enhancement.

Strategic AI Marketing Investment Roadmap: Maximizing ROI from the $360 Billion Surge | 2025 Marketing Tech Budget Guide

Navigate the $360 billion AI investment surge with strategic marketing technology budget allocation. Discover proven frameworks for maximizing ROI from AI marketing tools in 2025.