Demystifying Treasury Bonds: Visual Guide to Economic Stability

Understanding the fundamental building blocks of government finance

I've spent years studying financial markets and have always been fascinated by how Treasury bonds form the backbone of our economic system. In this comprehensive guide, I'll walk you through everything you need to know about these powerful fiscal instruments and their critical role in maintaining economic stability.

The Fundamentals of Treasury Bonds

When I first started learning about government securities, I found the different types confusing. Treasury bonds (T-bonds) are just one type of debt security issued by the U.S. Department of the Treasury, but they play a unique and critical role in our financial system.

Treasury bonds stand apart from other Treasury securities primarily due to their long-term nature. While Treasury bills mature in a year or less and Treasury notes mature between 2-10 years, T-bonds have maturities of 20 or 30 years. This makes them particularly important for long-term fiscal planning and investment strategies.

Key Treasury Bond Terminology

- Par Value: The face value of the bond that will be paid at maturity (typically $1,000).

- Yield: The return an investor realizes on a bond, expressed as a percentage.

- Coupon Rate: The fixed interest rate paid semi-annually to bondholders.

- Maturity Date: The date when the principal amount of the bond is repaid to the investor.

Treasury Securities Comparison

I've created this visual comparison to help you understand how T-bonds fit into the broader Treasury securities landscape:

graph TD

Treasury["U.S. Treasury Securities"]

Bills["Treasury Bills

(T-Bills)

Maturity: Up to 1 year

No coupon payments"]

Notes["Treasury Notes

(T-Notes)

Maturity: 2-10 years

Semi-annual coupon"]

Bonds["Treasury Bonds

(T-Bonds)

Maturity: 20-30 years

Semi-annual coupon"]

TIPS["Treasury Inflation-Protected

Securities (TIPS)

Maturity: 5, 10, 30 years

Principal adjusts with inflation"]

Treasury --> Bills

Treasury --> Notes

Treasury --> Bonds

Treasury --> TIPS

style Bonds fill:#FF8000,stroke:#FF6000,color:white

When explaining complex financial instruments like Treasury bonds to my clients, I often need to break down their structure visually. PageOn.ai's AI Blocks feature has been invaluable for transforming these abstract concepts into intuitive diagrams that clearly show the relationship between maturity, yield, and risk. The ability to quickly generate custom visualizations helps me communicate these fundamental concepts more effectively than words alone ever could.

The Treasury Bond Ecosystem: Key Players and Relationships

The Treasury bond market represents one of the largest and most liquid financial markets in the world. To truly understand how these bonds function, we need to examine the complex ecosystem of institutions and investors that interact with them.

Treasury Bond Market Flow

This diagram illustrates how Treasury bonds move through the financial system:

flowchart TD

Treasury["U.S. Treasury Department

Issues Bonds"]

PrimaryDealers["Primary Dealers

Major Financial Institutions"]

FederalReserve["Federal Reserve

Monetary Policy Operations"]

SecondaryMarket["Secondary Market

Bond Trading"]

Investors1["Domestic Investors

- Pension Funds

- Insurance Companies

- Individual Investors"]

Investors2["Foreign Investors

- Central Banks

- Sovereign Wealth Funds

- Foreign Institutions"]

Treasury -->|"Issues bonds

at auction"| PrimaryDealers

PrimaryDealers -->|"Sell bonds"| SecondaryMarket

SecondaryMarket -->|"Buy/Sell"| Investors1

SecondaryMarket -->|"Buy/Sell"| Investors2

FederalReserve -->|"Open Market

Operations"| SecondaryMarket

style Treasury fill:#FF8000,stroke:#FF6000,color:white

style FederalReserve fill:#6495ED,stroke:#4169E1,color:white

At the center of this ecosystem is the relationship between the U.S. Treasury Department, which issues the bonds, and the Federal Reserve System, which implements monetary policy and helps maintain market stability.

Global Treasury Bond Ownership

Understanding who holds U.S. Treasury bonds provides insight into their global importance:

In my experience analyzing market trends, I've found that visualizing this complex ecosystem is crucial for understanding market movements. Using PageOn.ai's Deep Search functionality, I can integrate the latest Treasury bond ownership data into my presentations, creating compelling visualizations that help my team track shifts in the market landscape in real-time. This gives us a significant advantage when advising clients on potential investment strategies.

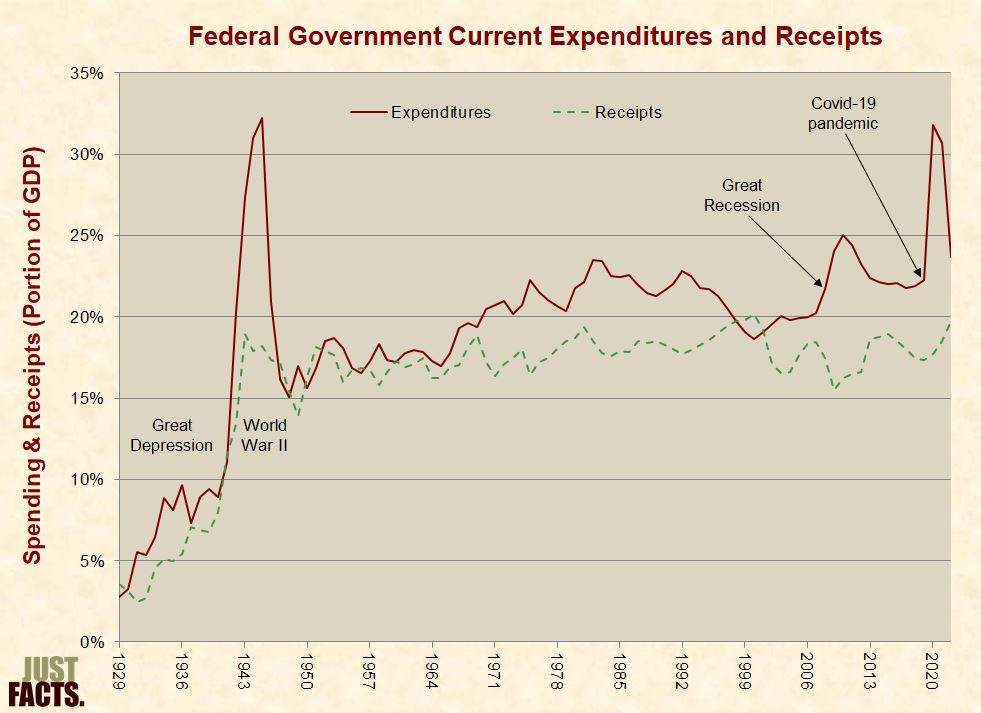

Treasury Bonds as Fiscal Policy Instruments

Treasury bonds are more than just investment vehicles—they're vital tools for government fiscal policy. When the government needs to finance deficits or manage its debt obligations, Treasury bonds provide a mechanism to borrow from the public and global investors.

Throughout history, major government initiatives—from war financing to pandemic recovery programs—have been funded through Treasury bond issuance. This creates a delicate balance between necessary spending and responsible debt management.

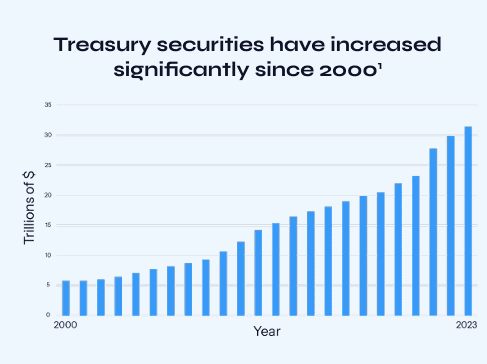

U.S. National Debt and Treasury Bond Issuance

The relationship between government spending and debt financing:

Balancing Debt Financing and Fiscal Responsibility

The government must balance several competing priorities when issuing Treasury bonds:

- Funding Current Operations: Covering shortfalls between tax revenue and government spending

- Managing Interest Costs: Minimizing the cost of servicing existing debt

- Maintaining Market Stability: Ensuring predictable, regular issuance to support market function

- Addressing Long-term Fiscal Health: Considering the sustainability of debt levels

When I need to explain these complex fiscal policy relationships to stakeholders, I rely on PageOn.ai's conversation-based creation tools. They allow me to transform abstract economic concepts into clear visual narratives that illustrate the delicate balance between government financing needs and fiscal responsibility. This visual approach makes it much easier for my audience to grasp how Treasury bonds function as critical policy instruments in our economy.

The Risk-Safety Spectrum of Treasury Bonds

One of the most fundamental characteristics of Treasury bonds is their status as "risk-free" investments. This designation comes from the fact that they're backed by the full faith and credit of the U.S. government, which has never defaulted on its debt obligations.

Investment Risk Spectrum

This diagram illustrates where Treasury bonds sit on the investment risk spectrum:

graph LR

Cash["Cash & Money

Market Accounts"]

TBonds["Treasury

Bonds"]

MuniBonds["Municipal

Bonds"]

CorpBonds["Corporate

Bonds"]

Stocks["Stocks"]

RealEstate["Real Estate"]

PrivateEquity["Private Equity/

Venture Capital"]

Crypto["Cryptocurrencies"]

Cash -->|"Lower Risk

Lower Return"| TBonds

TBonds --> MuniBonds

MuniBonds --> CorpBonds

CorpBonds --> Stocks

Stocks --> RealEstate

RealEstate --> PrivateEquity

PrivateEquity -->|"Higher Risk

Higher Return"| Crypto

style TBonds fill:#FF8000,stroke:#FF6000,color:white

While Treasury bonds are considered extremely safe investments, they're not entirely risk-free. Investors face several types of risk:

Interest Rate Risk

When interest rates rise, the value of existing bonds falls. With their long maturities, Treasury bonds are particularly sensitive to interest rate changes.

Inflation Risk

If inflation exceeds the bond's yield, the real purchasing power of both interest payments and principal repayment decreases over time.

Opportunity Cost

Capital invested in Treasury bonds cannot be deployed in potentially higher-returning investments during the bond term.

Liquidity Risk

While generally highly liquid, Treasury bonds can experience reduced liquidity during market stress, potentially affecting selling price.

In my work with risk-averse clients, I've found that visual comparisons are extremely effective for explaining investment trade-offs. PageOn.ai's block-building approach allows me to create comparative risk assessment visuals that clearly demonstrate how Treasury bonds typically perform during market volatility compared to other assets. This helps my clients make more informed decisions about their portfolio allocations based on their personal risk tolerance and investment goals.

Interest Rates and Treasury Bond Dynamics

The relationship between interest rates and Treasury bond prices is one of the most critical concepts in fixed-income investing. This inverse relationship—when interest rates rise, bond prices fall, and vice versa—forms the foundation of bond market dynamics.

Interest Rate and Bond Price Relationship

This chart illustrates the inverse relationship between interest rates and bond prices:

The Yield Curve and Economic Forecasting

The yield curve—a graphical representation of yields across different maturity periods—is one of the most watched indicators in financial markets. Its shape can provide valuable insights into economic expectations.

Different yield curve shapes and their implications:

The Federal Reserve's monetary policy decisions have direct and significant impacts on Treasury bond markets. When the Fed raises or lowers interest rates, or engages in quantitative easing or tightening, the effects ripple through the entire Treasury bond ecosystem.

Throughout my career analyzing bond markets, I've found that visualizing yield curves is essential for understanding market sentiment. Using PageOn.ai, I've transformed complex yield curve data into accessible, dynamic visualizations that help my clients grasp these abstract concepts. The platform's ability to create interactive charts has been particularly valuable when explaining how yield curve inversions have historically preceded economic recessions.

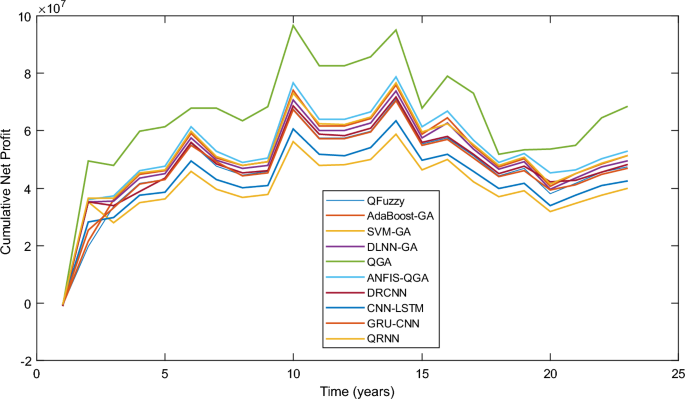

Treasury Bonds in Investment Portfolios

Treasury bonds serve multiple crucial functions within diversified investment portfolios. Their primary roles include providing steady income, preserving capital, and acting as a counterbalance to more volatile assets like stocks.

Portfolio Allocation Models by Investor Profile

How Treasury bond allocations vary across different investor profiles:

Treasury Bonds vs. Inflation

A critical consideration for Treasury bond investors is how these securities perform against inflation over time. While they provide stability, traditional Treasury bonds don't offer inflation protection, which can erode real returns.

Historical comparison of Treasury bond yields vs. inflation rates:

Life-Stage Treasury Bond Allocation

| Life Stage | Recommended T-Bond Allocation | Strategic Purpose |

|---|---|---|

| Early Career (20s-30s) | 5-15% | Portfolio stabilizer during market volatility |

| Mid-Career (40s-50s) | 15-30% | Growing income component and volatility hedge |

| Pre-Retirement (55-65) | 30-50% | Capital preservation and income generation |

| Retirement (65+) | 40-60% | Stable income stream and principal protection |

In my financial advisory practice, I've found that customized visual models are essential for helping clients understand appropriate asset allocations. PageOn.ai's asset integration capabilities have allowed me to create personalized portfolio allocation visuals that clearly demonstrate how Treasury bonds can be strategically incorporated at different life stages. This visual approach has been particularly effective in helping clients understand the evolving role of fixed income as they approach retirement.

Global Implications of U.S. Treasury Bond Markets

The U.S. Treasury bond market is not just a domestic concern—it's a cornerstone of the global financial system. As the world's benchmark "risk-free" asset, Treasury bonds influence everything from international interest rates to currency valuations.

Global Financial Interconnections

How U.S. Treasury bonds influence the global financial system:

flowchart TD

TBonds["U.S. Treasury

Bond Market"]

Dollar["U.S. Dollar

Reserve Currency Status"]

GlobalRates["Global Interest

Rate Benchmarks"]

ForeignPolicy["U.S. Foreign

Policy Leverage"]

TradeBalance["Global Trade

Balances"]

EmergingMarkets["Emerging Market

Economies"]

CapitalFlows["International

Capital Flows"]

TBonds -->|"Supports"| Dollar

Dollar -->|"Reinforces demand for"| TBonds

TBonds -->|"Establishes"| GlobalRates

TBonds -->|"Provides"| ForeignPolicy

TBonds -->|"Influences"| TradeBalance

TBonds -->|"Affects stability of"| EmergingMarkets

TBonds -->|"Directs"| CapitalFlows

style TBonds fill:#FF8000,stroke:#FF6000,color:white

The relationship between Treasury bonds and the dollar's status as the world's reserve currency creates a powerful feedback loop that reinforces U.S. financial dominance. This relationship has profound implications for US trade balance evolution and global economic stability.

Case Study: 2008 Financial Crisis

During the 2008 financial crisis, we witnessed the "flight to safety" phenomenon in real time:

- As global financial markets collapsed, investors worldwide rushed to purchase U.S. Treasury bonds

- This massive inflow of capital actually pushed Treasury yields to historic lows despite the crisis originating in the U.S.

- The dollar strengthened against most currencies, reinforcing its safe-haven status

- This pattern demonstrated the unique position of Treasury bonds as the world's ultimate safe asset

Similar patterns have emerged during other periods of global instability, including the European sovereign debt crisis, Brexit, and the COVID-19 pandemic. This wall street financial crises pattern recognition shows how Treasury bonds function as a global financial stabilizer.

Foreign Ownership of U.S. Treasury Securities

Top foreign holders of U.S. Treasury bonds (in billions USD):

In my work analyzing global market trends, I've found that visualizing these complex international relationships is essential for understanding capital flows. PageOn.ai has been instrumental in helping me transform these intricate financial relationships into clear visual narratives that my international clients can easily comprehend. The platform's ability to create interactive global maps and flow diagrams has been particularly valuable when explaining how Treasury bond movements affect currency markets and international trade.

The Future of Treasury Bonds in a Digital Economy

As we move deeper into the digital age, Treasury bonds face both challenges and opportunities. From the rise of cryptocurrencies to the potential of blockchain technology for bond issuance and trading, the landscape is evolving rapidly.

Potential Evolution Scenarios

Digital Treasury Bonds

The Treasury could issue fully digital bonds on blockchain platforms, potentially increasing efficiency, reducing costs, and expanding accessibility to global investors.

Competition from CBDCs

Central Bank Digital Currencies could create new competition for Treasury bonds as safe stores of value, potentially altering traditional investment patterns.

Enhanced Transparency

New technologies could enable real-time tracking of Treasury bond ownership and trading, potentially reducing market manipulation and improving price discovery.

Automated Interest Payments

Smart contracts could automate coupon payments and redemption processes, increasing efficiency and reducing administrative costs.

Treasury Bond Performance Scenarios

Projected Treasury bond yield scenarios under different economic conditions:

As economic forecasts visual scenarios continue to evolve, Treasury bonds will likely remain a cornerstone of the global financial system, though their form and function may change significantly.

In my work forecasting financial market trends, I've found that visualizing potential future scenarios is crucial for strategic planning. PageOn.ai's agentic capabilities have been invaluable for creating forward-looking visual scenarios that illustrate how Treasury bonds might evolve in response to technological innovation and changing economic conditions. The platform's ability to generate multiple scenario visualizations has helped my team prepare for a range of possible futures in this rapidly changing landscape.

Transform Your Financial Visualizations with PageOn.ai

Create stunning, informative visualizations that make complex financial concepts like Treasury bonds clear and engaging for any audience.

Start Creating with PageOn.ai TodayConclusion: The Enduring Importance of Treasury Bonds

Throughout this exploration, we've seen how Treasury bonds serve as the foundation of the global financial system, providing stability, benchmarks for pricing other assets, and a mechanism for government fiscal policy implementation.

Despite technological changes and economic evolution, Treasury bonds will likely remain central to financial markets for decades to come. Their unique combination of safety, liquidity, and governmental backing makes them irreplaceable in many contexts.

For investors, understanding Treasury bonds is essential for building resilient portfolios that can weather various economic conditions. For policymakers, these instruments remain critical tools for managing the economy and funding government operations.

As we've demonstrated throughout this guide, visualizing these complex financial relationships makes them more accessible and actionable. Whether you're creating financial slides for pitch decks or analyzing market trends, the ability to transform abstract financial concepts into clear visual expressions is invaluable.

I hope this visual guide has helped demystify Treasury bonds and their critical role in economic stability. By leveraging modern visualization tools like PageOn.ai, we can all gain deeper insights into these fundamental financial instruments and their far-reaching implications.

You Might Also Like

Prompt Chaining Techniques That Scale Your Business Intelligence | Advanced AI Strategies

Master prompt chaining techniques to transform complex business intelligence workflows into scalable, automated insights. Learn strategic AI methodologies for data analysis.

How 85% of Marketers Transform Content Strategy with AI Visual Tools | PageOn.ai

Discover how 85% of marketers are revolutionizing content strategy with AI tools, saving 3 hours per piece while improving quality and output by 82%.

Transforming Marketing Teams: From AI Hesitation to Strategic Implementation Success

Discover proven strategies to overcome the four critical barriers blocking marketing AI adoption. Transform your team from hesitant observers to strategic AI implementers with actionable roadmaps and success metrics.

How AI Amplifies Marketing Team Capabilities While Preserving Human Jobs | Strategic Marketing Enhancement

Discover how AI transforms marketing teams into powerhouses without reducing workforce size. Learn proven strategies for capability multiplication and strategic enhancement.