Decoding the Dollar's Unexpected Decline: Visual Analysis of Market Contradictions

Understanding the Dollar's Puzzling Behavior in Today's Economy

In the world of financial markets, certain correlations are taken as gospel. Rising interest rates strengthen a nation's currency - that's Economics 101. Yet recently, we've witnessed a perplexing phenomenon: the U.S. dollar declining despite climbing interest rates. I'll take you through a visual exploration of this market contradiction and what it means for investors, businesses, and the global economy.

The Dollar's Puzzling Behavior

When I first noticed the dollar's decline coinciding with rising U.S. interest rates, I was immediately struck by the contradiction. This unusual phenomenon has puzzled market experts and economists alike. Typically, higher interest rates attract foreign capital seeking better returns, strengthening a currency. But recently, we've seen the opposite occur.

Interest Rates vs. Dollar Index (2022-2024)

The divergence between rising interest rates and falling dollar value challenges conventional market wisdom:

Historical data shows that currency strength typically follows interest rate trends. When a central bank raises rates, the higher yields attract foreign investment, increasing demand for that currency. What we're seeing now represents a significant break from this pattern.

Market Expectations vs. Reality

The timeline below shows key points where market predictions diverged from the dollar's actual performance:

flowchart TD

A[Fed Signals

Rate Hikes] -->|Market Expects

Dollar Strength| B[Q2 2022]

B -->|Dollar Initially

Strengthens| C[Q3-Q4 2022]

C -->|Peak Dollar

Strength| D[Q1 2023]

D -->|Despite

Higher Rates| E[Dollar Begins

Declining]

E -->|Expectations

Diverge| F[Q2-Q3 2023]

F -->|Further Rate

Increases| G[Dollar Continues

Weakening]

G -->|Market

Recalibration| H[Q4 2023-Q1 2024]

H -->|Expectations

Shift| I[New Dollar

Paradigm]

style A fill:#FF8000,color:white

style D fill:#3B82F6,color:white

style I fill:#FF8000,color:white

The key inflection point occurred in early 2023, when despite continued rate hikes by the Federal Reserve, the dollar began its unexpected decline. This divergence from expected behavior signals deeper economic forces at work beyond simple interest rate differentials. As I explore in wall street financial crises pattern recognition, these market contradictions often precede significant economic shifts.

Underlying Economic Forces at Play

To understand the dollar's puzzling behavior, I need to examine the complex web of economic forces that influence currency markets. These interconnected factors create a dynamic system where traditional correlations can break down.

Interconnected Factors Driving Dollar Decline

This diagram illustrates the complex relationships between economic forces affecting the dollar:

flowchart TD

A[Rising US

Interest Rates] --> B[Higher Borrowing

Costs]

B --> C[Economic Growth

Concerns]

C --> D[Dollar

Weakness]

E[Global

Alternatives] --> D

F[US Fiscal

Deficit] --> G[Debt Sustainability

Concerns]

G --> D

H[Inflation

Expectations] --> I[Real Yield

Calculations]

I --> D

J[Global

Trade Tensions] --> K[Reduced Dollar

Dominance]

K --> D

style A fill:#FF8000,color:white

style D fill:#3B82F6,color:white

style H fill:#FF8000,color:white

The relationship between U.S. bond markets and currency valuation has become increasingly complex. When bond yields rise but inflation expectations remain elevated, real yields may not be as attractive as nominal rates suggest.

Bond Yields vs. Inflation Expectations

This chart compares 10-year Treasury yields with inflation expectations, revealing the impact on real yields:

Domestic and global economic indicators often tell different stories. While the U.S. economy has shown resilience in some areas, global growth concerns and shifting capital flows have impacted the dollar's traditional safe-haven status.

Domestic vs. Global Economic Growth

Comparing U.S. economic performance with global growth trends:

The relationship between inflation expectations and currency markets has become particularly important in the current economic environment. As the federal reserve system navigates the delicate balance between fighting inflation and supporting economic growth, market participants are increasingly focused on real yields rather than nominal rates.

The Rare Triple Decline Pattern

One of the most concerning aspects of recent market behavior has been the simultaneous decline in the dollar, U.S. stocks, and bonds. This rare "triple decline" pattern typically signals capital flight from a country and has historically been much more common in emerging markets than in the United States.

Triple Decline Pattern Visualization

The synchronized decline of dollar, stocks, and bonds is a rare occurrence in U.S. markets:

According to J.P. Morgan Private Bank research, this triple decline pattern has occurred just 6% of the time in U.S. markets, compared to over 30% for emerging markets like Brazil. This stark contrast highlights the unusual nature of current market conditions.

Frequency of Triple Decline Pattern by Country

Comparing how often different countries experience simultaneous declines in currency, stocks, and bonds:

This pattern raises important questions about potential systemic risks. When a developed economy like the United States experiences this type of market behavior, it often signals deeper concerns about economic fundamentals or policy direction. As we've seen throughout america's economic journey, these rare market signals can precede significant economic adjustments.

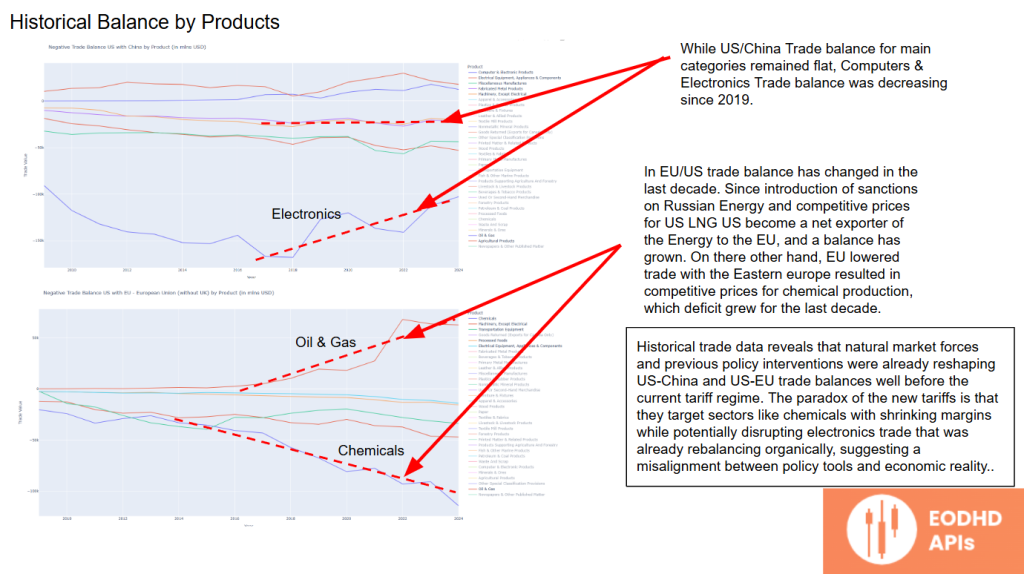

Global Trade Dynamics and Currency Impacts

Trade policy decisions, particularly regarding tariffs and international agreements, have significant implications for currency valuation. Recent discussions about potential new U.S. tariffs have contributed to the dollar's weakness by creating uncertainty about future trade relationships and economic growth.

Tariff Policy Impact on Dollar Value

This visualization shows how changes in U.S. tariff policy have historically affected the dollar:

The relationship between trade balances and currency movements is complex but important for understanding the dollar's trajectory. The us trade balance evolution has been a significant factor in long-term currency trends.

U.S. Trade Balance and Dollar Value

Examining the relationship between trade deficits and currency strength:

Supply chain disruptions have added another layer of complexity to global trade dynamics. These disruptions affect multinational companies' profit margins and influence currency markets through changes in capital flows.

Global Capital Flows During Currency Volatility

This flow chart illustrates how capital moves during periods of dollar weakness:

flowchart TD

A[Dollar Weakness

Begins] --> B[U.S. Assets

Less Attractive]

A --> C[Foreign Assets

More Attractive]

B --> D[Capital Outflow

from U.S. Markets]

C --> D

D --> E[Emerging Markets

Inflow]

D --> F[European Markets

Inflow]

D --> G[Asian Markets

Inflow]

E --> H[Further Dollar

Weakening]

F --> H

G --> H

H --> I[U.S. Export

Competitiveness↑]

H --> J[Import Costs↑]

I --> K[Trade Balance

Improvement]

J --> L[Inflation

Pressure]

K --> M[Long-term

Stabilization]

L --> N[Fed Policy

Response]

N --> M

style A fill:#FF8000,color:white

style D fill:#3B82F6,color:white

style H fill:#FF8000,color:white

style M fill:#10B981,color:white

Understanding these global trade dynamics is crucial for businesses engaged in international commerce. For those managing multicurrency operations, tools for currency conversion in Excel can help track and visualize the impact of these fluctuations on business operations.

The Dollar's Changing Role in Market Cycles

Historically, the U.S. dollar has enjoyed a unique "dual advantage" pattern in global markets. It would strengthen during risk-off environments as investors sought safety, but also during risk-on rallies driven by U.S. growth leadership. This dual advantage is now showing signs of breaking down.

Dollar Performance Across Market Conditions

This chart compares dollar performance in different market environments over time:

The breakdown of traditional safe-haven currency behavior is particularly noteworthy. Several factors have contributed to this shift, including changing investor perceptions about U.S. fiscal sustainability, the emergence of viable currency alternatives, and evolving global trade patterns.

Timeline of Shifting Investor Sentiment

Key events that have influenced perceptions of the dollar's role:

Comparative analysis across different market conditions reveals that the dollar's performance has become less predictable and more nuanced. This change requires investors and businesses to develop more sophisticated approaches to currency risk management.

Currency Performance in Different Market Environments

Comparing how major currencies perform across various market conditions:

This evolving landscape suggests that the dollar's traditional role in the global financial system is undergoing a significant transformation. While it remains the world's primary reserve currency, its behavior in response to different market conditions is becoming more similar to that of other major currencies, rather than maintaining its exceptional status.

Economic Implications and Future Outlook

A weaker dollar has far-reaching implications for the global economy, domestic inflation, and monetary policy. For the United States, currency depreciation can create both challenges and opportunities across different sectors of the economy.

Inflation Scenarios Based on Dollar Weakness

Potential inflation outcomes under different dollar scenarios:

The Federal Reserve faces significant challenges in responding to currency devaluation. If dollar weakness contributes to inflation through higher import costs, the Fed may need to maintain higher interest rates for longer than currently anticipated.

Federal Reserve Policy Response Options

Decision tree for potential Fed responses to continued dollar weakness:

flowchart TD

A[Dollar

Weakness

Persists] --> B{Impact on

Inflation?}

B -->|Significant| C[Delay Rate Cuts]

B -->|Minimal| D[Proceed with

Planned Cuts]

C --> E{Economic

Growth?}

D --> E

E -->|Weakening| F[Prioritize Growth

Accept Inflation Risk]

E -->|Resilient| G[Prioritize Price Stability

Maintain Restrictive Policy]

F --> H[Gradual Rate Cuts

with Careful Monitoring]

G --> I[Hold Rates Higher

for Longer]

H --> J[Dollar Stabilization

Through Growth Focus]

I --> K[Dollar Support

Through Yield Advantage]

style A fill:#FF8000,color:white

style B fill:#3B82F6,color:white

style E fill:#FF8000,color:white

For U.S. multinational corporations, a weaker dollar can boost overseas revenues when translated back into dollars. Companies with significant international operations often benefit from currency depreciation, though the impact varies by sector and specific business model.

Sector Impact of Dollar Weakness

How different sectors of the economy are affected by a declining dollar:

Looking ahead, the dollar's trajectory will be influenced by several key factors: Federal Reserve policy decisions, U.S. fiscal management, global economic growth differentials, and geopolitical developments. Monitoring these factors will be crucial for anticipating future currency movements and their economic implications.

Investment Strategy Considerations

In light of the dollar's unexpected behavior, investors need to reconsider traditional portfolio allocation strategies. Currency volatility creates both risks and opportunities that require thoughtful management.

Portfolio Diversification Approaches

Strategies for diversifying investments during currency volatility:

Different sectors of the economy are affected in various ways by dollar weakness. Understanding these sector-specific impacts is crucial for making informed investment decisions in the current environment.

International vs. Domestic Investment Performance

Comparing returns for U.S. and international investments during dollar weakness:

Hedging strategies can help protect portfolios against further currency fluctuations. These approaches range from direct currency hedges to allocations in assets that historically perform well during dollar weakness.

Hedging Strategies for Dollar Weakness

Comparing effectiveness of different hedging approaches:

Developing a comprehensive investment strategy in this environment requires careful consideration of currency exposure, sector allocation, and geographic diversification. The unusual behavior of the dollar suggests that traditional approaches may need to be reconsidered or supplemented with new strategies designed specifically for the current market conditions.

Transform Your Financial Visualizations with PageOn.ai

Make complex market contradictions clear and compelling with powerful visual tools designed for financial analysis. Create professional charts, diagrams, and infographics that help your audience understand intricate economic relationships.

Start Creating with PageOn.ai TodayConclusion: Navigating the New Currency Landscape

The dollar's unexpected decline despite rising interest rates represents a significant shift in global financial markets. This contradiction of conventional wisdom highlights the complex interplay of factors that influence currency valuation in today's interconnected economy.

The rare triple decline pattern—simultaneous weakness in the dollar, U.S. stocks, and bonds—deserves particular attention as it has historically been uncommon in developed markets. This pattern suggests deeper structural issues that may require thoughtful policy responses.

For investors and businesses, adapting to this new currency landscape requires a multifaceted approach. Understanding sector-specific impacts, reconsidering portfolio allocations, and implementing appropriate hedging strategies can help navigate the challenges and opportunities presented by dollar weakness.

As we move forward, monitoring key economic indicators, policy decisions, and global developments will be essential for anticipating future currency movements. The evolving role of the dollar in the global financial system represents both a challenge and an opportunity for informed market participants.

You Might Also Like

Prompt Chaining Techniques That Scale Your Business Intelligence | Advanced AI Strategies

Master prompt chaining techniques to transform complex business intelligence workflows into scalable, automated insights. Learn strategic AI methodologies for data analysis.

Bridging Worlds: How Diffusion Models Are Reshaping Language Generation | PageOn.ai

Explore the revolutionary convergence of diffusion models and language generation. Discover how diffusion techniques are creating new paradigms for NLP, bridging visual and linguistic domains.

First Principles Framework for Building Powerful AI Commands | Master AI Prompt Engineering

Learn the first principles approach to crafting powerful AI commands. Master prompt engineering with proven frameworks, templates, and visualization techniques for optimal AI interaction.

Visualizing the AI Revolution: From AlphaGo to AGI Through Key Visual Milestones

Explore the visual journey of AI evolution from AlphaGo to AGI through compelling timelines, infographics and interactive visualizations that map key breakthroughs in artificial intelligence.