Comparing AI Models: ChatGPT vs Claude vs Gemini for Trading

A comprehensive analysis of leading AI assistants for financial markets

The AI Revolution in Trading

Artificial intelligence is fundamentally transforming how traders analyze markets, manage risk, and execute strategies. From retail day traders to institutional investors, AI tools are becoming indispensable for gaining a competitive edge in increasingly complex financial markets.

As these technologies become more sophisticated, choosing the right AI model for your specific trading needs has never been more important. Different models excel in various aspects of financial analysis, from technical pattern recognition to fundamental data interpretation and risk assessment.

In this comprehensive guide, we'll examine three leading AI models—ChatGPT, Claude, and Gemini—evaluating their strengths, limitations, and optimal use cases for trading applications. Whether you're a day trader focused on technical analysis, a long-term investor emphasizing fundamentals, or somewhere in between, understanding these AI tools can significantly enhance your trading process.

By the end of this analysis, you'll have a clear framework for selecting the AI assistant that best aligns with your trading style, risk tolerance, and analytical needs.

Understanding AI Models in Trading Contexts

Before diving into specific models, it's crucial to understand what capabilities make an AI assistant valuable for trading applications. The financial markets demand particular strengths from AI systems:

Core Capabilities for Trading

- Data interpretation and pattern recognition: The ability to analyze large datasets and identify meaningful patterns that might indicate trading opportunities.

- Real-time market analysis: Processing current market conditions and news events to provide timely insights.

- Risk assessment frameworks: Evaluating potential downside scenarios and helping traders manage position sizing and exposure.

- Strategy formulation and backtesting: Assisting in developing trading strategies and testing them against historical data.

Model Architecture Differences

Several technical aspects of these AI models directly impact their effectiveness for trading:

| Feature | Importance in Trading |

|---|---|

| Context Window Size | Determines how much historical data and market context the model can consider simultaneously |

| Reasoning Capabilities | Affects how well the model can analyze complex market scenarios and causal relationships |

| Multimodal Abilities | Enables analysis of charts, graphs, and visual market data alongside textual information |

| External Data Access | Determines whether the model can access real-time market data or relies on training data |

flowchart TD

A[Trading AI Requirements] --> B[Data Analysis]

A --> C[Strategy Development]

A --> D[Risk Management]

A --> E[Market Awareness]

B --> B1[Historical Data Processing]

B --> B2[Pattern Recognition]

C --> C1[Hypothesis Generation]

C --> C2[Backtesting Support]

D --> D1[Position Sizing]

D --> D2[Risk/Reward Calculation]

E --> E1[News Integration]

E --> E2[Real-time Data Access]

With these core capabilities in mind, let's examine how each of the three leading AI models—ChatGPT, Claude, and Gemini—performs in trading contexts.

ChatGPT's Trading Capabilities

Strengths for Traders

- Trading strategy development: ChatGPT excels at generating creative trading hypotheses and helping traders develop structured strategies based on various market conditions and indicators.

- Pattern recognition: The model demonstrates strong capabilities in identifying patterns in historical market data when provided with sufficient context.

- Plugin ecosystem: ChatGPT Plus users can leverage plugins for enhanced functionality, including some that provide financial data integration and analysis tools.

- Narrative analysis: Particularly effective at interpreting market narratives, news sentiment, and thematic investment trends.

Limitations in Trading Contexts

- Knowledge cutoff: ChatGPT's training data has a cutoff date, limiting its awareness of recent market events without web browsing capabilities.

- Occasional "hallucinations": The model may sometimes generate plausible-sounding but incorrect information about market movements or company data.

- Prompt dependency: The quality of trading insights heavily depends on how well the user structures their prompts and provides relevant context.

Best Trading Use Cases

Strategy Development

Brainstorming trading strategies and refining entry/exit criteria

Market Sentiment Analysis

Interpreting news, reports, and market narratives

Trading Journal Analysis

Reviewing past trades to identify patterns and improve performance

Educational Resource

Learning trading concepts and methodologies

ChatGPT serves as a versatile trading assistant that balances creative strategy development with analytical capabilities. Its strength lies in helping traders develop structured approaches to the market while providing educational support for improving trading knowledge.

"I've found ChatGPT particularly useful for developing and refining trading strategies. By feeding it my historical trade data and market observations, it helps me identify patterns in my successful trades that I hadn't noticed myself." — Retail Trader, 5 years experience

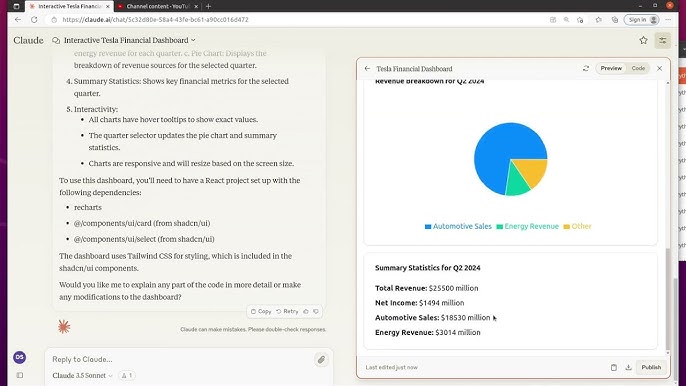

Claude's Trading Advantages

Strengths for Traders

- Superior reasoning: Claude demonstrates exceptional reasoning capabilities when analyzing complex market conditions and interrelationships between economic factors.

- Document analysis: Particularly strong at analyzing lengthy financial reports, earnings calls transcripts, and SEC filings to extract meaningful insights.

- Cautious approach: Takes a more measured approach to risk assessment, which can help traders avoid overconfidence biases.

- Transparency: Claude is generally more transparent about its limitations and uncertainties, which is valuable in high-stakes financial decision-making.

Limitations in Trading Contexts

- No direct web access: Claude cannot access real-time market data or current news without the user providing this information.

- Integration limitations: Less developed ecosystem for third-party integrations compared to competitors.

- Conservative recommendations: May be overly cautious in trading recommendations, potentially missing opportunistic trades.

flowchart LR

A[Claude's Trading Strengths] --> B[Fundamental Analysis]

A --> C[Risk Assessment]

A --> D[Document Processing]

A --> E[Ethical Considerations]

B --> B1[Financial Statement Analysis]

B --> B2[Economic Factor Correlation]

C --> C1[Conservative Risk Modeling]

C --> C2[Scenario Planning]

D --> D1[SEC Filing Analysis]

D --> D2[Earnings Call Interpretation]

E --> E1[Regulatory Compliance]

E --> E2[Ethical Trading Practices]

Best Trading Use Cases

Fundamental Analysis

In-depth analysis of company financials and economic factors

Regulatory Compliance

Ensuring trading strategies adhere to regulations and ethical standards

Long-form Research

Comprehensive market analysis and investment theses development

Scenario Planning

Stress testing strategies against various market conditions

Claude shines as a thoughtful trading assistant that excels in deep fundamental analysis and cautious risk assessment. It's particularly valuable for investors who prioritize thorough research and risk management in their trading approach.

"What impresses me most about Claude is its ability to analyze lengthy financial reports and extract the most relevant insights. It's like having a research analyst who can process quarterly reports in seconds and highlight the key factors that might impact my investment decisions." — Investment Analyst, institutional firm

Gemini's Trading Capabilities

Strengths for Traders

- Real-time market data: Gemini can access current market information through Google, providing timely insights on price movements and news.

- Google ecosystem integration: Seamless integration with Google's financial data and tools creates a cohesive workflow for traders already using these services.

- Multimodal capabilities: Strong ability to analyze charts, graphs, and other visual market data alongside textual information.

- Spreadsheet integration: Excellent for quantitative analysis when combined with Google Sheets for trading models and calculations.

Limitations in Trading Contexts

- Strategic reasoning: Sometimes less nuanced in complex strategic reasoning compared to competitors.

- Specialized knowledge: May prioritize general information over specialized trading knowledge in some instances.

- Ecosystem limitations: Most valuable within Google's ecosystem, potentially limiting integration with other trading platforms.

Best Trading Use Cases

Real-time Monitoring

Keeping track of market movements and breaking news

Technical Analysis

Identifying chart patterns and technical indicators

Data-Driven Trend Analysis

Analyzing market trends using quantitative methods

Google Sheets Integration

Building and maintaining trading models in spreadsheets

Gemini functions as a data-driven trading assistant that excels in providing real-time market insights and visual analysis. It's particularly valuable for traders who rely heavily on technical analysis and current market data for their decision-making process.

"The real-time data access through Gemini gives me an edge when I need to make quick trading decisions. Being able to ask about breaking news and immediately see how it might impact my positions has significantly improved my reaction time to market events." — Day Trader, specializing in news-based momentum strategies

Comparative Analysis for Trading Applications

To help traders make an informed decision, let's compare how these three AI models perform across key dimensions of trading analysis:

| Capability | ChatGPT | Claude | Gemini |

|---|---|---|---|

| Data Handling | Versatile with varied data sources | Excellent with large documents | Superior real-time data integration |

| Technical Analysis | Strong pattern recognition with plugins | Methodical but limited visualization | Excellent chart interpretation |

| Fundamental Analysis | Good balance of depth and accessibility | Superior financial statement analysis | Strong for data-driven metrics |

| Risk Management | Balanced risk assessment | Conservative and compliance-focused | Data-driven but sometimes less nuanced |

Key Insights from the Comparison

- Data handling: Claude excels with large financial documents, while Gemini offers superior real-time data access, and ChatGPT provides the most versatile approach to varied data sources.

- Technical analysis: Gemini's visual processing capabilities give it an edge for chart analysis, with ChatGPT following closely behind when enhanced with plugins.

- Fundamental analysis: Claude leads in deep financial statement analysis, making it ideal for value investors and those focusing on company fundamentals.

- Risk management: Claude's cautious approach provides the most conservative risk assessments, while ChatGPT offers a more balanced perspective.

This comparison highlights that no single AI model dominates across all trading dimensions. The optimal choice depends heavily on your trading style, time horizon, and analytical priorities.

Implementation Strategies for Traders

Successfully integrating AI models into your trading workflow requires thoughtful implementation. Here are key strategies to maximize the value of these tools:

Creating Effective Trading Prompts

Model-Specific Prompt Engineering

ChatGPT

Provide specific parameters, historical context, and desired output format. Use system prompts to establish trading expertise.

Claude

Structure requests with clear sections. Upload relevant documents and ask for detailed reasoning behind recommendations.

Gemini

Be direct and specific. Include visual elements for analysis and leverage its ability to search for current market data.

Sample Trading Prompt Template

I'm analyzing [TICKER/MARKET] for a potential [TRADE TYPE] position.

Context:

- Current price: [PRICE]

- Key support/resistance levels: [LEVELS]

- Recent news: [NEWS SUMMARY]

- Market environment: [MARKET CONDITIONS]

Please help me with:

1. Technical analysis of current chart patterns

2. Key fundamental factors to consider

3. Potential entry/exit points with risk/reward ratios

4. Alternative scenarios that could invalidate this trade idea

Include specific indicators like [INDICATOR NAMES] in your analysis.

Integrating AI Models into Trading Workflows

AI as Research Assistant

- Use AI to scan news, earnings reports, and market data

- Generate preliminary analyses before making decisions

- Create watchlists based on screening criteria

- Summarize complex market information

Combining Multiple Models

- Use Gemini for real-time data and technical analysis

- Leverage Claude for deep fundamental research

- Employ ChatGPT for strategy development and backtesting

- Cross-verify insights between models

Important: Always validate AI-generated trading insights with your own analysis. These tools should complement your decision-making process, not replace critical thinking or risk management principles.

Practical Tools and Extensions

| Integration Type | ChatGPT Options | Claude Options | Gemini Options |

|---|---|---|---|

| Market Data APIs | Yahoo Finance plugin, Bloomberg plugin | API integrations via custom code | Native Google Finance integration |

| Trading Platforms | Custom GPTs for trading, API connections | Claude API for custom solutions | Google Sheets integration for strategies |

| Workflow Automation | Zapier, Make.com integrations | Slack integration, AWS Lambda | Google Apps Script automation |

By thoughtfully implementing these strategies, traders can create a powerful AI-augmented workflow that enhances their decision-making process while maintaining human judgment as the final authority.

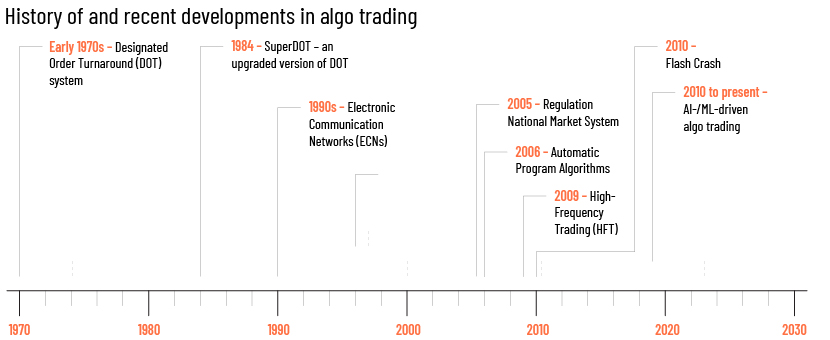

Future Developments and Trading Implications

The AI landscape for trading is rapidly evolving. Understanding upcoming developments can help traders position themselves to leverage future capabilities:

Upcoming Model Improvements

Extended Context Windows

Future models will process even larger datasets, enabling analysis of longer market histories and more comprehensive backtesting of strategies across multiple market cycles.

Enhanced Multimodal Capabilities

Improved ability to analyze charts, candlestick patterns, and visual market data will make AI models more effective for technical analysis and pattern recognition.

Sophisticated Reasoning

More advanced reasoning capabilities will enable models to better understand complex market dynamics, correlations between assets, and macroeconomic factors.

timeline

title AI Trading Assistant Evolution

2023 : Basic market analysis

: Strategy suggestions

2024 : Real-time data integration

: Advanced chart analysis

: Custom trading agents

2025 : Predictive market modeling

: Automated strategy testing

: Portfolio optimization

2026 : Adaptive trading systems

: Multi-asset correlation analysis

: Regulatory-compliant automation

Regulatory Considerations

As AI becomes more integral to trading processes, regulatory frameworks are evolving to address potential risks and ensure market integrity:

- Transparency requirements: Traders may need to document how AI tools inform their decision-making process, especially for regulated entities.

- Auditability: Maintaining records of AI-assisted analysis for compliance reviews and audit trails.

- Accountability: Clear delineation of responsibility between human traders and AI assistants in the decision chain.

- Model risk management: Understanding and documenting the limitations of AI models used in trading processes.

Regulatory Tip: Consider maintaining a log of how AI tools influence your trading decisions, particularly for significant positions or strategies. This documentation can be valuable for both personal improvement and potential regulatory inquiries.

The Evolving Role of AI in Trading Strategy

The relationship between traders and AI is evolving from basic assistance to collaborative intelligence:

- From assistant to augmented intelligence: AI models are becoming active collaborators in the trading process rather than passive information providers.

- AI-human collaborative systems: Future trading environments will feature tighter integration between human judgment and AI capabilities, with each complementing the other's strengths.

- Balancing automation with judgment: The most successful traders will be those who effectively balance algorithmic efficiency with human intuition and experience.

As these technologies continue to advance, traders who develop expertise in effectively leveraging AI capabilities while maintaining strong independent judgment will likely have a significant advantage in the markets.

Making the Optimal Choice for Your Trading Style

Selecting the right AI model depends heavily on your specific trading approach, time horizon, and analytical preferences. Here's a decision framework to guide your choice:

Decision Framework Based on Trading Approach

Day Traders & Technical Analysts

Focus on short-term price movements and chart patterns

Real-time data access and strong chart analysis capabilities make Gemini ideal for traders who need current market information and technical pattern recognition.

Fundamental Investors

Emphasis on company financials and economic factors

Superior document analysis and thoughtful reasoning make Claude excellent for analyzing financial statements, earnings reports, and economic data for long-term investment decisions.

Diversified Strategies

Blend of technical, fundamental, and other approaches

Versatility across different analysis types and trading methodologies makes ChatGPT well-suited for traders who employ multiple strategies and need a flexible assistant.

Recommendations for Different Trader Profiles

| Trader Profile | Primary Recommendation | Secondary Recommendation | Key Consideration |

|---|---|---|---|

| Beginner Traders | ChatGPT | Gemini | Educational value and ease of use |

| Professional Traders | Multiple Models | API Integrations | Specialized tools for different aspects |

| Institutional Traders | Claude | Enterprise API Solutions | Compliance and documentation |

Final Thoughts on the Future of AI-Assisted Trading

As AI continues to evolve and integrate into trading workflows, several principles remain important:

- Continuous learning and adaptation: The AI landscape is rapidly changing. Traders who regularly update their knowledge and adapt their workflows will maintain a competitive edge.

- Human oversight remains crucial: While AI models provide valuable insights, the final trading decisions should incorporate human judgment, experience, and contextual understanding that AI may lack.

- AI as a tool, not a replacement: The most successful approach views AI as a powerful augmentation to a trader's capabilities rather than a complete replacement for human analysis.

"The future of trading isn't about humans versus AI, but rather humans with AI versus humans without it. Those who learn to effectively collaborate with these tools while maintaining their unique human edge will likely find the greatest success in tomorrow's markets."

Transform Your Trading with Visual Intelligence

Take your market analysis to the next level with PageOn.ai's powerful visualization tools. Create stunning charts, diagrams, and visual models that help you identify patterns and opportunities others might miss.

Explore AI Stock Charting ToolsYou Might Also Like

The Creative Edge: Harnessing Templates and Icons for Impactful Visual Design

Discover how to leverage the power of templates and icons in design to boost creativity, not restrict it. Learn best practices for iconic communication and template customization.

Navigating the Digital Labyrinth: Maze and Labyrinth Design Patterns for Digital Products

Discover how maze and labyrinth design patterns can transform your digital products into engaging user experiences. Learn strategic applications, implementation techniques, and ethical considerations.

Bringing Google Slides to Life with Dynamic Animations | Complete Guide

Transform static presentations into engaging visual stories with our comprehensive guide to Google Slides animations. Learn essential techniques, advanced storytelling, and practical applications.

Advanced Shape Effects for Professional Slide Design | Transform Your Presentations

Discover professional slide design techniques using advanced shape effects. Learn strategic implementation, customization, and optimization to create stunning presentations that engage audiences.