Building Daily Financial Momentum: Transform Money Strategies Into Visual Action Systems

The Foundation: Mapping Your Financial Architecture

Discover how to break down overwhelming financial concepts into clear, actionable daily habits. Transform complex money strategies into visual frameworks that build sustainable wealth through systematic approaches and intelligent automation.

Mapping Your Financial Architecture

Building a successful money machine starts with understanding your current financial landscape. Just as architects create blueprints before construction, you need a comprehensive visual map of where your money flows. This foundation enables you to identify opportunities, eliminate inefficiencies, and create systematic approaches to wealth building.

Core Components of Your Financial Framework

Your financial architecture consists of interconnected systems that work together to create wealth. By visualizing personal success through structured frameworks, you can identify patterns and optimize your money management approach. The key is breaking down complex financial concepts into digestible, visual checklists that guide daily decision-making.

Money Flow Architecture

Below is a visualization of how money flows through your financial system:

flowchart TD

A[Income Sources] --> B[Primary Account]

B --> C[Fixed Expenses]

B --> D[Variable Expenses]

B --> E[Savings Goals]

B --> F[Investment Accounts]

C --> G[Housing]

C --> H[Insurance]

C --> I[Debt Payments]

D --> J[Food & Dining]

D --> K[Entertainment]

D --> L[Transportation]

E --> M[Emergency Fund]

E --> N[Short-term Goals]

F --> O[Retirement Accounts]

F --> P[Investment Portfolio]

style A fill:#FF8000

style B fill:#42A5F5

style E fill:#66BB6A

style F fill:#FFA726

To construct modular financial dashboards that adapt as your situation evolves, PageOn.ai's powerful AI Blocks feature allows for the creation of dynamic visual frameworks. These tools help you establish baseline metrics for tracking financial health and progress, ensuring your money machine operates with precision and clarity.

Essential Baseline Metrics

- Monthly cash flow (income minus all expenses)

- Emergency fund coverage (months of expenses saved)

- Debt-to-income ratio

- Savings rate percentage

- Investment allocation and performance

Converting Strategy Into Daily Habits

The gap between financial knowledge and financial success lies in implementation. Research shows that breaking down complex financial concepts into clear, actionable steps dramatically improves success rates. Your daily habits become the building blocks of your wealth-building machine.

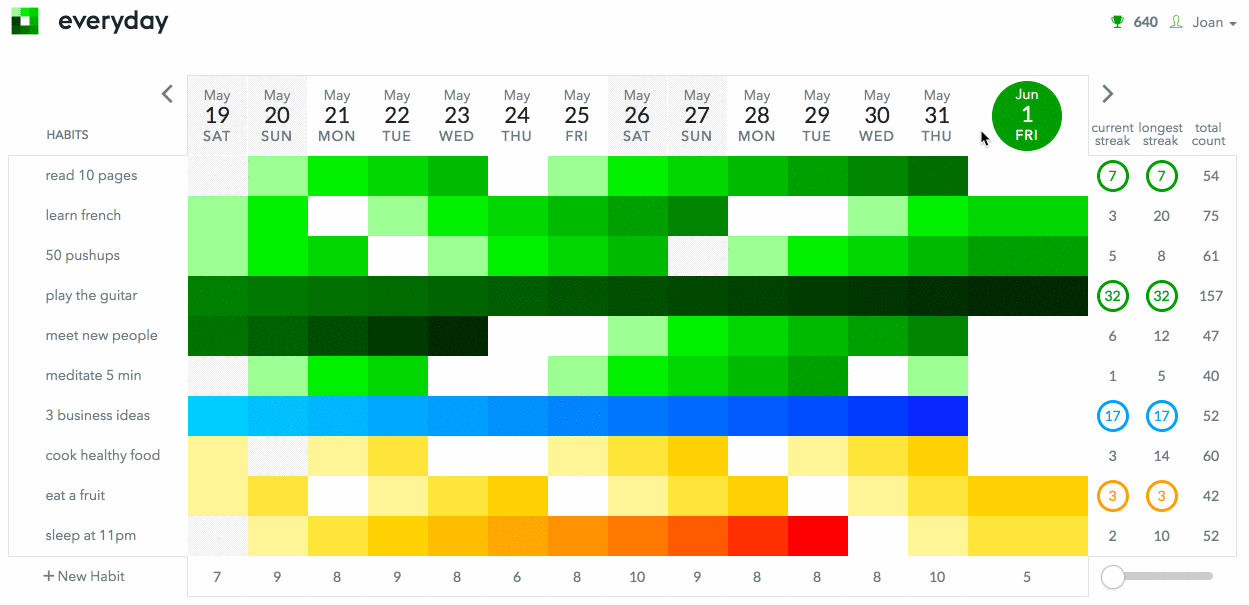

Daily Financial Habits Impact

This chart demonstrates how small daily actions compound into significant financial outcomes:

Creating accountability frameworks using visual progress indicators transforms abstract goals into tangible achievements. When you use Notion for productivity combined with visual design tools, you can build decision trees for common financial choices that guide spending, saving, and investing decisions.

Micro-Actions

- Check account balances (2 minutes)

- Log expenses in real-time

- Review investment performance

- Automate one bill payment

Macro-Outcomes

- Complete financial awareness

- Optimized spending patterns

- Compound investment growth

- Streamlined money management

PageOn.ai's Vibe Creation feature excels at turning abstract financial concepts into engaging, easy-to-follow visual guides. By leveraging this capability, you can transform overwhelming financial goals into clear, actionable daily steps that build momentum and create lasting behavioral change.

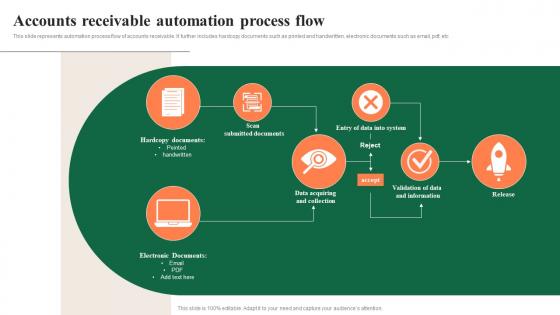

Building Self-Sustaining Money Flows

The ultimate goal of your money machine is to operate with minimal daily intervention while maximizing financial growth. Automation architecture creates systems that work continuously in the background, making optimal financial decisions and maintaining your wealth-building momentum even when you're focused on other priorities.

Automated Financial Ecosystem

This diagram illustrates how automated systems create seamless money flows:

flowchart LR

A[Paycheck] --> B[Checking Account]

B --> C[Auto-Transfer 20%]

B --> D[Auto-Pay Bills]

B --> E[Investment Transfer]

C --> F[High-Yield Savings]

C --> G[Emergency Fund]

D --> H[Rent/Mortgage]

D --> I[Utilities]

D --> J[Insurance]

E --> K[401k Contribution]

E --> L[Brokerage Account]

E --> M[Roth IRA]

F -.-> N[Goal-Based Savings]

L --> O[Auto-Rebalancing]

style A fill:#FF8000

style B fill:#42A5F5

style F fill:#66BB6A

style K fill:#FFA726

style O fill:#AB47BC

Understanding how federal reserve system policies impact your automated investment strategies helps you build more resilient financial systems. By implementing PageOn.ai's Deep Search capabilities, you can integrate real-time financial data and market insights directly into your visual planning system.

Emergency Financial Protocols

Create decision frameworks for financial stress situations:

- Pause non-essential automated transfers

- Activate emergency fund access procedures

- Implement expense reduction protocols

- Review and adjust investment allocations

- Establish communication with financial advisors

Designing feedback loops that adjust your system based on performance data ensures continuous optimization. Modern AI financial assistant tools can monitor your automated systems and suggest improvements based on changing market conditions and personal financial goals.

Visual Progress Tracking

What gets measured gets managed. Establishing key performance indicators (KPIs) for your money machine creates accountability and enables data-driven decision making. Visual dashboards transform raw financial data into compelling stories of progress and areas for improvement.

Financial Health Score Components

This radar chart shows the key metrics that comprise your overall financial wellness:

Building review cycles that identify system improvements and adjustments ensures your money machine evolves with your changing circumstances. By leveraging agentic workflows, you can automate the analysis of your financial data and generate insights that inform strategic decisions.

Leading Indicators

- Daily expense tracking

- Investment contributions

- Debt payments made

Current Indicators

- Monthly cash flow

- Account balances

- Budget variance

Lagging Indicators

- Net worth growth

- Investment returns

- Goal achievement

PageOn.ai's Agentic capabilities excel at transforming raw financial data into polished, actionable visual reports. These tools help you design celebration markers for achieving financial victories, creating positive reinforcement loops that sustain long-term financial discipline and motivation.

From Personal to Sustainable Wealth Building

Once your daily financial habits are established and automated, the next phase involves scaling successful strategies into comprehensive wealth-building systems. This transition from personal money management to sustainable wealth creation requires sophisticated planning and execution frameworks.

Wealth Building Progression Timeline

This timeline shows how financial systems evolve from basic to advanced wealth-building strategies:

Creating visual models for investment diversification and risk management becomes crucial as your wealth grows. Advanced financial systems require frameworks that compound your financial knowledge and decision-making ability over time, building institutional-quality processes for personal wealth management.

Advanced Wealth Building Strategies

Investment Sophistication

- Tax-loss harvesting automation

- Asset location optimization

- Alternative investment allocation

- International diversification

System Multiplication

- Multiple income stream development

- Business investment frameworks

- Real estate investment systems

- Knowledge monetization strategies

PageOn.ai's visual storytelling features excel at documenting your financial journey and creating compelling narratives around your money management success. These capabilities enable you to design frameworks for teaching and sharing your financial system with others, potentially creating additional income streams through financial education and consulting.

Knowledge Compounding System

This flowchart demonstrates how financial knowledge builds upon itself:

flowchart TD

A[Basic Financial Literacy] --> B[Personal System Mastery]

B --> C[Advanced Strategy Implementation]

C --> D[Teaching & Sharing Knowledge]

D --> E[Building Financial Community]

B --> F[Continuous Learning]

F --> G[Market Research & Analysis]

G --> C

D --> H[Content Creation]

H --> I[Monetized Education]

I --> J[Additional Income Streams]

E --> K[Network Effects]

K --> L[Investment Opportunities]

L --> M[Compound Wealth Growth]

style A fill:#FFA726

style B fill:#42A5F5

style C fill:#66BB6A

style M fill:#FF8000

Transform Your Financial Vision with PageOn.ai

Ready to turn your complex financial strategies into clear, actionable visual systems? PageOn.ai provides the tools you need to create compelling financial dashboards, automate progress tracking, and build wealth-building frameworks that actually work.

Start Creating with PageOn.ai TodayYou Might Also Like

Visualizing Your Path to Personal Success: Map and Measure What Truly Matters

Discover how to map and visualize your personal success metrics, align them with your core values, and create a customized tracking system that motivates genuine fulfillment.

Visualizing Spooky Action at a Distance: Making Quantum Entanglement Comprehensible

Explore quantum entanglement visualization techniques that transform Einstein's 'spooky action at a distance' from abstract theory into intuitive visual models for better understanding.

Mapping the Great Depression: Visualizing Economic Devastation and Recovery

Explore how data visualization transforms our understanding of the Great Depression, from unemployment heat maps to New Deal program impacts, bringing America's greatest economic crisis to life.

Visualizing Electronics Fundamentals: ROHM's Component Guide for Beginners to Experts

Explore ROHM's electronics basics through visual guides covering essential components, power semiconductors, sensors, automotive applications, and design resources for all skill levels.