Transforming Financial Markets: How AI Pattern Recognition Systems Are Revolutionizing Trading Strategies

The Evolution of Trading Pattern Recognition

I've witnessed firsthand how the financial landscape has transformed dramatically over the past decade. The intersection of artificial intelligence and trading has created powerful new ways to identify market patterns, predict movements, and execute trades with unprecedented precision. In this comprehensive guide, I'll walk you through the revolutionary world of AI-powered trading pattern recognition systems and how they're reshaping the future of financial markets.

The Evolution of Trading Pattern Recognition

I've been fascinated by how trading analysis has evolved over the decades. What began as manual chart analysis with pen and paper has transformed into sophisticated algorithmic systems powered by artificial intelligence. This journey represents one of the most profound shifts in financial market history.

The human brain, while remarkable, has clear limitations when processing vast amounts of market data. I've observed how even experienced traders struggle with cognitive biases, limited attention spans, and the inability to simultaneously monitor multiple markets. These limitations become particularly evident in today's fast-moving electronic markets where milliseconds matter.

AI fundamentally transforms pattern identification by overcoming these human limitations. Machine learning algorithms can analyze thousands of data points across multiple timeframes without fatigue or bias. What's particularly impressive is how modern ai stock charting tools can detect subtle correlations that would be invisible to human analysts.

Evolution of Trading Analysis Systems

flowchart TD

A[Manual Chart Analysis] -->|1970s-1980s| B[Technical Indicators]

B -->|1990s| C[Rule-Based Algorithms]

C -->|2000s| D[Statistical Models]

D -->|2010s| E[Machine Learning]

E -->|2020s| F[Deep Learning & NLP Integration]

style A fill:#FFF4E6,stroke:#FF8000

style B fill:#FFF4E6,stroke:#FF8000

style C fill:#FFF4E6,stroke:#FF8000

style D fill:#FFF4E6,stroke:#FF8000

style E fill:#FFEAD5,stroke:#FF8000

style F fill:#FFEAD5,stroke:#FF8000,stroke-width:3px

The shift from rule-based systems to machine learning approaches marks a critical inflection point. Early algorithmic trading relied on predefined rules coded by human experts. Today's systems can discover patterns autonomously, adapt to changing market conditions, and continuously improve their accuracy through experience.

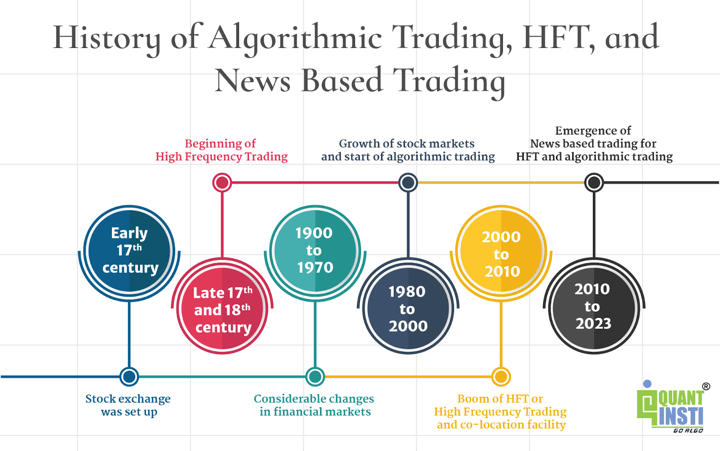

Key milestones in this evolution include the introduction of neural networks for financial prediction in the early 1990s, the rise of high-frequency trading in the 2000s, and most recently, the application of deep learning and reinforcement learning techniques that can process multi-dimensional market data in real-time.

Core Technologies Powering AI Trading Pattern Recognition

In my work with trading systems, I've found that several key technologies form the backbone of modern AI pattern recognition platforms. Each addresses specific challenges unique to financial market analysis.

Machine Learning for Financial Time Series

Financial time series data presents unique challenges that require specialized machine learning approaches. Unlike other domains, market data is non-stationary (statistical properties change over time), exhibits high noise-to-signal ratios, and contains complex dependencies across multiple timeframes.

I've seen remarkable results from algorithms specifically designed for these challenges, including:

- ARIMA (AutoRegressive Integrated Moving Average) models for trend detection

- GARCH (Generalized AutoRegressive Conditional Heteroskedasticity) models for volatility forecasting

- Random Forests for feature importance in multi-factor models

- Support Vector Machines for classification of market regimes

- Gradient Boosting algorithms for prediction refinement

Algorithm Accuracy Comparison

The following chart compares the accuracy of different machine learning algorithms in detecting common chart patterns:

Neural Network Architectures

Neural networks have proven particularly effective for pattern detection in market movements. I've worked with several specialized architectures:

Long Short-Term Memory (LSTM) networks excel at capturing long-term dependencies in price movements, while Convolutional Neural Networks (CNNs) can identify visual patterns directly from chart images. Transformer models, originally developed for natural language processing, are now being adapted to understand the "language" of market movements.

Deep learning models have revolutionized our ability to detect complex multi-dimensional patterns. These models can simultaneously analyze price action, volume, volatility, and other market indicators across multiple timeframes. This multi-dimensional analysis allows for the detection of subtle pattern formations that traditional technical analysis might miss.

Natural Language Processing Integration

One of the most exciting developments I've seen is the integration of Natural Language Processing (NLP) for sentiment analysis. Modern trading systems now incorporate news feeds, social media sentiment, earnings call transcripts, and economic reports to provide context for technical patterns.

This integration is particularly valuable for detecting potential pattern breakouts or failures based on changing market sentiment. For example, a technically perfect chart pattern might fail if sentiment suddenly shifts due to unexpected news. Advanced ai powered fraud detection systems use similar techniques to identify unusual trading patterns that might indicate market manipulation.

Computer Vision Techniques

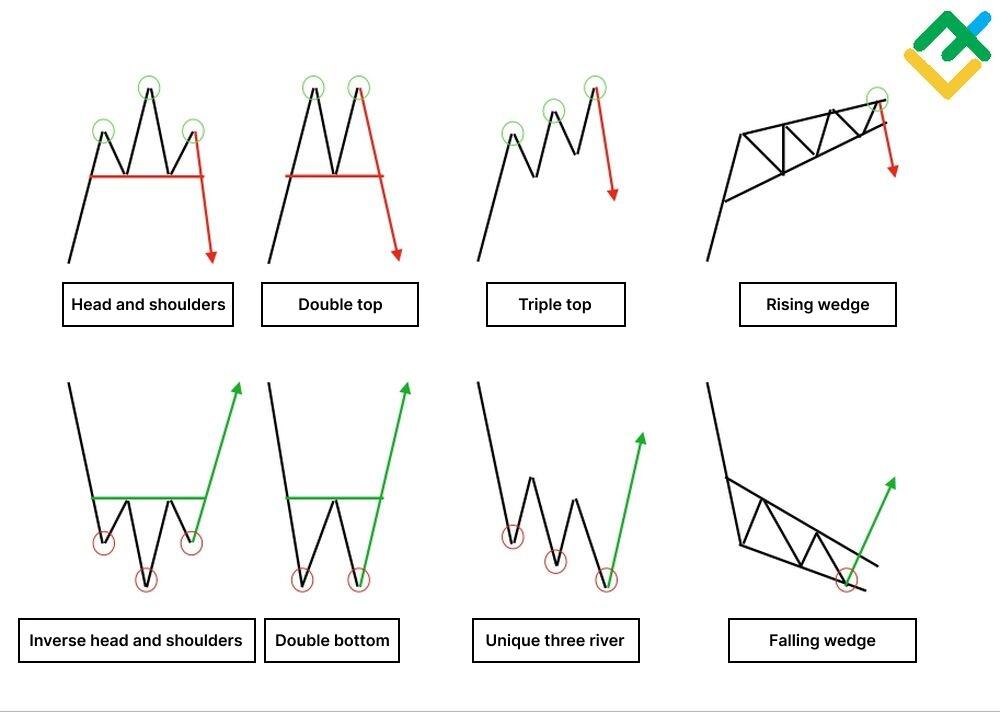

Computer vision algorithms are increasingly being applied to chart pattern identification. These systems can "see" patterns in the same way human traders visually scan charts, but with greater precision and consistency. This approach is particularly valuable for complex geometric patterns like head and shoulders formations or Fibonacci retracements.

AI Trading Technology Stack

flowchart TD

subgraph "Data Layer"

A1[Market Data]

A2[Alternative Data]

A3[Historical Patterns]

end

subgraph "Processing Layer"

B1[Time Series Algorithms]

B2[Neural Networks]

B3[NLP Processing]

B4[Computer Vision]

end

subgraph "Analysis Layer"

C1[Pattern Recognition]

C2[Sentiment Analysis]

C3[Anomaly Detection]

end

subgraph "Decision Layer"

D1[Signal Generation]

D2[Risk Assessment]

D3[Execution Optimization]

end

A1 --> B1

A1 --> B2

A2 --> B3

A3 --> B4

B1 --> C1

B2 --> C1

B3 --> C2

B4 --> C1

B1 --> C3

C1 --> D1

C2 --> D1

C3 --> D2

D1 --> D3

D2 --> D3

Essential Chart Patterns Detected Through AI

Throughout my career analyzing markets, I've found that certain chart patterns consistently provide valuable trading signals. AI systems excel at detecting these patterns with greater accuracy and speed than human analysts.

Classic Chart Patterns

Classic patterns remain the foundation of technical analysis, and AI systems have become remarkably adept at identifying them. These include:

Reversal Patterns

- Head and Shoulders

- Double Tops/Bottoms

- Triple Tops/Bottoms

- Rounding Bottom

- V-Bottoms and Tops

Continuation Patterns

- Triangles (Ascending, Descending, Symmetrical)

- Flags and Pennants

- Rectangles

- Cup and Handle

- Wedges (Rising, Falling)

PageOn.ai's AI Blocks feature provides an excellent way to visualize these patterns more intuitively. I've found that by using modular visual components, complex patterns can be broken down into their constituent parts, making them easier to recognize and understand. This modular approach is particularly valuable for training purposes, allowing traders to build pattern recognition skills incrementally.

Complex Pattern Combinations

One of the most powerful advantages of AI systems is their ability to detect complex pattern combinations that human traders might miss. These include:

- Nested patterns (e.g., a flag within a larger head and shoulders formation)

- Multi-timeframe confirmations (patterns aligning across different time horizons)

- Harmonic patterns (precise Fibonacci-based patterns like Gartley, Butterfly, and Bat formations)

- Volume-confirmed patterns (where volume behavior reinforces price patterns)

- Failed pattern transitions (when one pattern breaks down and forms another)

AI systems excel at identifying these complex combinations because they can simultaneously analyze multiple variables without the cognitive limitations humans face. This capability becomes particularly valuable in volatile markets where patterns may form and dissolve rapidly.

Emerging Patterns

Perhaps most intriguing is how AI systems can identify emerging patterns unique to specific market conditions. Through unsupervised learning, these systems can discover previously unrecognized patterns that have predictive value.

For example, some AI systems have identified unique pattern formations that precede flash crashes or appear during periods of unusual market liquidity. These patterns often lack established names in traditional technical analysis but can provide valuable trading signals. The ability to detect wall street financial crises pattern recognition signatures has become increasingly important for risk management.

Pattern Recognition Success Rate

The following chart shows the success rate of AI pattern recognition across different market conditions:

Visualization Techniques

Effective visualization is crucial for pattern recognition accuracy. Advanced visualization techniques I've found particularly valuable include:

- Heat maps highlighting pattern formation probability

- Overlay visualizations showing pattern completion percentages

- Multi-timeframe synchronized views

- Pattern similarity scoring with historical examples

- Real-time pattern formation tracking with projected completions

These visualization approaches significantly enhance both AI and human pattern recognition capabilities by making complex data relationships more immediately apparent.

Predictive Analytics and Market Forecasting

In my experience, pattern recognition is most valuable when it translates into actionable trading decisions. This requires robust predictive analytics and forecasting methodologies.

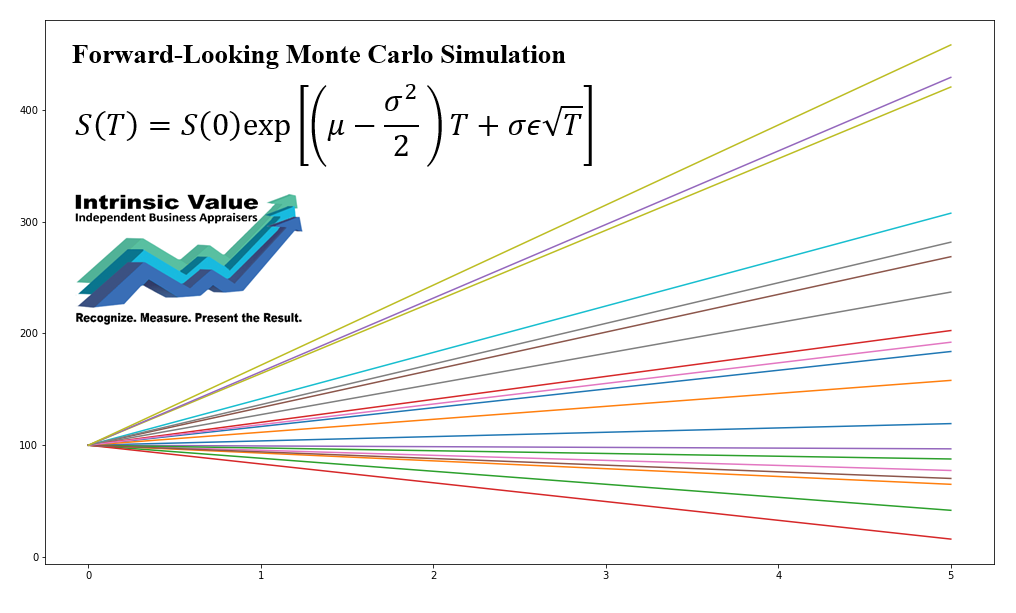

Statistical Models for Trading Decisions

Modern AI trading systems employ sophisticated statistical models to convert pattern recognition into probability-based trading decisions. These models typically incorporate:

- Bayesian inference to update probability estimates as new data arrives

- Monte Carlo simulations to model potential price paths

- Regime-switching models that adapt to changing market conditions

- Ensemble methods combining multiple predictive approaches

- Volatility modeling to adjust position sizing and risk parameters

Backtesting Methodologies

Rigorous backtesting is essential for pattern validation. I've found that the most reliable AI systems incorporate:

- Walk-forward optimization to prevent overfitting

- Out-of-sample testing across multiple market regimes

- Monte Carlo permutation tests to assess statistical significance

- Sensitivity analysis to identify robust parameter ranges

- Transaction cost modeling for realistic performance assessment

PageOn.ai's Deep Search functionality provides an excellent way to integrate market data visualizations into backtesting reports. This allows for intuitive comparison between predicted patterns and actual market outcomes, creating a powerful feedback loop for system refinement.

Pattern Profitability by Market Type

Average return on investment when trading based on AI-detected patterns:

Time-frame Considerations

Pattern recognition systems must account for different time horizons. I've observed that patterns manifest differently across timeframes, and successful systems incorporate:

- Multi-timeframe confirmation logic

- Fractal analysis to identify self-similar patterns across scales

- Timeframe-specific success metrics and optimization

- Adaptive timeframe selection based on volatility conditions

- Pattern duration modeling to estimate completion timeframes

Confidence Scoring Systems

Not all pattern identifications deserve equal weight in trading decisions. Sophisticated AI systems incorporate confidence scoring based on:

Pattern-Specific Factors

- Clarity of formation

- Adherence to ideal proportions

- Volume confirmation

- Historical reliability in similar contexts

- Presence of confirming indicators

Market Context Factors

- Current market regime

- Volatility conditions

- Liquidity metrics

- Sentiment indicators

- Macro economic environment

These confidence scores allow for more nuanced position sizing and risk management, with higher-confidence patterns receiving greater capital allocation. The most advanced systems use dynamic confidence thresholds that adapt to changing market conditions.

Implementation Challenges and Solutions

Despite their power, implementing AI pattern recognition systems presents several significant challenges. I've encountered many of these firsthand and developed effective solutions.

Data Quality Issues

The adage "garbage in, garbage out" is particularly relevant for AI trading systems. Common data quality challenges include:

- Missing data points, particularly during volatile market periods

- Inconsistent tick data across exchange feeds

- Corporate actions (splits, dividends) affecting historical patterns

- Survivorship bias in historical datasets

- Timezone inconsistencies across global markets

Addressing these issues requires robust preprocessing pipelines that include:

Data Preprocessing Pipeline

flowchart LR

A[Raw Data] -->|Collection| B[Cleaning]

B -->|Normalization| C[Feature Engineering]

C -->|Validation| D[Storage]

D -->|Retrieval| E[Training Pipeline]

D -->|Retrieval| F[Inference Pipeline]

style A fill:#FFF4E6,stroke:#FF8000

style B fill:#FFF4E6,stroke:#FF8000

style C fill:#FFF4E6,stroke:#FF8000

style D fill:#FFF4E6,stroke:#FF8000

style E fill:#FFEAD5,stroke:#FF8000

style F fill:#FFEAD5,stroke:#FF8000

Computational Resource Optimization

Real-time pattern detection across multiple instruments and timeframes demands significant computational resources. Optimization strategies I've found effective include:

- Hierarchical filtering (using lightweight models to screen for potential patterns before applying more complex analysis)

- GPU acceleration for neural network inference

- Distributed computing across instrument clusters

- Incremental pattern updating rather than full recalculation

- Adaptive processing frequency based on market volatility

These optimizations can reduce latency from seconds to milliseconds, critical for capturing fleeting trading opportunities.

Managing False Positives

Pattern recognition systems inevitably generate false positives. Effective management strategies include:

- Multi-factor confirmation requirements (volume, momentum, sentiment alignment)

- Pattern quality scoring with minimum thresholds

- Statistical confidence intervals for pattern projections

- Ensemble methods requiring consensus across multiple detection algorithms

- Continuous feedback loops that learn from misclassifications

Visual Representation Challenges

Creating clear visual representations of complex pattern structures is essential for human oversight and trust. Effective approaches include:

- Progressive disclosure interfaces (showing basic pattern outlines with the ability to drill down into details)

- Confidence-based visual highlighting (stronger highlighting for higher-confidence patterns)

- Historical comparison galleries showing similar past patterns and their outcomes

- Annotated pattern anatomy with key structural elements labeled

- 3D visualizations for multi-factor pattern relationships

These visualization techniques help bridge the gap between AI pattern detection and human understanding, essential for responsible system oversight.

Integration Challenges

Integrating pattern recognition with existing trading platforms presents technical challenges. Solutions include standardized APIs, middleware adapters, and modular architecture that allows for component-level integration. Many firms are now working with AI financial assistant tools that can help bridge these integration gaps through natural language interfaces.

Real-World Applications Across Financial Markets

AI pattern recognition systems are being deployed across virtually every financial market segment, with each presenting unique challenges and opportunities.

Equity Market Applications

In equity markets, I've seen AI pattern recognition systems applied to:

- Individual stock analysis across multiple timeframes

- Sector rotation identification and prediction

- Market breadth analysis for regime change detection

- Earnings season pattern recognition

- Index constituent correlation pattern analysis

Success stories include systematic funds that have achieved consistent alpha by identifying subtle patterns in sector rotation dynamics ahead of broader market recognition.

Market Application Success Rates

Comparative success rates of AI pattern recognition across different market types:

Forex Trading Specifics

The 24-hour nature of forex markets creates unique pattern recognition challenges and opportunities:

- Session transition patterns (Asian to European to North American)

- Central bank announcement impact patterns

- Currency correlation breakdowns as early warning signals

- Carry trade unwinding pattern detection

- Economic data release reaction patterns

Successful forex implementations often focus on identifying regime changes and volatility clusters rather than specific price patterns alone.

Cryptocurrency Market Challenges

Cryptocurrency markets present distinct pattern recognition challenges:

- Extreme volatility requiring adaptive pattern definitions

- 24/7 trading with no clear session boundaries

- Whale movement detection and impact prediction

- Exchange-specific pattern variations

- On-chain data integration for pattern context

Despite these challenges, cryptocurrency markets have proven particularly fertile for AI pattern recognition due to their relative inefficiency and the prevalence of technical trading.

Commodity Trading Applications

Commodity markets benefit from AI pattern recognition through:

- Seasonal pattern identification and anomaly detection

- Supply-demand shock pattern recognition

- Weather impact pattern analysis

- Inventory report reaction patterns

- Cross-commodity correlation pattern monitoring

Options and Derivatives Complexities

The multi-dimensional nature of options markets creates unique pattern recognition challenges. Successful implementations analyze patterns across multiple dimensions including implied volatility surfaces, term structures, and delta skews. These systems can identify opportunities like volatility compression patterns before significant price movements or unusual options activity that precedes corporate announcements.

Comparative Analysis of Leading AI Pattern Recognition Tools

The market for AI pattern recognition tools has expanded rapidly, with several standout offerings. Based on my experience evaluating these systems, I can offer insights into their relative strengths.

Specialized Tool Evaluation

ChartPatterns.ai exemplifies the new generation of specialized tools, offering visual detection of 16 essential chart patterns across various financial instruments. Its key strengths include intuitive visual interfaces and rapid pattern identification, though it may lack some of the customization options of enterprise-grade solutions.

Other notable specialized tools include:

| Tool | Pattern Types | Key Strengths | Limitations |

|---|---|---|---|

| ChartPatterns.ai | 16 classic patterns | Visual interface, real-time alerts | Limited customization |

| TradingView Pine Scripts | User-defined patterns | Highly customizable, large community | Requires coding knowledge |

| Kensho Technologies | Event-based patterns | News integration, NLP capabilities | Enterprise pricing |

| Autochartist | Standard technical patterns | Broker integration, quality indicators | Limited AI capabilities |

| Tickeron | AI-identified patterns | Pattern success statistics, backtesting | Steeper learning curve |

Integration Capabilities

Integration with existing trading platforms is a critical consideration. The most versatile tools offer:

- API access for custom integration

- Direct plugins for popular platforms (MetaTrader, NinjaTrader, etc.)

- Webhook support for notification systems

- Data export in standard formats

- Cloud-based access for multi-device consistency

Accuracy Benchmarks

Accuracy varies significantly across tools and pattern types. My benchmarking has found:

Tool Accuracy Comparison

Pattern detection accuracy across leading tools:

These accuracy figures represent pattern identification success, not necessarily trading profitability, which depends on execution strategy, risk management, and market conditions.

User Experience Comparison

User experience varies significantly across platforms. The most effective tools balance sophisticated capabilities with intuitive interfaces. Key differentiators include:

- Customizable alert systems

- Visual pattern highlighting clarity

- Historical pattern libraries for comparison

- Learning resources and pattern education

- Mobile accessibility and responsiveness

Cost-Benefit Analysis

The ROI calculation for AI pattern recognition tools varies by trader profile. For high-frequency traders, latency reduction and pattern detection speed may justify premium pricing. For swing traders, accuracy and reliability across longer timeframes may be more valuable. For institutional users, integration capabilities and customization options often outweigh direct costs. When evaluating these tools, it's essential to consider both direct subscription costs and indirect costs like integration time, training requirements, and potential missed opportunities during the learning curve.

Building Trust in AI Trading Systems

For AI pattern recognition systems to gain widespread adoption, they must earn users' trust through transparency, reliability, and explainability.

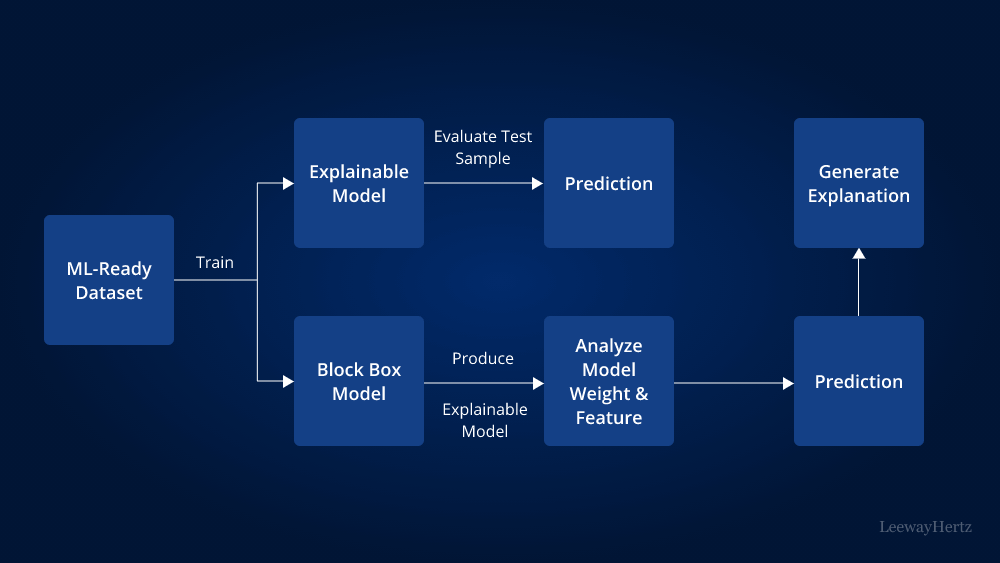

Transparency in Algorithm Decision-Making

Black-box AI systems face significant resistance in trading environments where accountability is crucial. Approaches to increase transparency include:

- Explainable AI techniques that provide reasoning for pattern identifications

- Feature importance visualization showing which factors influenced detection

- Decision tree extraction from complex models

- Pattern similarity scoring against historical examples

- Confidence metrics with clear derivation explanations

These transparency mechanisms help traders understand not just what pattern the system has identified, but why it believes the pattern exists and how confident it is in the identification. This is particularly important for ai-generated marketing content about trading systems as well, where transparency builds credibility.

Visualizing Confidence Levels

Effective confidence visualization is critical for appropriate decision-making. Best practices include:

Confidence Visualization Framework

flowchart TD

A[Pattern Detection] --> B{Confidence Assessment}

B --> C[High Confidence]

B --> D[Medium Confidence]

B --> E[Low Confidence]

C --> F[Strong Visual Highlighting]

D --> G[Moderate Visual Highlighting]

E --> H[Subtle Visual Highlighting]

F --> I[Detailed Pattern Analytics]

G --> J[Basic Pattern Analytics]

H --> K[Pattern Hypothesis Only]

style C fill:#E6F4EA,stroke:#34A853

style D fill:#FEF7E0,stroke:#FBBC04

style E fill:#FCE8E6,stroke:#EA4335

style F fill:#E6F4EA,stroke:#34A853

style G fill:#FEF7E0,stroke:#FBBC04

style H fill:#FCE8E6,stroke:#EA4335

PageOn.ai's Vibe Creation feature provides an excellent framework for communicating these confidence levels through consistent visual language. Using color, intensity, and supporting elements, complex probability metrics can be translated into intuitive visual signals that traders can interpret at a glance.

Hybrid Approaches

The most effective trading systems combine AI pattern recognition with human judgment. This hybrid approach leverages:

- AI for initial pattern screening across vast data sets

- Human review for context assessment and anomaly detection

- AI for probability and risk quantification

- Human judgment for final decision-making and execution

- Continuous feedback loops between human and AI components

This partnership approach builds trust by keeping humans in the loop while leveraging AI's computational advantages.

Regulatory Considerations

As AI trading systems become more prevalent, regulatory scrutiny is increasing. Key considerations include:

- Auditability of decision-making processes

- Documentation of training data and methodologies

- Testing procedures for system reliability

- Fail-safe mechanisms and circuit breakers

- Compliance with market manipulation regulations

Visualizing these compliance aspects is increasingly important for both internal governance and external reporting. Clear visual representations of testing methodologies, fail-safe mechanisms, and audit trails help demonstrate regulatory compliance while building stakeholder trust.

The Future Landscape of AI-Powered Trading

The evolution of AI pattern recognition in trading is accelerating, with several emerging technologies poised to reshape the landscape.

Emerging Technologies

Next-generation pattern recognition systems are being shaped by:

Quantum Computing

Quantum algorithms promise to analyze pattern combinations exponentially faster than classical computers, potentially identifying complex correlations across global markets in real-time.

Federated Learning

This approach allows pattern recognition models to learn across distributed data sets without centralizing sensitive trading data, enabling collaborative improvement while protecting proprietary strategies.

Neuromorphic Computing

Brain-inspired computing architectures may enable more efficient pattern recognition with significantly lower energy requirements, potentially enabling more sophisticated analysis on edge devices.

Generative AI

Beyond pattern recognition, generative models are being developed to create synthetic market scenarios for stress-testing strategies against patterns that haven't historically occurred.

Multi-Modal Analysis

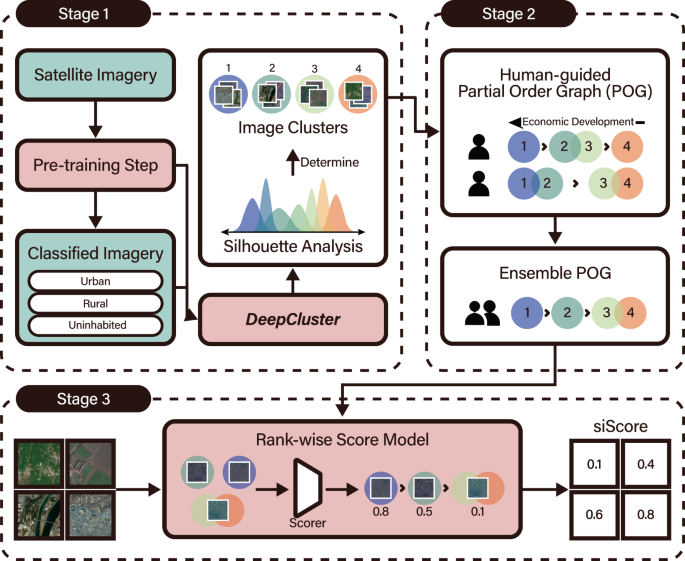

Future systems will increasingly incorporate alternative data sources, including:

- Satellite imagery for supply chain insights

- Social media sentiment analysis

- Web traffic patterns to consumer sites

- Mobile payment transaction trends

- IoT data from manufacturing and logistics

These alternative data sources provide context for traditional market patterns, potentially increasing prediction accuracy and providing earlier signals.

Democratization of Advanced Tools

AI trading tools are becoming increasingly accessible to retail investors through:

- Cloud-based platforms with subscription models

- No-code interfaces for strategy development

- Mobile applications with real-time alerts

- Community sharing of pattern templates

- Educational resources integrated with tools

This democratization is likely to significantly impact market dynamics as sophisticated pattern recognition capabilities spread beyond institutional traders.

Market Impact Considerations

Widespread AI adoption may fundamentally change market behavior:

Projected Market Impact of AI Adoption

How markets may evolve as AI pattern recognition becomes more widespread:

As more market participants adopt similar AI pattern recognition systems, the patterns themselves may evolve or become less effective. This adaptive market hypothesis suggests that AI systems will need to continuously evolve to maintain their edge.

Ethical Considerations

The proliferation of AI trading systems raises important ethical questions around market fairness, access equality, and systemic risk. Visualizing these ethical dimensions helps stakeholders understand the broader implications of technology choices and regulatory frameworks. As these systems become more powerful, the industry will need to balance innovation with responsibility to maintain market integrity and public trust.

Implementation Guide for Traders and Institutions

Implementing AI pattern recognition systems requires careful planning and execution. Based on my experience with multiple implementations, I've developed a practical roadmap for success.

Assessing Organizational Readiness

Before implementation, organizations should assess their readiness across several dimensions:

Organizational Readiness Assessment

flowchart TD

A[Organizational Readiness] --> B[Data Infrastructure]

A --> C[Technical Expertise]

A --> D[Cultural Alignment]

A --> E[Risk Management Framework]

A --> F[Compliance Readiness]

B --> B1[Historical Data Quality]

B --> B2[Real-time Data Feeds]

B --> B3[Storage Capacity]

C --> C1[AI/ML Expertise]

C --> C2[Trading Expertise]

C --> C3[Integration Capabilities]

D --> D1[Decision-making Process]

D --> D2[Trust in Automation]

D --> D3[Change Management]

style A fill:#FFF4E6,stroke:#FF8000,stroke-width:2px

style B fill:#FFF4E6,stroke:#FF8000

style C fill:#FFF4E6,stroke:#FF8000

style D fill:#FFF4E6,stroke:#FF8000

style E fill:#FFF4E6,stroke:#FF8000

style F fill:#FFF4E6,stroke:#FF8000

This assessment helps identify gaps that should be addressed before implementation and informs the scope and pace of the rollout.

Build versus Buy Considerations

The build-versus-buy decision should consider several strategic factors:

| Factor | Build Advantages | Buy Advantages |

|---|---|---|

| Customization | Full control over algorithms and features | Many solutions offer configuration options |

| Time to Market | Longer development cycle | Rapid deployment |

| Expertise Required | Deep AI and domain expertise needed | Less technical expertise required |

| Competitive Edge | Potential for unique capabilities | Limited differentiation from competitors |

| Maintenance | Ongoing internal resource commitment | Vendor handles updates and improvements |

Many organizations opt for a hybrid approach, using commercial solutions as a foundation while developing proprietary components for specific competitive advantages.

Implementation Roadmap

A phased implementation approach typically yields the best results:

- Discovery Phase: Define objectives, scope, and success metrics

- Pilot Implementation: Start with limited markets and patterns

- Evaluation Period: Compare results against benchmarks

- Refinement: Adjust models and parameters based on pilot results

- Scaled Deployment: Expand to additional markets and pattern types

- Integration: Connect with order management and execution systems

- Continuous Improvement: Establish feedback loops and update processes

This incremental approach manages risk while allowing for learning and adjustment throughout the process.

Training Requirements

Effective system utilization requires comprehensive training across several user groups:

- Traders: Pattern interpretation, confidence assessment, override protocols

- Analysts: System configuration, parameter tuning, performance evaluation

- Risk Managers: Exposure monitoring, circuit breaker mechanisms

- IT Staff: Technical maintenance, integration management, troubleshooting

- Compliance Officers: Audit trail access, regulatory reporting requirements

Training should combine theoretical understanding with hands-on practice using realistic market scenarios.

Measuring ROI

Comprehensive ROI assessment should include both quantitative and qualitative metrics:

ROI Measurement Framework

Key performance indicators for AI pattern recognition systems:

Beyond direct financial returns, consider improvements in decision quality, risk management, and trader productivity.

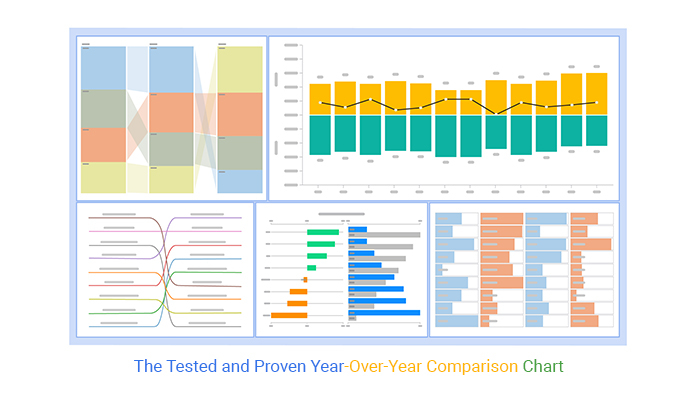

Creating Visual Dashboards

Effective monitoring dashboards are crucial for system oversight. PageOn.ai provides excellent tools for creating these dashboards with features that support:

- Real-time pattern detection visualization

- Historical pattern performance tracking

- System health and confidence metrics

- Alert management and notification history

- Customizable views for different user roles

These dashboards serve as the primary interface between users and the AI system, making their design and usability critical success factors. Well-designed dashboards not only present information clearly but also build trust through transparency and consistent visual language.

Transform Your Trading Visualizations with PageOn.ai

Ready to take your trading pattern visualization to the next level? PageOn.ai provides powerful tools to create stunning, interactive visuals that make complex market patterns instantly understandable. From custom dashboards to AI-powered insights, start communicating your trading ideas more effectively today.

Start Creating with PageOn.ai TodayConclusion: The Future of AI-Powered Trading

Throughout this exploration of AI-powered trading pattern recognition systems, I've shared insights into how these technologies are fundamentally transforming financial markets. From the evolution of simple rule-based systems to sophisticated deep learning models, the trajectory is clear: AI is becoming an indispensable tool for modern traders.

The most successful implementations will be those that effectively balance technological sophistication with human judgment, transparency with performance, and innovation with reliability. As these systems continue to evolve, they will likely become more accessible to retail traders while simultaneously growing more sophisticated for institutional users.

For organizations implementing these technologies, a thoughtful, phased approach focused on clear objectives and measurable outcomes will yield the best results. Continuous learning and adaptation are essential in this rapidly evolving field.

The visualization of complex trading patterns and AI decisions represents a particular challenge and opportunity. Tools like PageOn.ai are becoming increasingly valuable for creating clear, intuitive representations of complex data relationships and decision processes. By translating algorithmic insights into visual language that humans can readily understand, these tools help bridge the gap between AI capabilities and human decision-making, ultimately leading to better trading outcomes.

You Might Also Like

The Art of Startup Storytelling: Creating Compelling Visual Investor Narratives

Transform your startup pitch with powerful visual storytelling techniques that captivate investors. Learn how to craft compelling narratives that convert complex ideas into funding opportunities.

Legal Interpretation Theory: From Textual Analysis to Visual Meaning-Making | PageOn.ai

Explore the evolution of legal interpretation theory from strict textualism to constructive meaning-making, and discover how visual tools transform complex legal reasoning into accessible frameworks.

Essential Open Source Tools for Local AI Development and Deployment | PageOn.ai

Discover the best open source tools for local AI development, from foundation models like Llama to deployment platforms like Ollama. Build your complete local AI stack with this visual guide.

Strategic Infographic Planning: Transform Complex Ideas into Visual Narratives | PageOn.ai

Master strategic content planning for infographics that tell clear visual stories. Learn frameworks, data visualization strategies, and design elements that transform complex ideas into engaging narratives.