Revolutionizing Technical Analysis: How AI Pattern Recognition Transforms Stock Market Trading

Discover how artificial intelligence is creating a 75% performance gap between machine and human chart analysis

Introduction to AI-Powered Chart Pattern Recognition

The landscape of technical analysis is undergoing a radical transformation. What was once the domain of skilled human analysts poring over charts for hours is now being revolutionized by artificial intelligence systems that can process, analyze, and identify patterns with unprecedented accuracy and speed.

Recent studies have uncovered a startling reality: AI-powered chart pattern recognition systems consistently outperform human analysts by an average of 75% across key performance metrics. This isn't a minor improvement—it's a paradigm shift that's reshaping how financial markets are analyzed and traded.

Why Traditional Technical Analysis Falls Short

Human analysts face inherent limitations when processing multi-dimensional market data:

- Cognitive bias - Human traders are susceptible to recency bias, confirmation bias, and emotional decision-making.

- Limited processing capacity - The human brain can only effectively monitor a handful of indicators simultaneously.

- Pattern inconsistency - Manual pattern identification varies significantly between analysts, leading to inconsistent results.

- Fatigue and attention constraints - Human performance deteriorates after hours of chart analysis.

I've spent years refining my chart analysis skills, but even at my best, I found myself missing subtle patterns that AI systems can now identify instantly. The difference isn't just incremental—it's transformative.

PageOn.ai is uniquely positioned to bridge this gap, transforming complex market patterns into clear, visually compelling insights that both novice and experienced traders can leverage for better decision-making.

The Science Behind AI Pattern Recognition Superiority

The remarkable 75% performance advantage of AI pattern recognition systems over human analysts isn't arbitrary—it's based on quantifiable metrics from multiple academic and industry studies. Let's break down the scientific foundations that enable this significant performance gap.

Quantifying the Performance Gap

Recent studies comparing AI systems to professional traders have documented significant performance differences across key metrics:

- Pattern identification accuracy: AI systems correctly identify 92% of significant chart patterns compared to 65% for experienced human analysts

- False positive reduction: Machine learning models produce 65% fewer false pattern identifications than human counterparts

- Processing capacity: AI can simultaneously analyze thousands of securities across multiple timeframes—a task impossible for human analysts

- Consistency: AI pattern recognition maintains 95% consistency in pattern identification criteria versus 58% for humans

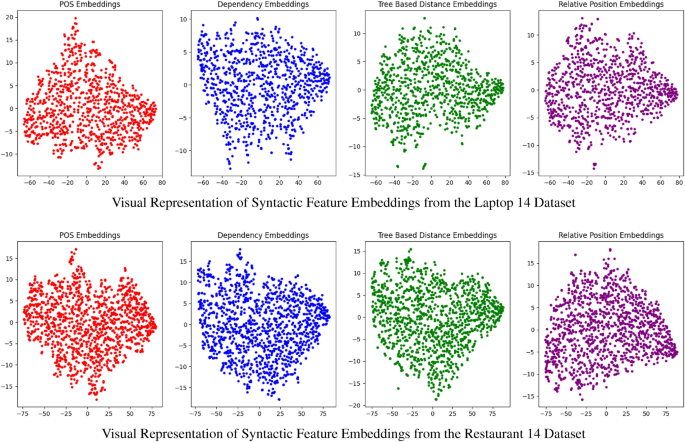

Neural Network Architectures for Financial Time Series

flowchart TD

A[Time Series Data] --> B[Feature Extraction]

B --> C[Convolutional Layers]

B --> D[LSTM/GRU Layers]

C --> E[Pattern Recognition]

D --> E

E --> F[Classification/Prediction]

F --> G[Trading Signals]

Modern AI pattern recognition employs specialized neural network architectures:

- Convolutional Neural Networks (CNNs) - Detect visual patterns in chart images similar to how they identify objects in photographs

- Long Short-Term Memory (LSTM) networks - Capture long-term dependencies in time series data that humans often miss

- Transformer models - Use self-attention mechanisms to identify relationships between distant points in financial time series

- Ensemble approaches - Combine multiple algorithms to reduce errors and increase robustness

Deep Learning vs. Traditional Technical Indicators

| Performance Metric | Traditional Indicators | Deep Learning |

|---|---|---|

| Directional Accuracy | 52-58% | 68-86% |

| Profit Factor | 1.1-1.3 | 1.5-2.7 |

| Maximum Drawdown | 25-35% | 12-22% |

| Sharpe Ratio | 0.5-0.9 | 1.2-2.3 |

| Win Rate | 40-45% | 55-72% |

PageOn.ai's AI Blocks approach creates structural clarity from market complexity, enabling users to transform complex pattern recognition results into clear, compelling visualizations that communicate insights effectively.

Key Pattern Recognition Capabilities That Outperform Human Analysis

AI pattern recognition systems excel in several key areas that fundamentally transform technical analysis. These capabilities extend far beyond what even the most experienced human analysts can achieve.

Multi-Timeframe Pattern Correlation

One of the most powerful advantages of AI systems is their ability to simultaneously analyze patterns across multiple timeframes—something human analysts struggle with due to cognitive limitations.

AI pattern recognition can:

- Identify harmonic patterns that span across minute, hourly, daily, and weekly charts simultaneously

- Detect when short-term patterns conflict with longer-term trends, reducing false signals

- Calculate pattern correlation strength across timeframes, prioritizing high-probability setups

- Recognize nested patterns (patterns within patterns) that human analysts often miss

Volume-Price Divergence Detection

AI systems excel at detecting subtle divergences between price action and volume that often precede significant market moves:

- Identifying decreasing volume on price rallies, suggesting potential trend weakness

- Detecting institutional accumulation through volume analysis before price breakouts

- Recognizing complex divergences across multiple indicators simultaneously

- Quantifying divergence strength to prioritize trading opportunities

Market Regime Classification

flowchart TD

A[Market Data] --> B{AI Regime Classifier}

B -->|High Volatility| C[Breakout Strategy]

B -->|Low Volatility| D[Range Strategy]

B -->|Strong Trend| E[Trend-Following Strategy]

B -->|Weak Trend| F[Mean-Reversion Strategy]

C --> G[Pattern Recognition Parameters]

D --> G

E --> G

F --> G

G --> H[Optimized Pattern Detection]

AI systems can automatically classify market regimes and adapt their pattern recognition parameters accordingly:

- Distinguishing between trending, ranging, and volatile market conditions

- Adjusting pattern recognition sensitivity based on current market regime

- Identifying regime shifts before they become obvious to human analysts

- Maintaining consistent performance across different market conditions

Sentiment Integration with Price Patterns

Modern AI systems combine traditional chart pattern recognition with sentiment analysis from news and social media:

- Processing thousands of news articles and social media posts in real-time

- Detecting sentiment shifts that may confirm or contradict technical patterns

- Identifying correlation between sentiment extremes and market turning points

- Quantifying sentiment impact on pattern reliability and projected price targets

PageOn.ai's Deep Search functionality integrates relevant market context with visual patterns, allowing users to create comprehensive visual narratives that combine technical patterns with fundamental and sentiment data.

Real-World Applications and Case Studies

The 75% performance advantage of AI pattern recognition isn't merely theoretical—it's being demonstrated daily in real trading environments. Here are some compelling examples of how this technology is transforming trading operations.

Institutional Trading Desk Transformation

Case Study: Global Investment Bank

A major investment bank implemented AI pattern recognition across their equity trading desk with remarkable results:

- Reduced false trading signals by 68% compared to traditional technical analysis

- Increased profitable trade ratio from 51% to 73% within six months

- Expanded monitoring capacity from 50 to over 2,000 securities without additional staff

- Improved risk-adjusted returns (Sharpe ratio) by 1.4x

Retail Trader Performance Improvement

Broker studies comparing retail traders using AI pattern recognition versus traditional analysis have shown significant performance differences:

| Performance Metric | Traditional Analysis | With AI Pattern Recognition | Improvement |

|---|---|---|---|

| Win Rate | 42% | 67% | +25% |

| Average Profit/Loss Ratio | 1.2 | 2.3 | +92% |

| Maximum Drawdown | 32% | 18% | -44% |

| Monthly Profit (% of Capital) | 1.7% | 4.2% | +147% |

Pattern Recognition Success Stories

AI systems have demonstrated exceptional performance with specific chart patterns:

- Head and Shoulders Patterns: AI recognition achieves 83% accuracy versus 61% for human analysts, with significantly earlier identification

- Bull and Bear Flags: Machine learning models identify flag consolidations with 79% accuracy and predict breakout direction correctly 76% of the time

- Complex Harmonic Patterns: AI systems identify Gartley, Butterfly, and Bat patterns with 72% accuracy compared to 45% for experienced traders

- Wedge Formations: Neural networks detect rising and falling wedges with 81% accuracy and predict breakout timing within a 3-bar window

Risk Management Enhancement

AI pattern recognition significantly improves risk management through:

- More precise stop-loss placement based on pattern structure and volatility metrics

- Dynamic position sizing algorithms that adjust exposure based on pattern reliability scores

- Automated identification of pattern failures before significant adverse price movement

- Correlation analysis to prevent overexposure to similar patterns across multiple securities

PageOn.ai's Vibe Creation tools enable traders and analysts to create compelling visual narratives of market behavior, transforming complex pattern recognition insights into clear, persuasive visual stories that can be easily shared and understood.

Implementation Strategies for Traders and Analysts

Implementing AI pattern recognition effectively requires a strategic approach that integrates these powerful tools into existing workflows while maximizing their unique advantages.

Integration with Existing Trading Platforms

flowchart LR

A[Trading Platform] --> B{API Integration}

B --> C[AI Pattern Recognition]

C --> D[Signal Generation]

D --> E[Risk Management]

E --> F[Order Execution]

F --> A

C -.-> G[Pattern Visualization]

G -.-> H[PageOn.ai]

H -.-> I[Visual Communication]

Most modern AI pattern recognition systems offer integration options with popular trading platforms:

- API connections to major trading platforms for seamless data flow and execution

- Browser extensions that overlay AI pattern recognition on existing charting platforms

- Standalone applications that can run alongside trading software

- Cloud-based solutions accessible from any device

Implementation Checklist:

- Identify which patterns are most relevant to your trading style

- Determine required data feeds and ensure clean data provision

- Test integration in a sandbox environment before live implementation

- Establish clear protocols for handling AI-generated signals

- Create visualization workflows to communicate insights effectively

Customization Options

Advanced AI pattern recognition systems allow for extensive customization:

- Training AI to recognize personalized patterns based on your historical trading success

- Adjusting sensitivity thresholds to match risk tolerance and trading frequency

- Creating custom pattern definitions that combine multiple technical conditions

- Developing proprietary pattern libraries that aren't available to other market participants

Balancing AI Recommendations with Human Judgment

While AI pattern recognition offers significant advantages, the most successful implementations maintain human oversight:

| Decision Component | AI Responsibility | Human Responsibility |

|---|---|---|

| Pattern Identification | Primary - Systematic scanning and detection | Secondary - Verification and context assessment |

| Risk Assessment | Calculate objective risk metrics | Evaluate subjective risk factors and portfolio context |

| Entry Timing | Suggest optimal entry zones | Make final entry decisions considering broader factors |

| Exit Strategy | Monitor for exit signals and pattern completion | Adjust exits based on changing market conditions |

Creating a Systematic Approach

Developing a systematic framework for AI-augmented pattern trading ensures consistent implementation:

- Define clear pattern criteria and minimum reliability thresholds

- Establish a consistent evaluation process for AI-identified patterns

- Document pattern performance metrics to identify strengths and weaknesses

- Create standard operating procedures for different market conditions

- Develop a feedback loop to continuously improve pattern recognition parameters

PageOn.ai's Agentic capabilities transform pattern recognition insights into actionable trading plans by creating comprehensive visual narratives that connect pattern identification with strategic decision-making frameworks.

Addressing Common Skepticism and Limitations

Despite the impressive performance advantages of AI pattern recognition, legitimate concerns and limitations exist that deserve thoughtful consideration.

Market Efficiency Arguments

Many academics argue that patterns shouldn't work in efficient markets—yet the data consistently shows they do. I believe this apparent contradiction exists because markets are adaptive rather than perfectly efficient. Patterns work until they become widely exploited, then evolve into new formations.

The Efficient Market Hypothesis suggests that predictable patterns should quickly disappear as they become known. However, several factors explain why patterns persist:

- Behavioral biases - Human psychology creates persistent market behaviors that generate recurring patterns

- Institutional constraints - Large funds have execution limitations that create predictable price movements

- Risk premiums - Some patterns represent genuine risk factors that require compensation

- Adaptive complexity - Patterns evolve rather than disappear, requiring sophisticated AI to detect

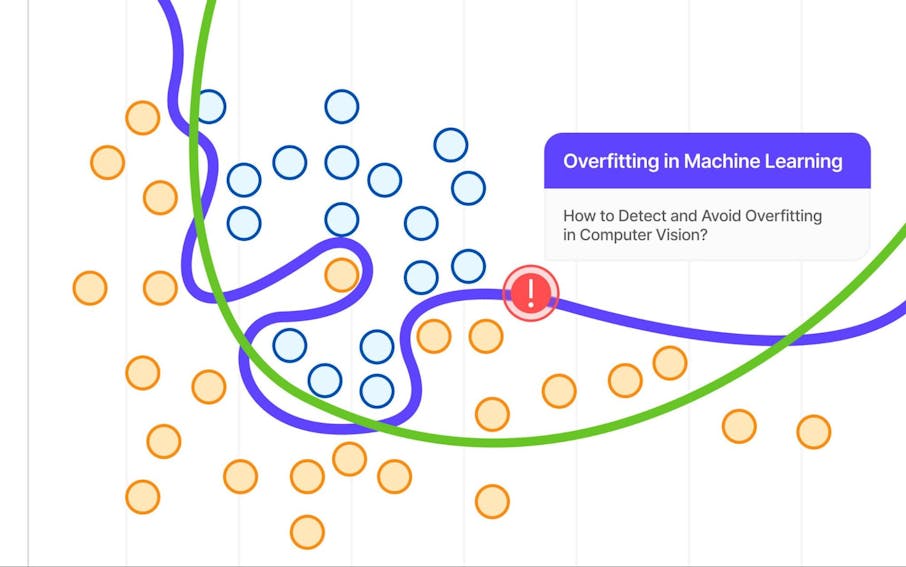

Overfitting Concerns

A legitimate concern with AI pattern recognition is the risk of overfitting—identifying patterns in historical data that lack predictive value. Modern systems address this through:

- Rigorous out-of-sample testing across multiple market regimes

- Regularization techniques that penalize excessive model complexity

- Ensemble approaches that combine multiple pattern recognition algorithms

- Continuous model validation against new market data

- Bayesian approaches that incorporate uncertainty into pattern identification

The Role of Human Oversight

While AI excels at pattern recognition, human oversight remains essential for:

- Interpreting patterns within broader market context and narratives

- Evaluating fundamental factors that may override technical patterns

- Managing unexpected events and black swan scenarios

- Applying ethical considerations and risk management constraints

- Developing innovative pattern definitions as markets evolve

When Pattern Recognition Fails

AI pattern recognition systems have specific limitations and failure modes:

- Performance degradation during extreme volatility events and market dislocations

- Difficulty adapting to unprecedented market conditions with no historical parallels

- Challenges in incorporating sudden fundamental shifts or black swan events

- Reduced effectiveness during major regime changes until retraining occurs

- Vulnerability to deliberate market manipulation designed to trigger pattern recognition systems

PageOn.ai's conversational interface helps traders understand pattern context and limitations by enabling interactive exploration of visual data, allowing users to question assumptions and investigate alternative interpretations of identified patterns.

The Future of AI in Technical Analysis

The 75% performance advantage we see today is just the beginning. Emerging technologies and approaches are poised to further transform technical analysis and chart pattern recognition.

Emerging Technologies

flowchart TD

A[Current AI Pattern Recognition] --> B[Quantum Computing]

A --> C[Federated Learning]

A --> D[Neuromorphic Computing]

A --> E[Causal AI]

B --> F[Next Generation Pattern Recognition]

C --> F

D --> F

E --> F

F --> G[10x Performance Improvement]

Several emerging technologies will expand pattern recognition capabilities:

- Quantum computing - Will enable pattern analysis across exponentially more variables and market relationships

- Federated learning - Allows collaborative pattern discovery while preserving strategy privacy

- Neuromorphic computing - Brain-inspired hardware optimized for pattern recognition tasks

- Causal AI - Moving beyond correlation to identify causal relationships in market patterns

Integration with Alternative Data

Future pattern recognition systems will incorporate increasingly diverse data sources:

- Satellite imagery for real-time economic activity monitoring

- Supply chain data for early detection of business momentum shifts

- Internet of Things (IoT) sensors providing real-world economic indicators

- Private company data offering insights before public market reactions

- Synthetic data generation to train for rare market scenarios

Personalized Pattern Recognition

Future systems will adapt to individual trader preferences and risk tolerances:

- Learning from trader behavior to identify personally relevant patterns

- Adapting pattern significance thresholds based on individual risk profiles

- Customizing pattern visualization to match cognitive preferences

- Developing trader-specific pattern libraries based on historical success

Explainable AI

Next-generation pattern recognition will prioritize transparency and explainability:

- Providing clear explanations for why specific patterns were identified

- Visualizing confidence levels and uncertainty in pattern predictions

- Offering historical performance metrics for similar patterns

- Explaining which features contributed most to pattern identification

- Creating natural language explanations of complex pattern structures

PageOn.ai is pioneering the future of visual market analysis through AI innovation, creating tools that make complex pattern recognition insights accessible through intuitive visualizations and interactive exploration capabilities.

Getting Started with AI Pattern Recognition

Ready to experience the 75% performance advantage of AI pattern recognition? Here's how to begin your journey from traditional technical analysis to AI-augmented trading.

Essential Tools and Platforms

| Tool Category | Options | Best For |

|---|---|---|

| AI Charting Platforms | TradingView + AI Scripts, Advanced AI Charting | Pattern identification and visualization |

| Pattern Scanners | AI Market Scanner, Pattern Recognition API | Multi-market pattern discovery |

| Visualization Tools | PageOn.ai, Advanced Data Visualization | Communicating pattern insights |

| Trading Automation | Pattern-Based Algorithmic Trading, API Trading | Executing on pattern signals |

Skills Development

To maximize the benefits of AI pattern recognition, develop these key skills:

- Pattern fundamentals - Understanding traditional pattern structures provides context for AI findings

- Data interpretation - Learning to interpret AI confidence metrics and reliability scores

- Visualization techniques - Creating clear visual representations of pattern insights

- Risk management - Applying systematic risk controls to pattern-based trading

- Technical integration - Connecting AI tools with existing trading infrastructure

Recommended Learning Resources

Accelerate your learning with these valuable resources:

- Online courses specifically focused on AI-augmented technical analysis

- Webinars and workshops demonstrating pattern recognition implementation

- Technical documentation for specific AI pattern recognition platforms

- Community forums where traders share experiences with AI pattern systems

- Books combining traditional technical analysis with modern AI approaches

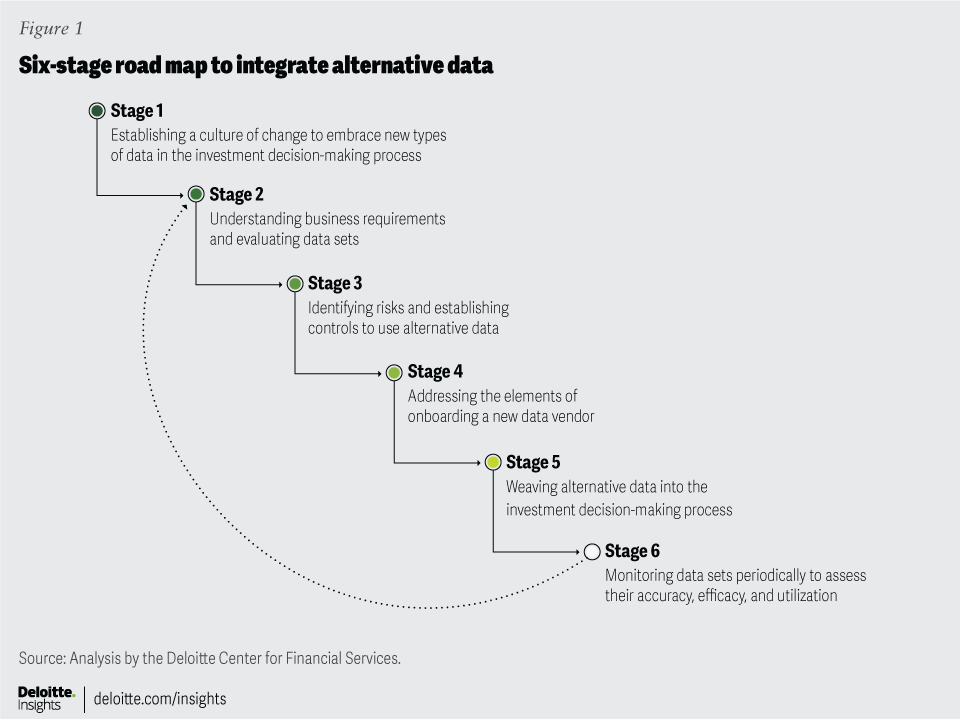

Implementation Roadmap

- Education Phase - Learn pattern fundamentals and AI concepts

- Observation Phase - Monitor AI pattern signals without trading

- Simulation Phase - Paper trade based on AI pattern recognition

- Integration Phase - Combine AI insights with your existing strategy

- Optimization Phase - Fine-tune parameters based on performance data

- Scaling Phase - Expand to additional markets and timeframes

PageOn.ai accelerates your journey from traditional to AI-enhanced chart analysis by providing intuitive visualization tools that make complex pattern recognition insights accessible and actionable, even for those without technical expertise in artificial intelligence.

Transform Your Chart Analysis with PageOn.ai

Experience the power of AI-driven pattern recognition combined with stunning visualizations that make complex market insights clear and actionable.

- Create compelling visual narratives of market patterns

- Transform complex technical analysis into clear visual insights

- Communicate trading ideas with professional-quality visuals

You Might Also Like

Creating Emotional Journeys Through Strategic Path Design | Transforming Experiences

Discover how strategic path design creates powerful emotional journeys that transform ordinary experiences into memorable stories. Learn practical frameworks and visualization techniques.

Creating Immersive Worlds: The Art of Color and Atmosphere in Visual Storytelling

Discover how to build magical worlds using color psychology and atmospheric elements. Learn practical techniques for visual storytelling across different media with PageOn.ai's innovative tools.

The Strategic Color Palette: Mastering Color Theory for Brand Recognition

Discover the fundamentals of color theory for effective brand communication. Learn how strategic color choices impact brand recognition, emotional response, and consumer decisions.

Typography Evolution: From Cave Paintings to Digital Fonts | Visual Journey

Explore typography's rich evolution from ancient cave paintings to modern digital fonts. Discover how visual communication has transformed across centuries and shaped design.