AI-Powered Fraud Detection in Financial Systems

Visualizing Security Through Intelligence

In today's rapidly evolving financial landscape, I've observed how AI-powered fraud detection systems are becoming essential for protecting institutions and customers alike. Join me as we explore how these intelligent systems are revolutionizing security while maintaining seamless user experiences.

The Evolving Landscape of Financial Fraud

In my years of experience with financial security systems, I've witnessed a dramatic shift in how fraud operates. Today's financial institutions face unprecedented challenges from increasingly sophisticated fraud attempts that cost the global economy billions annually. What was once a matter of simple rule-based detection has evolved into a complex battlefield requiring intelligent, adaptive solutions.

The statistics are sobering: financial fraud attempts have increased by over 300% in the past five years, with attack vectors becoming increasingly sophisticated. Meanwhile, customers demand frictionless experiences that don't interrupt their financial activities with excessive security measures.

Traditional rule-based systems that once formed the backbone of fraud detection now show critical limitations:

- Inability to adapt to new fraud patterns without manual updates

- High false positive rates that frustrate legitimate customers

- Delayed detection that often identifies fraud after financial losses occur

- Limited ability to process the vast volumes of transaction data generated daily

This is where AI financial assistant tools and advanced detection systems are changing the game. By implementing intelligent systems that learn and adapt, financial institutions can now strike the delicate balance between robust security and seamless user experience.

Core Components of AI-Powered Fraud Detection Architecture

In my work designing fraud detection systems, I've found that understanding the core technologies is essential for successful implementation. Modern AI-powered fraud detection relies on sophisticated machine learning models working in concert with robust data infrastructure.

Machine Learning Models Powering Modern Fraud Detection

flowchart TD

A[Transaction Data] --> B{AI Processing Layer}

B --> C[Supervised Learning]

B --> D[Unsupervised Learning]

B --> E[Deep Learning]

B --> F[Graph Neural Networks]

C --> G[Known Fraud Pattern Recognition]

D --> H[Anomaly Detection]

E --> I[Complex Pattern Identification]

F --> J[Relationship-Based Fraud Rings]

G --> K[Risk Assessment]

H --> K

I --> K

J --> K

K --> L[Decision Engine]

L --> M[Allow Transaction]

L --> N[Block Transaction]

L --> O[Flag for Review]

style B fill:#FF8000,stroke:#333,stroke-width:2px

style K fill:#E53935,stroke:#333,stroke-width:2px

style L fill:#E53935,stroke:#333,stroke-width:2px

Supervised Learning

Learns from labeled historical fraud data to identify similar patterns in new transactions. Highly effective for known fraud types but requires extensive labeled data.

Unsupervised Learning

Detects anomalies and outliers without prior examples. Particularly valuable for identifying novel fraud techniques that haven't been seen before.

Deep Learning

Uses neural networks to identify complex patterns across vast datasets. Excels at finding subtle fraud indicators that might be missed by simpler models.

Graph Neural Networks

Analyzes relationships between entities (accounts, transactions, customers) to detect fraud rings and coordinated attacks that span multiple accounts.

Essential Data Infrastructure Requirements

Even the most sophisticated AI models are only as good as the data infrastructure supporting them. My experience has shown that successful AI implementation requires careful attention to data quality, processing capabilities, and integration points.

| Infrastructure Component | Purpose | Implementation Considerations |

|---|---|---|

| Real-time Data Processing Pipeline | Process transaction data within milliseconds | Requires high-throughput streaming architecture (Kafka, Spark Streaming) |

| Data Quality & Preparation | Ensure clean, normalized data for models | Implement data validation, cleansing, and transformation processes |

| System Integration | Connect with existing financial infrastructure | API development, middleware solutions, legacy system compatibility |

| Compliance & Regulatory | Meet financial regulations and data protection laws | Data encryption, access controls, audit trails, GDPR/PCI DSS compliance |

Building Intelligent Detection Workflows

Having implemented fraud detection systems for various financial institutions, I've found that effective workflows combine behavioral analytics with real-time monitoring capabilities to create a comprehensive defense against fraudulent activities.

Behavioral Analytics Implementation Strategies

Behavioral analytics forms the foundation of modern fraud detection by establishing what "normal" looks like for each customer. My approach typically involves:

- User behavior profiling: Creating multi-dimensional profiles based on historical transaction patterns, device usage, geographic locations, and timing patterns

- Transaction pattern analysis: Establishing baselines for typical transaction amounts, frequencies, merchant categories, and geographic spread

- Contextual authentication: Incorporating device information, location data, and behavioral biometrics to verify user identity without adding friction

- Pattern recognition: Identifying suspicious deviations from established norms while minimizing disruption to legitimate users

These capabilities are particularly important for financial institutions using AI financial report generators and other automated financial tools where security must be maintained without impeding operations.

Real-time Monitoring and Response Mechanisms

flowchart TD

A[Transaction Initiated] -->|Real-time| B[Streaming Analytics Engine]

B --> C{Risk Scoring}

C -->|Low Risk| D[Allow Transaction]

C -->|Medium Risk| E[Step-up Authentication]

C -->|High Risk| F[Block Transaction]

E -->|Verified| D

E -->|Failed| F

F --> G[Generate Alert]

G --> H[Investigation Queue]

H --> I[Fraud Analyst Review]

I -->|Confirmed Fraud| J[Update AI Models]

I -->|False Positive| K[Adjust Thresholds]

style C fill:#FF8000,stroke:#333,stroke-width:2px

style B fill:#FF8000,stroke:#333,stroke-width:2px

In my experience implementing real-time monitoring systems, the key components include:

Streaming Analytics Infrastructure

High-performance systems capable of processing thousands of transactions per second with sub-second latency, enabling immediate fraud detection.

Risk Scoring Methodology

Multi-factor scoring algorithms that calculate transaction risk based on dozens of variables, with configurable thresholds for different customer segments.

Automated Response Protocols

Tiered response mechanisms that apply appropriate actions based on risk level, from allowing transactions to requesting additional verification or blocking entirely.

Alert Management Workflow

Efficient systems for routing alerts to fraud analysts, with prioritization based on risk level, amount, and customer impact.

These systems must be carefully tuned to balance security with customer experience. Too many false positives create friction and frustration, while missed fraud attempts lead to financial losses and damaged trust.

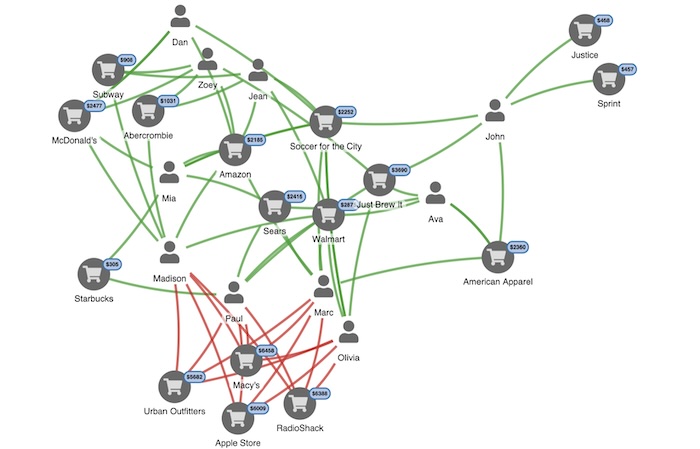

Visualization Capabilities for Fraud Pattern Recognition

One of the most powerful aspects of modern fraud detection is the ability to visualize complex patterns. In my experience, effective visualizations transform abstract data into actionable insights that fraud analysts can quickly interpret and act upon.

Transforming Complex Fraud Data into Actionable Visualizations

graph TD

A[Account 1] -->|$5,000| B[Account 2]

B -->|$3,200| C[Account 3]

B -->|$1,800| D[Account 4]

C -->|$3,200| E[Account 5]

D -->|$1,800| F[Account 6]

A -->|$8,500| G[Account 7]

G -->|$8,500| H[Account 8]

H -->|$8,500| I[Account 9]

subgraph "Money Laundering Pattern"

A

B

C

D

E

F

end

subgraph "Straight-Through Processing"

G

H

I

end

Using PageOn.ai's AI Blocks, fraud detection teams can create network visualizations like the one above to identify complex transaction relationships that might indicate money laundering or other financial crimes. These visual representations make it much easier to spot suspicious patterns that might be missed in tabular data.

Network Visualization

Maps relationships between accounts, transactions, and entities to identify coordinated fraud rings and money laundering schemes.

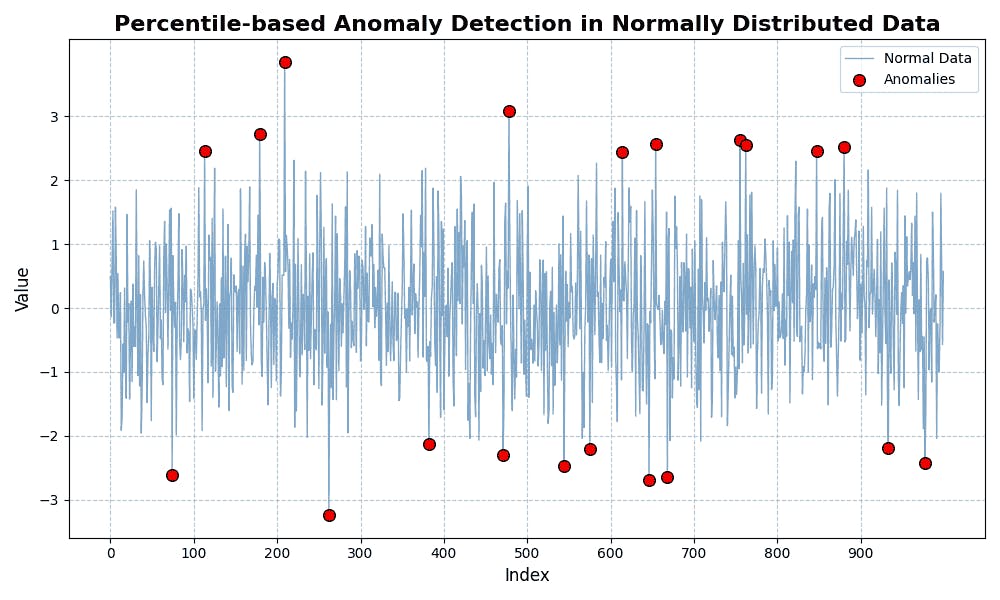

Time-Series Anomaly Representation

Displays transaction patterns over time, highlighting anomalous activities that deviate from established baselines.

Geographic Mapping

Plots transaction origins and destinations to identify unusual geographic patterns or impossible travel scenarios.

Interactive Dashboards

Provides fraud analysts with comprehensive views of risk indicators, allowing them to drill down into specific transactions or patterns.

Pattern Recognition Enhancement

Advanced visualization techniques significantly enhance pattern recognition capabilities, allowing fraud teams to identify trends that might otherwise remain hidden in the data. This approach is similar to how wall street financial crises pattern recognition helps analysts identify market anomalies.

Using PageOn.ai's Deep Search capabilities, fraud teams can integrate relevant indicators from multiple sources to create comprehensive visual representations of potential fraud patterns. This allows for:

- Visual clustering of similar fraud attempts to identify coordinated attacks

- Trend identification through temporal visualization, revealing evolving fraud tactics

- Comparative analysis tools for investigating related cases and establishing connections

- Pattern matching across historical fraud cases to quickly identify known attack vectors

Implementation Roadmap and Integration Strategy

Based on my experience implementing AI-powered fraud detection systems, I've found that a structured approach is essential for success. The implementation roadmap must account for both technical architecture and organizational readiness.

System Architecture Planning

flowchart TD

A[Data Sources] --> B[Data Ingestion Layer]

B --> C[Data Processing Layer]

C --> D[AI/ML Processing]

D --> E[Decision Engine]

E --> F[Response Orchestration]

G[Existing Core Banking System] -.-> B

H[Payment Gateways] -.-> B

I[Customer Databases] -.-> B

J[External Data Sources] -.-> B

F -.-> K[Transaction Processing]

F -.-> L[Customer Communication]

F -.-> M[Case Management]

N[API Gateway] --- E

O[Admin Interface] --- E

P[Analytics Dashboard] --- E

style D fill:#FF8000,stroke:#333,stroke-width:2px

style E fill:#FF8000,stroke:#333,stroke-width:2px

When designing the architecture for fraud detection systems, I focus on these key components:

- Core components and their interconnections: Ensuring each part of the system—from data ingestion to decision making—works seamlessly together

- API integration points: Developing robust APIs that connect with existing financial infrastructure without disrupting critical operations

- Scalability considerations: Building systems that can handle growing transaction volumes and expanding data sources

- Performance optimization: Ensuring real-time processing capabilities that can make decisions in milliseconds

Progressive Implementation Approach

I've found that a phased implementation approach is most effective for AI agents and fraud detection systems. This minimizes disruption while allowing for continuous refinement based on real-world performance.

| Implementation Phase | Key Activities | Success Metrics |

|---|---|---|

| Phase 1: Pilot Program |

|

|

| Phase 2: Limited Production |

|

|

| Phase 3: Full Deployment |

|

|

| Phase 4: Optimization |

|

|

This progressive approach allows organizations to build confidence in the system, train their teams effectively, and make adjustments based on real-world performance before full-scale deployment.

Measuring Success and ROI

In my experience implementing fraud detection systems, establishing clear metrics is essential for demonstrating value and guiding ongoing optimization efforts. A comprehensive measurement framework should include both technical and business metrics.

Key Performance Indicators for Fraud Detection Systems

When measuring the success of AI-powered fraud detection systems, I focus on these key metrics:

Reduction in False Positive Rates

The percentage decrease in legitimate transactions incorrectly flagged as fraudulent. This directly impacts customer experience and operational costs.

Improvement in Fraud Detection Accuracy

The increase in correctly identified fraudulent transactions, measured as a percentage of total fraud attempts.

Financial Loss Prevention

The monetary value of fraud prevented, calculated by comparing losses before and after implementation, adjusted for transaction volume.

Customer Experience Impact

Measured through reduced authentication challenges, decreased transaction abandonment, and improved customer satisfaction scores.

Case Studies and Success Stories

Global Bank Implementation

A major international bank implemented an AI-powered fraud detection system across their credit card operations in 2022. The results after 12 months were significant:

- 76% reduction in false positives

- 92% detection rate for fraudulent transactions (up from 65%)

- $24.7 million in prevented fraud losses

- Customer satisfaction scores increased by 18 points

The bank achieved these results by focusing on a phased implementation approach, extensive model training with historical data, and careful threshold tuning based on customer segments.

Implementation Lessons Learned

Through multiple implementations, I've identified several critical success factors:

- Executive sponsorship and clear ownership are essential for successful deployment

- Cross-functional teams (IT, fraud, customer experience, compliance) must collaborate from the start

- Data quality is the foundation of effective AI models

- Continuous model training and refinement are necessary as fraud tactics evolve

- Visual tools for fraud analysts dramatically improve investigation efficiency

Using PageOn.ai's Vibe Creation tools, organizations can craft compelling visual narratives about their fraud prevention successes, helping to communicate value to stakeholders and build customer confidence in security measures.

Future-Proofing: Adapting to Evolving Fraud Tactics

In my years working with financial security systems, I've observed that fraud tactics continuously evolve. Future-proofing requires building systems that can learn and adapt to new threats without requiring complete redesigns.

Continuous Learning Mechanisms

flowchart TD

A[New Transaction Data] --> B[Feature Extraction]

B --> C[Prediction/Classification]

C --> D{Human Review of Alerts}

D -->|Confirmed Fraud| E[Labeled Training Data]

D -->|False Positive| E

E --> F[Model Retraining]

F --> G[Validation Testing]

G -->|Improved Performance| H[Model Deployment]

H --> C

I[Adversarial Testing] --> J[Synthetic Fraud Scenarios]

J --> F

K[Emerging Pattern Detection] --> L[Unsupervised Anomaly Clusters]

L --> M[Analyst Review]

M --> E

style F fill:#FF8000,stroke:#333,stroke-width:2px

style C fill:#FF8000,stroke:#333,stroke-width:2px

Creating adaptive fraud detection systems requires implementing these continuous learning mechanisms:

- Model retraining protocols: Automated and scheduled retraining using newly labeled data to keep models current

- Adversarial testing frameworks: Simulating potential fraud attacks to identify vulnerabilities before they're exploited

- Emerging pattern identification: Using unsupervised learning to detect novel patterns that don't match known fraud or legitimate behavior

- PageOn.ai's Agentic capabilities: Leveraging intelligent agents that can autonomously investigate suspicious patterns and recommend model adjustments

Advanced Technologies on the Horizon

Looking ahead, several emerging technologies will reshape fraud detection capabilities:

Quantum Computing

Will enable processing of vastly more complex patterns and variables, potentially identifying subtle fraud indicators currently undetectable. Also presents new challenges for encryption security.

Federated Learning

Allows financial institutions to collaboratively train fraud detection models without sharing sensitive customer data, enhancing privacy while improving detection capabilities.

Explainable AI

Provides clear rationales for fraud determinations, essential for regulatory compliance and customer trust. Enables humans to understand and validate AI decisions.

Cross-Institutional Collaboration

Secure frameworks for financial institutions to share fraud intelligence while preserving privacy and competitive information, creating a more robust collective defense.

Organizations that invest in these emerging technologies and build adaptable systems will be better positioned to respond to evolving fraud tactics and maintain effective protection as the threat landscape changes.

Ethical Considerations and Compliance

Throughout my career implementing AI security systems, I've found that ethical considerations are not merely compliance requirements but fundamental to building effective, trusted fraud detection. Organizations must balance security imperatives with privacy rights and fairness principles.

Balancing Security with Privacy

Ethical Use of Customer Data

Financial institutions must establish clear boundaries for data usage, ensuring that fraud detection systems only access and process information that is necessary and proportionate to security goals.

- Implement data minimization principles

- Establish clear purpose limitations

- Create transparent data retention policies

- Obtain appropriate consent where required

Transparency in AI Decision-Making

Customers have the right to understand how decisions affecting their financial transactions are made, even when complex AI systems are involved.

- Provide clear explanations for transaction blocks

- Develop interpretable AI models where possible

- Create accessible documentation of decision factors

- Offer human review options for automated decisions

flowchart TD

A[Fraud Detection Requirements] --> B{Ethical Balancing}

B --> C[Security Imperatives]

B --> D[Privacy Rights]

B --> E[Fairness Principles]

B --> F[Regulatory Compliance]

C --> G[Technical Controls]

D --> G

E --> G

F --> G

G --> H[Ethical AI Framework]

H --> I[Model Development]

H --> J[Deployment Protocols]

H --> K[Monitoring Systems]

H --> L[Human Oversight]

style B fill:#FF8000,stroke:#333,stroke-width:2px

style H fill:#FF8000,stroke:#333,stroke-width:2px

Bias prevention in fraud detection algorithms is particularly critical, as biased systems can lead to discrimination and damaged trust. My approach includes:

- Diverse and representative training data to avoid reinforcing historical biases

- Regular bias audits across different demographic groups

- Removal of sensitive attributes that could lead to discriminatory outcomes

- Monitoring for disparate impact in system performance

Building Trust Through Responsible AI

Effective communication is essential for building customer trust in AI-powered security systems. Using PageOn.ai, financial institutions can create visual explanations that help customers understand how these complex systems protect their accounts while respecting their rights.

Customer Communication Strategies

Clear, accessible explanations of security measures build trust and cooperation. Visual representations can make complex security concepts understandable to all customers.

Appeal Processes for False Positives

Well-designed appeal mechanisms ensure customers have recourse when legitimate transactions are incorrectly flagged, maintaining trust even when systems make mistakes.

Regulatory compliance is non-negotiable for financial institutions. AI-powered fraud detection systems must be designed with comprehensive documentation and audit trails that satisfy:

- Anti-money laundering (AML) regulations

- Know Your Customer (KYC) requirements

- Data protection laws like GDPR and CCPA

- Financial industry-specific regulations

- AI governance and algorithmic accountability standards

Using PageOn.ai's visualization capabilities, compliance teams can create clear visual explanations of complex security systems for both customers and regulators, helping to build trust while demonstrating regulatory adherence.

Transform Your Fraud Detection Visualization with PageOn.ai

Ready to create powerful visual representations of your fraud detection systems? PageOn.ai provides the tools you need to transform complex security concepts into clear, engaging visualizations that help stakeholders understand your approach to financial security.

Conclusion: The Future of AI-Powered Fraud Detection

As I reflect on the evolution of fraud detection systems, it's clear that AI-powered approaches represent a transformative leap forward. By combining advanced machine learning models with powerful visualization capabilities, financial institutions can now detect and prevent fraud more effectively than ever before while maintaining excellent customer experiences.

The journey to implementing these systems is complex, requiring careful planning, phased deployment, and continuous refinement. However, the benefits are substantial: reduced fraud losses, improved customer trust, lower operational costs, and enhanced regulatory compliance.

Looking ahead, I see fraud detection systems becoming increasingly proactive and adaptive, leveraging emerging technologies like federated learning and explainable AI to stay ahead of evolving threats. The organizations that succeed will be those that balance technical capabilities with ethical considerations, building systems that protect financial assets while respecting customer privacy and fairness.

With tools like PageOn.ai, financial security teams can create compelling visualizations that transform complex fraud detection concepts into clear, actionable insights. These visual representations not only help analysts identify threats more quickly but also build stakeholder understanding and trust in security measures.

By embracing AI-powered fraud detection and investing in visualization capabilities, financial institutions can build stronger defenses against increasingly sophisticated fraud attempts while delivering the seamless, trustworthy experiences that customers demand.

You Might Also Like

Mapping the Great Depression: Visualizing Economic Devastation and Recovery

Explore how data visualization transforms our understanding of the Great Depression, from unemployment heat maps to New Deal program impacts, bringing America's greatest economic crisis to life.

Unleashing the Power of Agentic Workflows: Visual Clarity for Complex AI Processes

Discover how to transform complex agentic workflows into clear visual representations. Learn to design, implement and optimize AI agent processes with PageOn's visualization tools.

Bridging Worlds: How Diffusion Models Are Reshaping Language Generation | PageOn.ai

Explore the revolutionary convergence of diffusion models and language generation. Discover how diffusion techniques are creating new paradigms for NLP, bridging visual and linguistic domains.

Strategic AI Marketing Investment Roadmap: Maximizing ROI from the $360 Billion Surge | 2025 Marketing Tech Budget Guide

Navigate the $360 billion AI investment surge with strategic marketing technology budget allocation. Discover proven frameworks for maximizing ROI from AI marketing tools in 2025.