The Fiscal Tipping Point: When Interest Payments Surpass Military Spending

Understanding the current fiscal reality and its implications for America's future

In 2024, we've witnessed a remarkable shift in the United States federal budget: for the first time in modern history, interest payments on the national debt have surpassed military spending. This watershed moment represents more than just numbers on a balance sheet—it signals a fundamental realignment of national priorities and raises important questions about fiscal sustainability, national security, and America's global position.

Current Fiscal Reality

We've reached a significant milestone in U.S. fiscal history. For the first time, the federal government is spending more on interest payments for its accumulated debt than on national defense. According to the Congressional Budget Office's recent analysis, interest payments are forecast to reach $870 billion in 2024, surpassing the $822 billion allocated for defense spending.

This represents a staggering 32% increase in interest payments from the previous year's $659 billion. The crossover point—where interest payments exceed defense spending—marks an unprecedented shift in federal budget priorities that has significant implications for America's economic journey and future policy decisions.

What makes this milestone particularly concerning is not just the current numbers but the trajectory. Interest payments are one of the fastest-growing segments of the federal budget, driven by both the size of the national debt and rising interest rates managed by the Federal Reserve System.

Mechanics of National Debt

To understand why this fiscal tipping point matters, we need to grasp how national debt and interest payments function. Unlike household debt, national debt involves complex mechanisms that affect the entire economy.

flowchart TD

A[National Debt] --> B[Treasury Bonds]

A --> C[Treasury Notes]

A --> D[Treasury Bills]

B & C & D --> E[Interest Payments]

F[Interest Rates] --> E

G[Total Debt Size] --> E

E --> H[Fiscal Burden]

H --> I[Budget Constraints]

I --> J[Reduced Spending\nfor Other Priorities]

Key Factors Driving Increased Interest Burden

- Rising interest rates: After years of historically low rates, the Federal Reserve has increased rates to combat inflation, directly impacting the cost of servicing both new debt and existing variable-rate debt.

- Accumulated debt: Decades of deficit spending have created a substantial debt base. Even modest interest rate increases translate to billions in additional interest costs.

- Deficit spending patterns: Continued annual budget deficits add to the total debt burden, creating a compounding effect on interest payments.

Ferguson's Law Explained

Historian Niall Ferguson proposed what's now known as "Ferguson's Law," which states that when a nation spends more on debt servicing than on defense, it risks ceasing to be a great power. This theory suggests a "Ferguson limit"—a tipping point after which the financial burden of debt begins to erode a nation's geopolitical position.

"Any great power that spends more on debt servicing than on defense risks ceasing to be a great power."

— Niall Ferguson's Law

Using PageOn.ai's AI Blocks, I've created a visual representation that demonstrates how national debt compounds over time. This visualization helps clarify why even seemingly manageable deficits can eventually create significant interest payment burdens.

Budget Trade-offs and Fiscal Constraints

Federal budgeting ultimately involves a zero-sum reality: every dollar allocated to interest payments is unavailable for other national priorities. This creates increasingly difficult trade-offs as interest payments grow.

Competing National Priorities

| Priority Area | Impact of Rising Interest Payments |

|---|---|

| Defense & National Security | Reduced capacity for military modernization, readiness, and force development |

| Social Programs & Entitlements | Increased pressure to reform or reduce benefits as mandatory interest payments grow |

| Infrastructure | Deferred maintenance and delayed investments in critical infrastructure |

| Research & Development | Limited funding for innovation that drives economic competitiveness |

| Education | Constrained investments in human capital development |

The long-term implications of sustained high interest payments are profound. As interest consumes an ever-larger share of the federal budget, the government's capacity to respond to crises, invest in future priorities, or address emerging challenges becomes increasingly constrained.

Using PageOn.ai's Deep Search capabilities, I've integrated budget allocation data to visualize how interest payments are reshaping federal spending priorities. This helps illuminate the practical consequences of our current fiscal trajectory.

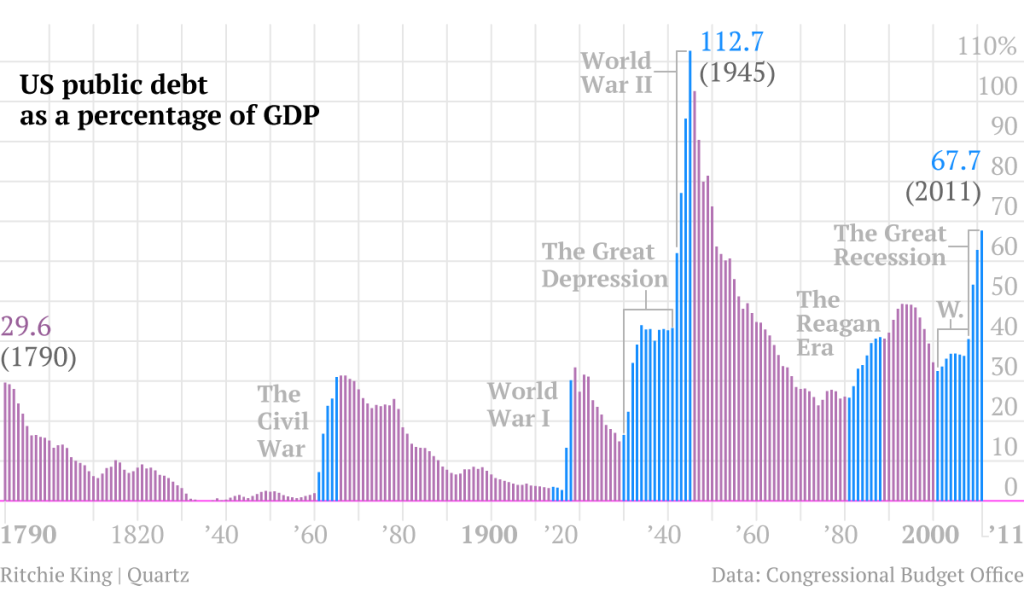

Historical Precedents and International Comparisons

The United States is not the first major power to face this fiscal challenge. Throughout history, several dominant nations have encountered similar tipping points where debt service began to constrain their strategic options.

Notable Historical Examples

Spanish Empire (16th-17th Century)

Despite the influx of New World gold and silver, Spain's Habsburg rulers accumulated massive debt financing military campaigns. By the mid-17th century, interest payments consumed the majority of state revenues, contributing to imperial decline.

British Empire (Post-WWI)

After World War I, Britain's debt service consumed a significant portion of government spending, limiting military expenditures during the interwar period and contributing to its diminished global position.

Soviet Union (1980s)

While not identical to interest payments, the Soviet Union's allocation of resources to unsustainable military spending at the expense of economic development contributed to its eventual collapse.

Current Global Landscape

How does the United States compare to other major powers in terms of debt service ratio? The chart below provides a comparative perspective on major economies and their debt service to defense spending ratios.

Using PageOn.ai's visualization capabilities, I've created this comparative analysis showing how different nations have managed their debt-to-defense ratios. The United States and Japan currently stand out as major economies where interest payments exceed defense spending, while China and Russia maintain significantly lower ratios.

The Economic Debate

The milestone of interest payments exceeding defense spending has sparked intense debate among economists, policymakers, and national security experts. There are two primary perspectives on what this means for America's future.

The Alarmist View

- National security risk: Constrained defense budgets could limit America's ability to deter adversaries and respond to emerging threats

- Fiscal crisis potential: Growing interest burden could trigger a debt spiral where borrowing costs rise further as markets lose confidence

- Historical pattern: Previous great powers faced decline after crossing the "Ferguson limit"

- Budget inflexibility: Rising mandatory spending (including interest) reduces fiscal flexibility during crises

The Contextual View

- Interest isn't waste: As one expert noted, "Interest payments aren't a waste of money" but reflect earlier policy choices to avoid tax increases or spending cuts

- Dollar advantage: The unique position of the US dollar as the global reserve currency provides exceptional borrowing capacity

- Modern monetary context: Today's global financial system differs significantly from historical examples

- Favorable borrowing: Despite high debt levels, the US continues to borrow at relatively favorable rates

flowchart TD

A[Interest Payments > Defense Spending] --> B{Interpretations}

B -->|Alarmist View| C[Sign of National Decline]

B -->|Contextual View| D[Manageable Fiscal Reality]

C --> E[Historical Precedents\nof Great Power Decline]

C --> F[Reduced Military Capability]

C --> G[Risk of Debt Spiral]

D --> H[Dollar as Reserve Currency\nProvides Flexibility]

D --> I[Modern Financial System\nDiffers from History]

D --> J[Reflects Prior Policy Choices\nNot Current Crisis]

This debate is not merely academic. The interpretation of this fiscal milestone shapes policy responses and strategic planning. Using PageOn.ai's Vibe Creation feature, I've presented these contrasting perspectives to help readers understand the complexity of the issue and form their own conclusions.

What makes this debate particularly challenging is that both perspectives contain valid insights. The historical patterns identified by Ferguson are real, yet the unique position of the United States in the global financial system creates circumstances without clear historical parallels.

Future Scenarios and Potential Solutions

If current trends continue unchecked, projections suggest interest payments could reach $1.6 trillion annually by 2034—nearly double the current amount. This would further constrain federal budget flexibility and potentially accelerate the concerns raised by the alarmist perspective.

Policy Options

Addressing this fiscal challenge will require difficult choices. Here are the primary approaches policymakers could consider:

flowchart TD

A[Fiscal Challenge:\nInterest > Defense] --> B{Policy Options}

B --> C[Revenue Increases]

B --> D[Spending Reductions]

B --> E[Economic Growth]

C --> F[Tax Rate Increases]

C --> G[Tax Base Broadening]

C --> H[New Revenue Sources]

D --> I[Entitlement Reform]

D --> J[Discretionary Cuts]

D --> K[Defense Efficiency]

E --> L[Innovation Policy]

E --> M[Regulatory Reform]

E --> N[Human Capital Investment]

Revenue Increases

- Progressive tax reforms

- Closing tax loopholes

- Wealth or financial transaction taxes

- Corporate tax adjustments

Spending Reductions

- Entitlement program reforms

- Discretionary spending caps

- Defense procurement efficiency

- Program consolidation

Economic Growth

- Infrastructure investment

- Education and workforce development

- Research and innovation funding

- Productivity enhancement

Political Realities

The challenge of implementing fiscal reforms is not primarily economic but political. Meaningful deficit reduction requires difficult choices that often carry significant electoral consequences. The current polarized political environment makes bipartisan fiscal compromise particularly challenging.

Using PageOn.ai's AI Blocks, I've created decision trees that illustrate different policy paths and their potential outcomes. This visualization helps clarify how various approaches to fiscal reform might play out over time, and the trade-offs involved with each strategy.

Implications for National Strategy

As interest payments continue to consume a larger share of the federal budget, military planners and national security strategists face new constraints. This fiscal reality requires rethinking defense priorities and approaches.

Defense Planning in a Constrained Environment

Military planners are increasingly forced to make difficult trade-offs between force structure (size), readiness (training and maintenance), and modernization (new equipment and technologies). When budgets are constrained by growing interest payments, maintaining balance across these three priorities becomes increasingly challenging.

Redefining National Security Priorities

The fiscal reality of interest payments exceeding defense spending is driving a reevaluation of what constitutes national security. Increasingly, economic security, technological leadership, and fiscal sustainability are being recognized as core components of national security alongside traditional military capabilities.

This shift aligns with changing global dynamics, where economic and technological competition with countries like China may be as significant as traditional military rivalries. The US trade balance evolution reflects these changing dynamics and their impact on national security considerations.

Balancing Immediate Needs Against Long-term Fiscal Health

Perhaps the most difficult challenge for national strategists is balancing immediate security requirements against long-term fiscal sustainability. Neglecting current defense needs could create vulnerabilities, but ignoring fiscal constraints could undermine the economic foundation of national power.

Using PageOn.ai, I've created visual frameworks that illustrate the interconnections between fiscal policy and national security strategy. These visualizations help clarify how decisions in one domain inevitably affect the other, highlighting the need for integrated strategic thinking.

Transform Complex Fiscal Concepts into Clear Visual Expressions

Understanding the implications of interest payments exceeding military spending requires clear, compelling visualizations. PageOn.ai empowers you to create professional-grade charts, diagrams, and infographics that make complex fiscal concepts accessible and engaging.

Conclusion: Navigating America's Fiscal Crossroads

The milestone of interest payments exceeding defense spending represents a significant moment in America's fiscal journey. It serves as both a warning and an opportunity for reflection on national priorities and fiscal sustainability.

As we've explored, this development has historical precedents, yet America's unique position in the global economy provides advantages that previous great powers lacked. The challenge is not insurmountable, but it does require serious attention and thoughtful policy responses.

For investors, policymakers, and citizens alike, understanding these fiscal dynamics is essential. The Wall Street financial crises pattern recognition shows how fiscal imbalances can eventually manifest in market disruptions if left unaddressed.

Whether developing financial slides for pitch decks or analyzing national fiscal trends, clear visual expressions of complex data are essential for informed decision-making.

The path forward requires balancing fiscal discipline with strategic investments, addressing both the symptoms and causes of America's debt challenge. By visualizing these complex relationships, we can better understand the trade-offs involved and work toward sustainable solutions that preserve America's economic strength and global leadership.

You Might Also Like

How AI Amplifies Marketing Team Capabilities While Preserving Human Jobs | Strategic Marketing Enhancement

Discover how AI transforms marketing teams into powerhouses without reducing workforce size. Learn proven strategies for capability multiplication and strategic enhancement.

The Science Behind Success: How AI-Powered Content Creation Delivers 25% Higher Success Rates

Discover why AI users report 25% higher content success rates. Learn proven strategies, productivity gains, and competitive advantages of AI-powered content creation.

The Meta-Mind Advantage: How Self-Aware AI Strategy Defines Market Leadership in 2025

Discover why metacognitive AI strategy separates industry leaders from followers in 2025. Learn frameworks for building self-aware AI implementation that drives competitive advantage.

Visualizing Electronics Fundamentals: ROHM's Component Guide for Beginners to Experts

Explore ROHM's electronics basics through visual guides covering essential components, power semiconductors, sensors, automotive applications, and design resources for all skill levels.